Medical Credentialing, Contracting, Billing Frequently Asked Questions

- Why Do Modifier Errors Happen?

- What are the Most Common Modifier Errors?

- What is a Modifier Error?

- What Ongoing Monitoring Should Providers Do for Contracted Payers?

- How Do Rate Negotiations Work for Ancillary Services?

- What is the Difference Between Contracted Rates and Billed Charges?

- How Do Practice Mergers or Acquisitions Affect Existing Payer Contracts?

- What are Common Rate Negotiation Timelines and Deadlines?

- How Do Quality Metrics in Payer Contracts Affect Reimbursement?

- What Should Providers Know about Fee Schedule Updates?

- How Do Outlier Payments Work in Bundled Payment Arrangements?

- What Leverage Do Specialty Providers Have in Contract Negotiations?

- How Do Payer Contracts Handle Telehealth Services?

- What is Primary Source Verification in Credentialing?

- How Do You Maintain Credentials Across Multiple States?

- What Happens if a Provider’s License or Certification Expires During Active Credentialing?

- How Do Hospital Privileges Relate to Insurance Credentialing?

- What Credentialing Challenges Do New Medical Practices Face?

- How Do You Handle Patients Who Cannot Pay Their Medical Bills?

- What is a Clearinghouse and How Does it Help with Medical Billing?

- How Do You Handle Coordination of Benefits When Patients Have Multiple Insurance Policies?

- What Role Does the Explanation of Benefits (EOB) Play in Medical Billing?

- How Does Bundling Affect Medical Billing Reimbursement?

- What is the Appeals Process for Denied Medical Claims?

- How Do you Determine the Right CPT Code for a Service?

- What Documentation do Payers Require to Support Medical Billing Claims?

- How Does Medical Billing Work for Practices with Multiple Locations?

- What are the Most Common Medical Billing Errors that Lead to Claim Denials?

- What is Privileging?

- What is a Credentialing Committee?

- How Do I Handle Out-of-Network Billing Situations?

- Can Medwave Help If I’m Joining an Existing Practice or Leaving One?

- What is the Difference Between a Claim Denial and a Claim Rejection?

- How Do Value-Based Care Contracts Differ from Traditional Fee-for-Service Contracts?

- What is a Modifier in Medical Billing and When Should I Use One?

- What Should I Do If an Insurance Company is Consistently Underpaying Claims?

- Do I Need Separate Malpractice Insurance for Telehealth Services?

- What is Medical Necessity and Why Do Claims Get Denied for Lack of It?

- How Long Do Insurance Companies Have to Pay Claims?

- What Clean Claim Rate Should My Practice Aim For?

- What is the National Provider Identifier (NPI) and Do I Need One?

- How Does Moving to a New State Affect My Credentialing and Payer Contracts?

- What is the Difference Between Credentialing and Privileging?

- Can I Bill Insurance Companies While My Credentialing is in Progress?

- What is CAQH and Why is it Important for Credentialing?

- How Do I Maintain My Credentialing Status During the COVID-19 Era and Beyond?

- What Happens if My Credentialing Application is Denied?

- What Common Mistakes Should I Avoid During the Credentialing Process?

- What is Recredentialing and How Often Does it Occur?

- What Documents and Information Do I Need to Prepare for Credentialing?

- How Long Does the Credentialing Process Typically Take?

- What Happens if I Want to Terminate a Payer Contract or if a Payer Terminates Me?

- Can I Negotiate Better Rates with Insurance Companies, and What Leverage Do I Have?

- What Key Terms Should I Focus on When Negotiating Payer Contracts?

- How Long Does the Typical Payer Contracting Process Take?

- What is Payer Contracting and Why is it Important for Healthcare Providers?

- How Important is Medical Credentialing to a Healthcare Provider?

- Do You Support Healthcare Providers that Perform Telehealth / Telemedicine?

- What is Medical Billing?

- What is Medical Credentialing?

- What’s the Difference Between Medical Billing and Credentialing?

- What Insurers Have We Worked with in the Past?

- What are Our Rates?

- What Types of Medical Practices do We Serve?

- Do You Support Cannabis Medicine with their Billing Requirements?

- Do You Support Genetic Testing Labs with their Billing Needs?

- Do You Fix Denied Medical Claims?

- Is A/R Recovery Part of Your Services?

- Which Regions do We Serve?

- What’s Your Medical Credentialing On-Board Protocol?

- Do You Partner with 3rd Party Medical Groups?

- Do You Provide Billing and / or Credentialing to Laboratories?

Why Do Modifier Errors Happen?

Payer rules around modifiers are not uniform. What one insurance company accepts, another may reject. Without up-to-date knowledge of each payer’s specific guidelines, it is easy for billing staff to apply modifiers inconsistently.

Back to Index

What are the Most Common Modifier Errors?

The ones that come up most often include leaving off a modifier entirely, using a modifier that does not match the procedure or payer’s rules, stacking too many modifiers on a single code, and using informational modifiers in the wrong position when payment modifiers need to come first.

Back to Index

What is a Modifier Error?

A modifier error happens when the wrong modifier is used, a required modifier is left off, or a modifier is attached to a code it does not belong with. These mistakes are among the most common billing errors practices face, and they can lead to claim denials, reduced reimbursements, or even audits.

Back to Index

What Ongoing Monitoring Should Providers Do for Contracted Payers?

Active contract management requires regular monitoring beyond initial negotiation. Track actual payment rates against contracted rates to identify underpayments, monitor denial rates by payer to spot problematic patterns, review days in accounts receivable by payer to identify slow payers, and track volume trends to see if patient loads are shifting. Document any payer practices that violate contract terms, such as missed payment deadlines or improper bundling. This ongoing monitoring identifies issues requiring action and builds documentation supporting future negotiations or contract termination if necessary.

Back to Index

How Do Rate Negotiations Work for Ancillary Services?

Ancillary services like laboratory, radiology, or physical therapy often face different negotiation dynamics than professional services. Payers may have less detailed rate schedules for certain ancillary services, creating negotiation opportunities. Ancillary services with significant equipment costs or technical components may have more rate variation between payers. Demonstrating lower per-test costs, faster turnaround times, or better quality metrics strengthens negotiating position. Some ancillary services face downward rate pressure from national reference labs or imaging chains, requiring strong local value propositions.

Back to Index

What is the Difference Between Contracted Rates and Billed Charges?

Contracted rates are the amounts payers agree to reimburse for specific services under network agreements, while billed charges are the amounts providers submit on claims. For in-network services, providers accept contracted rates as payment in full, writing off the difference between charges and contracted amounts. Billed charges should always exceed contracted rates. Some out-of-network payments are based on a percentage of billed charges or “usual and customary rates,” making charge amounts strategically important. Regular charge review ensures they remain competitive and appropriate.

Back to Index

How Do Practice Mergers or Acquisitions Affect Existing Payer Contracts?

Practice changes trigger contract reviews and potential renegotiations. Payers typically have change-of-control clauses allowing them to review or terminate contracts when practices merge or are acquired. Tax ID number changes require new contract execution in most cases. The acquiring entity may need to credential all providers under new arrangements. These transitions should be planned carefully with adequate lead time, as there may be gaps in network participation during the transition. Negotiating how mergers affect contracts before completing the business transaction prevents unwelcome surprises.

Back to Index

What are Common Rate Negotiation Timelines and Deadlines?

Rate negotiations typically align with contract renewal periods. Payers usually send renewal notices 90-180 days before contract expiration, opening the negotiation window. Some contracts allow for annual rate discussions even without full contract renewal. Request rate increases at least 120 days before renewal to allow time for review and back-and-forth discussion. If negotiations aren’t progressing and you’re considering termination, most contracts require 90-180 days advance notice. Missing these deadlines often means accepting existing rates for another contract term.

Back to Index

How Do Quality Metrics in Payer Contracts Affect Reimbursement?

Quality metrics increasingly tie to payment through various mechanisms. Pay-for-performance programs provide bonuses for achieving quality targets or penalties for poor performance. Value-based contracts may withhold a percentage of payments (typically 2-10%) that’s earned back by meeting quality benchmarks. Quality metrics commonly include clinical measures like diabetic control or preventive care rates, patient satisfaction scores, efficiency measures like generic prescribing rates, and utilization metrics like readmission rates. Understanding which metrics affect your payment and focusing improvement efforts on those measures maximizes financial performance.

Back to Index

What Should Providers Know about Fee Schedule Updates?

Payers update fee schedules periodically, sometimes annually or when Medicare releases rate changes. Contracts should specify how and when payers notify providers of fee schedule changes. Some changes are automatic based on Medicare updates, while others require mutual agreement. Providers should review fee schedule updates carefully to identify significant rate reductions that might warrant renegotiation or contract termination. Understanding how your contract handles fee schedule updates and whether you can contest changes protects your practice from surprise rate cuts.

Back to Index

How Do Outlier Payments Work in Bundled Payment Arrangements?

Outlier payments provide additional reimbursement when costs significantly exceed the bundled payment amount, protecting providers from excessive financial risk. Outlier thresholds define how far costs must exceed the bundle before additional payment triggers, typically 2-3 times the bundled amount. When costs surpass this threshold, providers receive a percentage of costs above the threshold. Outlier provisions are crucial in bundled payment arrangements because they limit downside risk from unusually expensive cases while maintaining incentives for efficiency in typical cases.

Back to Index

What Leverage Do Specialty Providers Have in Contract Negotiations?

Specialty providers often have significant negotiating leverage, particularly if they offer unique services or subspecialty expertise in their market. Limited specialist availability in an area strengthens negotiating position, as payers need adequate specialty coverage for network adequacy. Quality metrics, patient satisfaction scores, and efficient care delivery provide additional leverage. Specialists with hospital-based procedures may have more leverage than office-based specialties. Building data demonstrating your value to the payer’s network strengthens negotiating position for rate improvements.

Back to Index

How Do Payer Contracts Handle Telehealth Services?

Telehealth contract provisions vary widely by payer. Some contracts specifically address telehealth reimbursement rates, which may match in-person rates or be discounted. Contracts may limit which services can be provided via telehealth, specify acceptable technology platforms, and define geographic restrictions for where patients must be located. Some require specific telehealth-related modifiers on claims. As telehealth expands, reviewing and negotiating telehealth terms in payer contracts becomes increasingly important for practices offering virtual services.

Back to Index

What is Primary Source Verification in Credentialing?

Primary source verification means confirming credentials directly with the original issuing organization rather than relying on copies or attestations. Credentialing entities verify medical school graduation with the school itself, board certifications with specialty boards, licenses with state boards, and DEA registration with the federal DEA database. Work history is confirmed with previous employers. This direct verification prevents fraud and ensures accuracy but takes time, often contributing to long credentialing timelines. Providers cannot expedite primary source verification timelines.

Back to Index

How Do You Maintain Credentials Across Multiple States?

Multi-state credentialing requires systematic tracking of state-specific requirements. Each state has its own medical board, licensing requirements, and renewal timelines. Providers need separate licenses for each state where they practice, including telehealth services. Malpractice insurance must cover all practice states. CAQH profiles should list all state licenses. Some states participate in interstate medical licensure compacts that streamline multi-state licensing, but credentialing still requires state-by-state applications with most payers.

Back to Index

What Happens if a Provider’s License or Certification Expires During Active Credentialing?

Expired licenses or certifications create immediate credentialing problems. Most contracts require continuous maintenance of all credentials as a condition of network participation. If a license expires, providers must immediately notify all payers and facilities where they’re credentialed. The provider may be suspended from seeing insured patients until licensure is renewed and verified. Claims submitted during periods of expired licensure may be denied, and retroactive billing might not be allowed even after renewal. Setting up license renewal reminders well in advance prevents these disruptions.

Back to Index

How Do Hospital Privileges Relate to Insurance Credentialing?

Hospital privileges and insurance credentialing are separate but related processes. Hospital credentialing grants permission to admit and treat patients at that facility, while insurance credentialing allows billing that insurer for services. Many insurance companies require active hospital privileges as part of their credentialing criteria, viewing hospital affiliation as validation of clinical competence. Loss of hospital privileges can trigger notification requirements to insurance companies and may jeopardize insurance panel participation depending on contract terms.

Back to Index

What Credentialing Challenges Do New Medical Practices Face?

New practices encounter several hurdles including lack of practice history that payers typically review, no prior claim data to demonstrate volume or quality, longer approval timelines as new entities, potential delays in obtaining all necessary licenses and registrations, and difficulty demonstrating patient base without existing patient volumes. New providers should start credentialing applications 6-9 months before intended practice start date, maintain complete documentation, and consider interim solutions like locum tenens arrangements while awaiting full credentialing approval.

Back to Index

How Do You Handle Patients Who Cannot Pay Their Medical Bills?

Managing patient collections requires balancing financial needs with patient relationships. Options include offering payment plans with manageable monthly installments, providing financial assistance programs for qualifying patients, negotiating reduced lump-sum settlements, or referring accounts to collection agencies as a last resort. Clear communication about financial responsibility before services, transparency about costs, and compassionate but persistent follow-up helps maximize collections while maintaining patient satisfaction. Some practices offer prompt-payment discounts for full payment at time of service.

Back to Index

What is a Clearinghouse and How Does it Help with Medical Billing?

A clearinghouse acts as an intermediary between providers and payers, electronically transmitting claims and returning responses. Clearinghouses scrub claims for errors before submission, checking for common mistakes that would cause rejections. They translate claims into formats required by different payers, provide real-time eligibility verification, and return electronic remittance advice (ERA) showing payment details. Using a clearinghouse typically reduces rejection rates and speeds up the billing process compared to submitting paper claims directly to payers.

Back to Index

How Do You Handle Coordination of Benefits When Patients Have Multiple Insurance Policies?

Coordination of benefits (COB) determines which insurance pays first (primary) and which pays second (secondary). The birthday rule typically determines order for dependent children, with the parent whose birthday falls earlier in the calendar year being primary. For spouses, each person’s own insurance is usually primary for themselves. Claims must be submitted to the primary payer first, then the secondary payer receives the claim with the primary payer’s EOB. Improper COB filing causes delays and denials, so verifying correct payer order before billing is essential.

Back to Index

What Role Does the Explanation of Benefits (EOB) Play in Medical Billing?

EOBs provide detailed information about how a claim was processed, including allowed amounts, patient responsibility, denial reasons, and adjustment codes. Reviewing EOBs carefully helps identify underpayments, incorrect patient balances, and patterns in denials. EOBs contain important information for patient billing, showing what insurance paid and what the patient owes. They also provide appeal rights information and contact details for questions. Systematic EOB review is essential for effective revenue cycle management and identifying issues requiring follow-up.

Back to Index

How Does Bundling Affect Medical Billing Reimbursement?

Bundling occurs when payers group multiple related services into a single payment rather than paying for each separately. The Correct Coding Initiative (CCI) defines which codes bundle and under what circumstances. Some bundled services can be billed separately with appropriate modifiers like -59 or -25 when documentation supports distinct services. Bundling significantly impacts reimbursement because practices receive one payment instead of multiple, often resulting in lower total reimbursement than if services were paid separately.

Back to Index

What is the Appeals Process for Denied Medical Claims?

The appeals process typically has multiple levels. First-level appeals are often informal reviews where you submit additional documentation or clarification to the payer. If denied again, second-level appeals may involve peer-to-peer review with a medical director. Third-level appeals might go to an external review organization. Each level has specific deadlines, usually 30-180 days depending on the payer and appeal stage. Appeals should include clear explanations of why the service was medically necessary, relevant medical records, applicable clinical guidelines, and references to policy language supporting coverage.

Back to Index

How Do you Determine the Right CPT Code for a Service?

CPT code selection requires matching the service provided to the most specific code description available. Review the complete code description, including any parenthetical notes and code-specific guidelines. Consider the anatomical location, approach, and extent of the service. Check for bundling rules and mutually exclusive edits that might require modifiers. When multiple codes could apply, select the one that most accurately describes the work performed. Regular training on coding updates and specialty-specific coding guidelines helps ensure accuracy.

Back to Index

What Documentation do Payers Require to Support Medical Billing Claims?

Required documentation varies by service type and payer, but generally includes detailed provider notes describing the service rendered, diagnosis codes supported by clinical findings, medical necessity justification, and any applicable test results or imaging reports. For procedures, operative reports and procedural notes are essential. Time-based services require specific time documentation. Prior authorization approvals must be documented and referenced on claims. Payers may request additional records during audits, so maintaining thorough documentation for all patient encounters is critical for defending billed services.

Back to Index

How Does Medical Billing Work for Practices with Multiple Locations?

Multi-location billing requires careful attention to location-specific details. Each office location typically has its own place of service code, may have different payer contracts with varying rates, and might serve different patient populations. Claims must be submitted with the correct location information to ensure proper reimbursement. Some practices use a centralized billing office that handles all locations, while others maintain separate billing staff at each site. Reporting should track performance by individual location while also providing consolidated practice-wide metrics.

Back to Index

What are the Most Common Medical Billing Errors that Lead to Claim Denials?

The most frequent billing errors include incorrect patient demographics like misspelled names or wrong dates of birth, invalid insurance ID numbers, missing or incorrect provider information, coding errors such as using outdated CPT codes or mismatched diagnosis codes, and lack of required authorizations. Duplicate claim submissions also trigger denials, as do services billed beyond the timely filing deadline. Many denials stem from simple data entry mistakes that could be caught with proper quality control checks before submission.

Back to Index

What is Privileging?

Privileging is the process of granting an individual permission to perform specific clinical activities within a healthcare setting. It defines how a credentialed practitioner may be authorized to provide certain services outside their standard scope of practice, provided they work under appropriate supervision.

The privileging process establishes clear boundaries around what services a practitioner can deliver and under what conditions. Detailed privileging frameworks exist for different specialty areas, including orthotics, prosthetics, and pedorthics. For mastectomy-related services, specific privileging guidelines outline the requirements and supervision needed.

This structured approach to privileging ensures that practitioners provide safe, high-quality care while allowing for appropriate professional development under qualified supervision.

Back to Index

What is a Credentialing Committee?

A credentialing committee is a group of professionals, typically within a healthcare organization, responsible for evaluating and verifying the qualifications of practitioners seeking privileges to practice at that facility. The committee reviews credentials such as medical licenses, board certifications, training history, work experience, and professional references to ensure that healthcare providers meet established standards of competence and quality.

The committee’s primary responsibilities include:

- Initial credentialing – Reviewing applications from new practitioners who wish to join the medical staff or obtain clinical privileges at the organization.

- Reappointment – Periodically re-evaluating current practitioners (usually every two years) to ensure they maintain their qualifications and have no concerning performance issues.

- Privileging decisions – Determining what specific procedures and services each practitioner is qualified to perform based on their training and experience.

- Quality assurance – Monitoring ongoing professional practice and addressing any concerns about competence, conduct, or patient safety.

The credentialing process helps protect patients by ensuring that only qualified, competent healthcare professionals are granted the authority to provide care within the organization. The committee typically includes physicians, administrators, and other healthcare professionals who bring expertise in evaluating clinical qualifications and organizational needs.

Back to Index

How Do I Handle Out-of-Network Billing Situations?

Out-of-network (OON) billing occurs when you provide services to a patient whose insurance plan you don’t have a contract with. While these situations can be more complex than in-network billing, they can also be more profitable if handled correctly.

Key Steps for Out-of-Network Billing:

1. Verify Benefits and Set Expectations

Before providing services, verify the patient’s out-of-network benefits, including:

- Out-of-network deductible and whether it’s been met

- Coinsurance percentage (commonly 60-70% coverage vs 80-100% in-network)

- Out-of-network maximum out-of-pocket limit

- Whether the plan has out-of-network coverage at all (some HMOs and EPOs don’t)

Inform the patient in writing about their financial responsibility and obtain a signed acknowledgment.

2. Understand Your Billing Options

You have several approaches for OON billing:

- Balance Billing: You can bill patients for the difference between your charges and what insurance pays (except where prohibited by law or for emergency services under the No Surprises Act)

- Courtesy Billing: Submit claims to the insurance company on the patient’s behalf, but collect your full fee from the patient

- Self-Pay Arrangements: Offer discounted rates if the patient pays in full at time of service

3. Use Proper Claim Submission

- Submit claims using the CMS-1500 form with your full charges

- Include all required documentation

- Don’t use contracted rates; bill your standard (rack) rates

- Use appropriate modifiers if required by the payer

4. Payment Collection Strategy

- Collect estimated out-of-pocket costs upfront when possible

- Set clear payment policies for OON patients in your financial policy

- Send statements promptly when insurance processes the claim

- Offer payment plans for large balances

5. Appeal Underpayments

Insurance companies often underpay OON claims.

Don’t accept low payments without review:

- Compare payment to the usual and customary rate for your area

- Appeal if payment is unreasonably low

- Cite state prompt payment laws if applicable

- Consider balance billing the patient if appeals are unsuccessful

Important Legal Considerations:

- No Surprises Act: For emergency services and certain non-emergency services at in-network facilities, you cannot balance bill patients beyond in-network cost-sharing amounts

- State Balance Billing Laws: Some states restrict balance billing in specific situations

- Medicare/Medicaid: You generally cannot balance bill Medicare patients, and Medicaid prohibits it entirely

When to Accept OON Patients:

Consider these factors:

- Your practice’s payer mix and whether you can afford to see OON patients

- The patient’s ability to pay

- The complexity of the service and reimbursement potential

- Your capacity and whether OON patients displace in-network patients

Medwave can help you develop clear OON billing policies, verify benefits accurately, submit claims properly, and pursue maximum reimbursement while remaining compliant with all applicable laws.

Back to Index

What is Prior Authorization and How Does it Affect My Revenue Cycle?

Prior authorization (PA) is a cost-control process used by insurance companies that requires providers to obtain approval before performing certain services, procedures, or prescribing medications. The payer reviews the medical necessity of the proposed treatment before agreeing to cover it.

How Prior Authorization Affects Your Revenue Cycle:

Prior authorization significantly impacts your practice’s revenue cycle in several ways:

Cash Flow Delays: Services requiring PA cannot be performed until approval is granted, which can take anywhere from 24 hours to several weeks. This delays both the delivery of care and your ability to bill for services, creating gaps in your revenue stream.

Administrative Burden: The PA process requires substantial staff time to gather clinical documentation, complete forms, make follow-up calls, and track approvals. This diverts resources from other revenue cycle activities and increases operational costs.

Claim Denial Risk: Performing services without obtaining required prior authorization is one of the most common reasons for claim denials. Even if the service was medically necessary, payers will deny claims that lack proper authorization, requiring you to write off the charges or bill the patient directly (which often leads to collection challenges).

Patient Satisfaction Issues: PA delays can frustrate patients who are ready to receive care, potentially leading them to seek services elsewhere or abandon treatment altogether. This affects both your revenue and your practice’s reputation.

Best Practices to Minimize Impact:

- Maintain an updated list of services that require PA for each payer

- Verify PA requirements during insurance verification before scheduling

- Submit PA requests as early as possible with complete clinical documentation

- Track PA requests systematically and follow up promptly on pending approvals

- Train front-office staff to identify PA requirements during scheduling

- Consider working with a medical billing partner like Medwave that has dedicated PA specialists

At Medwave, we proactively manage prior authorization requirements as part of our comprehensive revenue cycle management services, helping practices avoid delays and denials while reducing administrative burden.

Back to Index

Can Medwave Help If I’m Joining an Existing Practice or Leaving One?

Yes, Medwave can assist with credentialing transitions when joining or leaving a practice. When joining a practice, we help ensure your individual credentialing is transferred or established correctly with all relevant payers, update NPI and provider enrollment information, and coordinate with the practice’s existing payer contracts to add you as a participating provider. When leaving a practice, we assist with notifying payers of your departure, establishing new contracts at your new location, transferring credentialing records, and ensuring continuity in your ability to bill for services. These transitions require careful timing and coordination to minimize gaps in your ability to see patients and receive reimbursement. We manage the administrative complexities so you can focus on patient care during these transitions.

Back to Index

What is the Difference Between a Claim Denial and a Claim Rejection?

A rejection occurs when a claim is not accepted into the payer’s system due to technical errors, such as incorrect patient information, invalid insurance ID numbers, missing required fields, or incorrect formatting. Rejected claims never enter the adjudication process and are returned quickly, usually within days. They don’t count against timely filing limits, so you can correct and resubmit them. A denial occurs after a claim has been processed and adjudicated by the payer, who determines they won’t pay for the service. Denials require formal appeals, do count against timely filing deadlines for the original claim, and may involve clinical review. Common denial reasons include lack of medical necessity, non-covered services, or benefits exhaustion. Knowing the difference between a denial vs a rejected claim is crucial for addressing each situation appropriately.

Back to Index

How Do Value-Based Care Contracts Differ from Traditional Fee-for-Service Contracts?

Traditional fee-for-service contracts pay providers based on the volume of services delivered, with each service having a set reimbursement rate. Value-based care contracts tie reimbursement to quality metrics, patient outcomes, and cost efficiency rather than just volume. In value-based arrangements, providers may receive bonuses for meeting quality benchmarks, shared savings for reducing overall healthcare costs, or penalties for poor outcomes. These contracts often include quality measures like patient satisfaction scores, preventive care rates, hospital readmission rates, and chronic disease management metrics. Value-based contracts typically require more robust data tracking and reporting capabilities. While they can increase revenue potential through performance bonuses, they also involve more risk and require investment in care coordination and quality improvement initiatives.

Back to Index

What is a Modifier in Medical Billing and When Should I Use One?

A modifier is a two-digit code added to a CPT or HCPCS code to provide additional information about the service performed without changing the basic definition of the procedure. Modifiers indicate circumstances such as bilateral procedures, multiple procedures during the same session, professional versus technical components, services performed by different providers, unusual circumstances, or distinct procedural services. Common modifiers include -25 (significant separately identifiable E&M service), -59 (distinct procedural service), -76 (repeat procedure by same physician), and -RT/-LT (right/left side). Using modifiers correctly is crucial for proper reimbursement, as they prevent claim denials, unbundling issues, and ensure you’re paid appropriately for the services provided. Incorrect modifier usage can result in denials or compliance issues.

Back to Index

What Should I Do If an Insurance Company is Consistently Underpaying Claims?

Consistent underpayment requires systematic investigation and action. First, document the pattern by comparing contracted rates to actual payments across multiple claims. Review your contract to confirm the agreed-upon fee schedule and payment terms. Common underpayment causes include outdated fee schedules in the payer’s system, incorrect contract loading, bundling of services that should be paid separately, or application of wrong payment policies. Contact the payer’s provider relations department with specific examples and documentation. File formal appeals for underpaid claims with detailed explanations of the correct payment amount. If the issue persists, consider involving your state’s insurance commissioner or seeking assistance from billing specialists who have experience negotiating with payers.

Back to Index

Do I Need Separate Malpractice Insurance for Telehealth Services?

Many traditional malpractice insurance policies now include telehealth coverage, but you should verify this explicitly with your insurance carrier. The coverage specifics can vary significantly, including whether it covers synchronous video visits, asynchronous consultations, phone consultations, and services provided across state lines. If you practice telehealth across multiple states, ensure your policy covers you in all states where you’re licensed and seeing patients. Some insurers offer telehealth endorsements or riders for an additional premium. As telehealth continues to evolve, review your malpractice coverage annually and document your telehealth policies and procedures. Having inadequate coverage for telehealth services could leave you personally liable in the event of a claim.

Back to Index

What is Medical Necessity and Why Do Claims Get Denied for Lack of It?

Medical necessity means that a service or procedure is appropriate, necessary, and meets accepted standards of medical practice for diagnosing or treating a patient’s condition. Insurance companies deny claims for “lack of medical necessity” when documentation doesn’t sufficiently demonstrate why the service was needed. This is one of the most common denial reasons. To avoid these denials, ensure your documentation clearly links the diagnosis to the treatment provided, demonstrates that the service meets evidence-based standards, shows that less costly or invasive alternatives were considered when appropriate, and includes adequate clinical information supporting the decision to perform the service. Proper ICD-10 coding that accurately reflects the patient’s condition is critical to demonstrating medical necessity.

Back to Index

How Long Do Insurance Companies Have to Pay Claims?

Payment timelines vary by state regulations and payer type. Most states have “prompt payment” laws requiring insurance companies to pay clean claims within 30-45 days of receipt. Medicare typically pays claims within 14-30 days. Some states impose penalties or interest on payers who consistently delay payments beyond statutory timeframes. However, these timelines apply only to “clean claims,” those submitted correctly with all required information. Claims requiring additional information, clarification, or corrections don’t start the payment clock until the payer receives the requested documentation. Understanding your state’s prompt payment laws and each payer’s specific policies helps you identify and address payment delays appropriately.

Back to Index

What Clean Claim Rate Should My Practice Aim For?

A clean claim rate of 95% or higher is considered excellent in the medical billing industry. Clean claims are those submitted correctly the first time without errors, requiring no additional information or corrections before processing. The industry average is typically between 75-85%, meaning there’s significant room for improvement in many practices. Low clean claim rates lead to delayed payments, increased administrative costs, and reduced revenue. Factors that impact your clean claim rate include accurate coding, complete patient information, proper documentation, timely filing, and understanding payer-specific requirements. Professional billing services often achieve higher clean claim rates through dedicated quality control processes, coding expertise, and familiarity with payer requirements.

Back to Index

What is the National Provider Identifier (NPI) and Do I Need One?

The National Provider Identifier (NPI) is a unique 10-digit identification number issued by the Centers for Medicare & Medicaid Services (CMS) to healthcare providers in the United States. Yes, you need an NPI to bill Medicare, Medicaid, and most insurance companies. There are two types: Type 1 for individual providers and Type 2 for organizations or group practices. Obtaining an NPI is free and can be done through the National Plan and Provider Enumeration System (NPPES). You only need to apply once, as your NPI remains the same throughout your career, even if you change specialties, locations, or employers. Your NPI must be included on all claims submissions and is required for credentialing with insurance companies.

Back to Index

How Does Moving to a New State Affect My Credentialing and Payer Contracts?

Moving to a new state significantly impacts your credentialing because you’ll need a medical license in the new state before practicing there. You must notify all insurance companies and healthcare facilities where you’re credentialed about your practice location change. Most payer contracts are state-specific, so you’ll likely need to initiate new credentialing applications in your new state rather than simply transferring existing contracts. This process can take 90-180 days, so plan ahead and start the new state licensing and credentialing process well before your move. You may also need to update your CAQH profile, NPI information, DEA registration, and malpractice insurance for the new location.

Back to Index

What is the Difference Between Credentialing and Privileging?

Credentialing verifies that you have the appropriate education, training, licenses, and competence to provide medical care. Privileging grants you permission to perform specific procedures or provide particular services at a healthcare facility. While credentialing confirms you’re a qualified physician, privileging determines exactly what you’re allowed to do at a specific location. For example, a surgeon may be credentialed as a qualified physician but privileged to perform only certain types of surgeries based on training and experience. Hospitals and surgical centers conduct privileging as a separate process after credentialing, reviewing your training, experience, and outcomes for specific procedures you wish to perform.

Back to Index

Can I Bill Insurance Companies While My Credentialing is in Progress?

Generally, you cannot bill insurance companies as an in-network provider until your credentialing is fully approved and effective. However, you may be able to see patients and bill them as self-pay or out-of-network during this period. Some insurance companies offer “interim” or “temporary” credentialing that allows you to begin seeing patients while full credentialing is being processed, though this is not universal. Once your credentialing is approved, some payers allow retroactive billing back to your application date or effective date, but this varies significantly by payer and contract terms. It’s crucial to understand each payer’s specific policies and inform patients about their potential financial responsibility during the credentialing period.

Back to Index

What is CAQH and Why is it Important for Credentialing?

CAQH (Council for Affordable Quality Healthcare) ProView is a centralized database that stores provider credentialing information used by most health plans and healthcare organizations. Instead of completing separate applications for each payer, providers enter their information once in CAQH, and participating organizations can access it. Maintaining an active, up-to-date CAQH profile is essential because most insurance companies require it for credentialing and recredentialing. You must attest to the accuracy of your information every 120 days to keep your profile active. Failure to maintain your CAQH profile can delay or prevent credentialing with new payers and cause issues with recredentialing for existing contracts.

Back to Index

How Do I Maintain My Credentialing Status During the COVID-19 Era and Beyond?

Maintaining credentialing status during evolving healthcare landscapes requires staying current with changing requirements. Many organizations have implemented temporary flexibilities for telehealth, cross-state practice, and documentation requirements that may continue or evolve. Keep all licenses and certifications current, even if renewal deadlines were extended. Maintain detailed records of any emergency privileges or temporary authorizations received. Stay in communication with your credentialing organizations about policy changes. Document any new skills, certifications, or training related to pandemic response or telehealth. Ensure your contact information and practice details are updated promptly as situations change.

Back to Index

What Happens if My Credentialing Application is Denied?

If your credentialing application is denied, you’ll typically receive written notice explaining the reasons for denial. Common reasons include incomplete documentation, licensing issues, malpractice history, or gaps in work history that weren’t adequately explained. You have the right to appeal the decision by providing additional documentation or clarification. The appeals process varies by organization but usually involves submitting a formal written appeal within 30-60 days. Working with credentialing specialists can help you understand the denial reasons, gather appropriate documentation, and navigate the appeals process effectively. In some cases, you may need to wait a specified period before reapplying.

Back to Index

What Common Mistakes Should I Avoid During the Credentialing Process?

Key mistakes include submitting incomplete applications with missing signatures or documents, providing outdated or expired documentation, failing to disclose required information (gaps in employment, malpractice claims, disciplinary actions), not responding promptly to requests for additional information, and missing critical deadlines. Also, avoid using inconsistent information across different applications, neglecting to maintain current contact information with credentialing organizations, and failing to track renewal dates for licenses and certifications. Consider using credentialing services to help manage the complex requirements and timelines across multiple organizations.

Back to Index

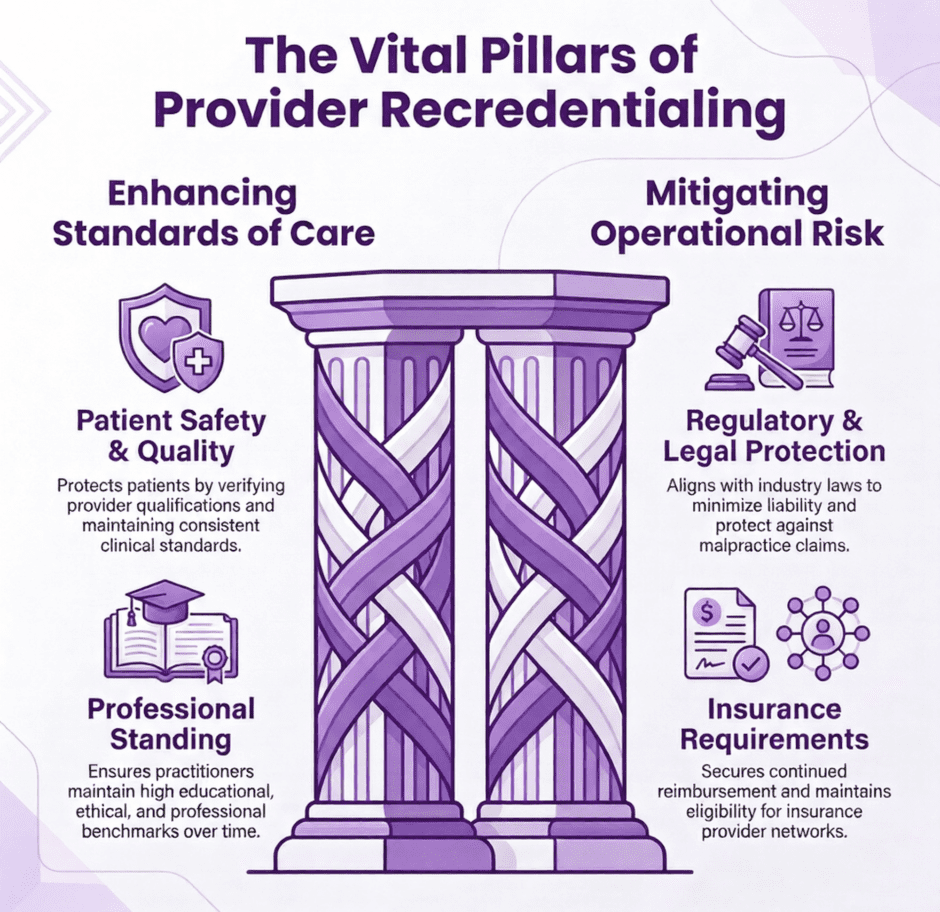

What is Recredentialing and How Often Does it Occur?

Recredentialing is the periodic review and renewal of your credentials to ensure ongoing compliance with standards. Most organizations re-credential providers every 2-3 years, with hospitals typically following a 2-year cycle and insurance plans varying between 2-3 years. The recredentialing process involves updating your application with any changes to licenses, certifications, practice locations, or incidents, and may include peer review evaluations and quality metric assessments.

The process itself is generally less intensive than initial credentialing, but it still demands attention. Providers must update their applications with any changes to licenses, certifications, practice locations, or insurance coverage, and disclose any malpractice claims, disciplinary actions, or loss of privileges. Unlike initial credentialing, recredentialing often incorporates performance data (such as peer review evaluations and quality metrics) to assess whether the provider continues to meet clinical standards. Missing a deadline can result in suspended privileges or removal from an insurance panel, making timely completion a practical necessity.

Back to Index

What Documents and Information Do I Need to Prepare for Credentialing?

Essential documents include current medical license(s), DEA registration, board certifications, CV with complete work history, medical school diploma and transcripts, residency and fellowship certificates, malpractice insurance declarations page, hospital privileges documentation, and Medicare/Medicaid enrollment information. You’ll also need to provide references from colleagues, complete background check authorizations, and may need additional specialty-specific certifications. Keep digital copies organized and ensure all documents are current, expired items will delay the process.

Back to Index

How Long Does the Credentialing Process Typically Take?

Primary source credentialing usually takes 90-120 days, though it can extend to 180 days or longer depending on the complexity of your background and responsiveness of verification sources. Initial hospital credentialing often takes 120-180 days. Insurance payer credentialing varies widely, from 30-90 days for some plans to 120+ days for others. Factors that can delay the process include incomplete applications, delays from primary sources (medical schools, training programs, state boards), international education or training requiring additional verification, gaps in employment history, and high application volumes during certain times of year.

Back to Index

What Happens if I Want to Terminate a Payer Contract or if a Payer Terminates Me?

Contract termination typically requires advance notice (usually 90-180 days) as specified in the agreement. If you initiate termination, you’ll need to notify affected patients and help them transition care or understand their options. You remain obligated to complete care for patients with ongoing treatment needs during the notice period. If a payer terminates your contract, they must provide adequate notice to patients and may need to continue covering your services for patients with ongoing episodes of care. Always review termination clauses carefully and consider the impact on your patient base and revenue before making termination decisions.

Back to Index

Can I Negotiate Better Rates with Insurance Companies, and What Leverage Do I Have?

Yes, rate negotiation is often possible, especially if you can demonstrate value to the payer. Your leverage may include unique specialties or services in your area, strong quality outcomes and patient satisfaction scores, efficient care delivery and lower per-episode costs, significant patient volume or market presence, and willingness to participate in value-based care programs. Smaller practices can sometimes gain leverage by joining provider networks or working with consultants who specialize in payer negotiations.

Back to Index

What Key Terms Should I Focus on When Negotiating Payer Contracts?

Critical contract terms include reimbursement rates and fee schedules, covered services and exclusions, prior authorization requirements, claims submission and payment timelines, quality metrics and performance standards, termination clauses and notice periods, and administrative requirements like electronic health record integration. Pay special attention to “holdback” provisions where payers retain a percentage of payments, and ensure you understand any risk-sharing arrangements or value-based care components.

Back to Index

How Long Does the Typical Payer Contracting Process Take?

The payer contracting timeline varies significantly depending on the payer, provider type, and complexity of services offered. Initial contracts with major commercial payers typically take 90-180 days from application submission to final execution. Government payers like Medicare and Medicaid may have shorter timelines (30-90 days) but involve different enrollment processes. Factors that can extend timelines include incomplete applications, credentialing requirements, site visits, and back-and-forth negotiations on contract terms.

Back to Index

What is Payer Contracting and Why is it Important for Healthcare Providers?

Payer contracting is the process of negotiating and establishing formal agreements between healthcare providers and insurance companies or other payers that define reimbursement rates, covered services, quality metrics, and administrative requirements. These contracts are crucial because they directly impact your revenue, determine which patients you can serve, and establish the terms under which you’ll be paid for services. Without proper contracts, providers may face reduced reimbursement rates, payment delays, or limited patient access.

Back to Index

How Important is Medical Credentialing to a Healthcare Provider?

Medical credentialing is a process by which medical organizations verify the credentials of healthcare providers to ensure they have the required licenses, certification and skills to properly care for patients. It’s an essential function for hospitals and others which precedes hiring or obtaining coverage by an insurance carrier. Medical credentialing is perhaps most important because it’s the one method that permits patients to place their trust with utmost confidence in their chosen healthcare provider(s). Through a standardized process involving data collection, primary source verification and committee review by health insurance plans, hospitals and other healthcare agencies, patients are confident in their healthcare professional’s ability and experience.

Back to Index

Do You Support Healthcare Providers that Perform Telehealth / Telemedicine?

Yes, we support medical providers who perform telehealth / telemedicine services. Virtual visits are an excellent way to boost your offices productivity and maintain your patient count. We can work with your established telehealth billing platform or help you set up a new one.

Back to Index

What is Medical Billing?

Medical billing is the process in which medical providers are paid for performing procedures. The procedures are coded using the most current CPT and ICD-10 codes. The codes are then sent to the insurance companies on the proper HCFA 1500 forms for review and payment. It is the responsibility of the medical biller and coder to make sure the claim is coded correctly, submitted in a timely manner and paid to the physician. Reducing spend is the primary reason that medical practices elect to outsource their medical billing to a third-party provider.

Back to Index

What is Medical Credentialing?

Medical Credentialing is the process of contracting with Insurance companies in order to become an in-network or approved medical provider for that company. Becoming a participating provider for insurance companies in your area is an extremely important part of any medical practice. Whichever companies you are contracted with will dictate which patients you are allowed to treat and what your reimbursement rates will be.

Back to Index

What’s the Difference Between Medical Billing and Credentialing?

Medical billing and credentialing for medical providers are two different categories in the healthcare world. Before any medical billing can even be completed, the healthcare provider needs to be credentialed with insurance companies in order to be an approved provider of services. Becoming credentialed as an in-network provider dictates the set amount of reimbursement that provider can expect back.

After the credentialing process has been completed the healthcare provider is then able to start treating patients in that network and sending claims for reimbursement. A medical biller will use CPT and ICD-10 codes on the claim to describe to the insurance companies what treatment the provider has given. They will then follow up on the claim to make sure that it has been properly paid by the insurance company.

That’s the difference between medical billing and credentialing.

Back to Index

What Insurers Have We Worked with in the Past?

Medwave Billing & Credentialing and its educated team of experts have worked with multiple commercial and government insurances.

We’ve worked with the following insurers:

- Aetna

- AARP

- Align Network

- Amerihealth

- Anthem BCBS

- Assurant Health

- CHIP

- Cigna

- Consumers Life Insurance Company

- Coventry One

- Freedom Blue

- Geisinger Health Plan

- Health America

- Health Net

- Highmark BCBS

- Horizon BCBS

- Humana

- Independence BCBS

- Magellan

- Medical Mutual of Ohio

- Medicaid

- Medicare, Novitas Solutions

- Optum Health

- Oxford Health Plans

- Premiere Comp Solutions

- Security Blue

- United Healthcare

- UPMC

- UPMC for You

- VBH

- Veterans Association

Back to Index

What are Our Rates?

Medwave and its team of medical billing and credentialing specialists understand the time and effort it takes to run an efficient medical office. That is why every office receives specialized attention and a tailored plan to help your practice succeed. Every contract is priced according to the needs of your practice and is always based upon volume.

Back to Index

What Types of Medical Practices do We Serve?

Although not limited to (as we have done practices outside of these), we typically serve the following medical practices: Behavioral Health, Durable Medical Equipment (DME), Toxicology Labs, Speech Therapy, Genetic Testing Labs, Substance Abuse, Chiropractic, Occupational Therapy, Family Practice, Internal Medicine, Physical Therapy, Holistic Therapy, Sleep Study Labs, Transportation, Medical Cannabis

Back to Index

Do You Support Cannabis Medicine with their Billing Requirements?

*Currently, most major insurers and Medicaid / Medicare do not cover medical marijuana treatment, since cannabis is a controlled substance on the federal level. However, if you’re a medical marijuana provider and perform services that are covered by the aforementioned insurers (no matter what they are), then reach out to us. We’ve helped a number of groups get credentialed and bill for internal, alternative services.

Back to Index

Do You Support Genetic Testing Labs with their Billing Needs?

Yes, we provide genetic testing lab billing services. Our team is experienced and well educated in the medical billing and coding guidelines of genetic testing lab specialists and has firsthand experience working with commercial and government companies to get your claims paid fast and efficiently.

Back to Index

Do You Fix Denied Medical Claims?

Yes, once you contractually sign with us and we start your medical billing, we will analyze past claims as well. Those denied medical claims can be fixed and you will be paid out on them.

Back to Index

Is A/R Recovery Part of Your Services?

Yes, Accounts receivables (AR) recovery is part of our services. In the last 16 years, our firm has resolved more than $100 million worth of insurance claims, in getting insurance companies to reimburse the amount due to health care providers.

Back to Index

Which Regions do We Serve?

Although we serve the entire United States and Europe (as billing codes do not often differ), we target the Greater Pittsburgh Region. Generally speaking, this includes twenty-eight Pennsylvania counties, nineteen West Virginia counties, five Ohio counties, and two Maryland counties.

Outside of the Pittsburgh region, we service Cleveland, Ohio medical billing and credentialing, Philadelphia, PA medical billing and credentialing and Washington, D.C. medical billing and credentialing, Louisville, KY medical billing and credentialing, Phoenix, AZ medical billing and credentialing, Charlotte, NC medical billing and credentialing, etc,.

Back to Index

What’s Your Medical Credentialing On-Board Protocol?

Providers and hospitals have many questions in reference to on-board medical credentialing protocol(s). The following blog post, Credentialing (On-Board Process for Providers, Facilities) discusses our overall protocol in detail.

Back to Index

Do You Partner with 3rd Party Medical Groups?

Medwave does partner with a number of 3rd party groups, especially medical product sales groups that have medical provider clients in need of credentialing and billing.

Back to Index

Do You Provide Billing and / or Credentialing to Laboratories?

Medwave does provide billing and credentialing to laboratories of all types, but specifically Sleep Study Labs, Genetic Testing Labs and Toxicology Labs.

Back to Index