Getting paid for the healthcare services you provide should be straightforward. You deliver quality care, submit your claims, and receive payment. Yet for many healthcare providers, the reality looks quite different. Claims get denied, payments are delayed, and the administrative burden grows heavier each month.

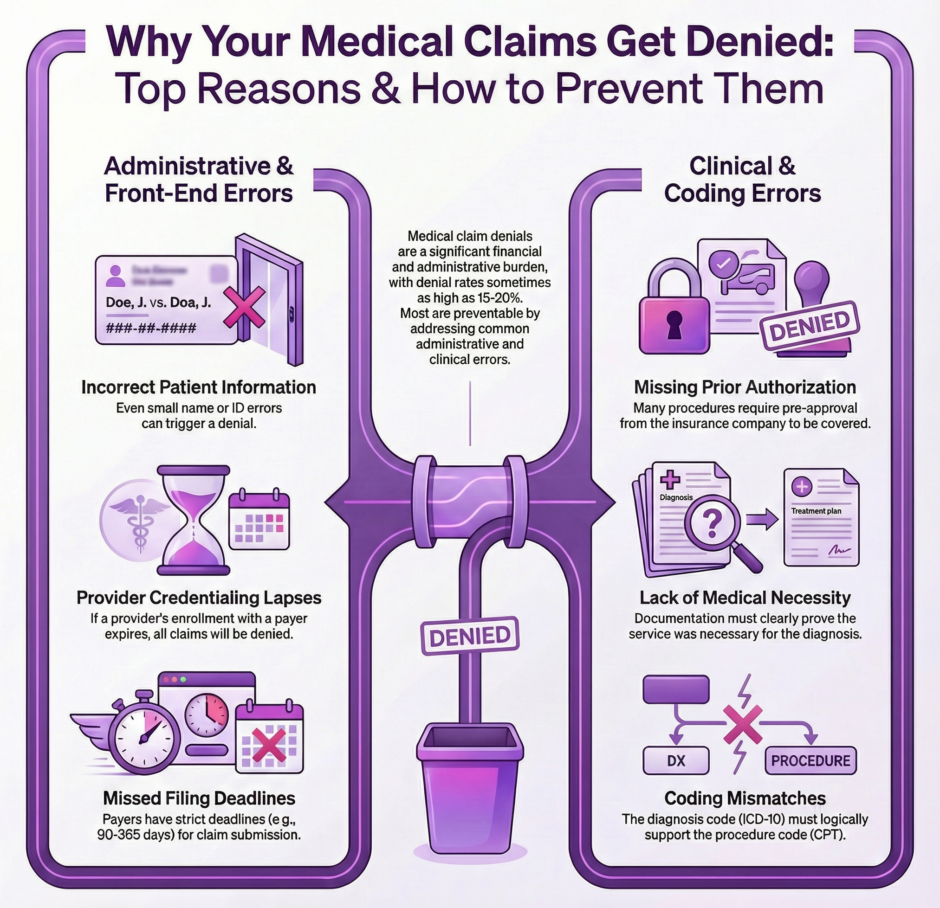

If you’re tired of seeing rejection letters pile up on your desk, you’re not alone. Claims denials have become an epidemic across the healthcare industry, with some practices experiencing denial rates as high as 15-20%. The good news? Most denials are preventable.

If you’re tired of seeing rejection letters pile up on your desk, you’re not alone. Claims denials have become an epidemic across the healthcare industry, with some practices experiencing denial rates as high as 15-20%. The good news? Most denials are preventable.

The financial impact of claims denials extends far beyond delayed revenue. Each denied claim triggers a cascade of administrative work including staff time spent investigating the denial, gathering additional documentation, filing appeals, and resubmitting claims. This cycle can consume hundreds of hours per month for busy practices, driving up operational costs while keeping cash flow uncertain. Meanwhile, patients may face unexpected bills or delays in care authorization, creating friction in the provider-patient relationship.

Let’s dive into the twelve most common reasons why claims get denied and, more importantly, what you can do about them.

1. Missing or Incorrect Patient Information

The foundation of every claim starts with accurate patient demographics. When basic information like names, dates of birth, addresses, or insurance member IDs contain errors, payers have no choice but to reject the claim. This might seem like a simple issue, but it’s surprisingly common.

Double-checking patient information at every visit is crucial. Staff members should verify insurance cards, update addresses, and confirm that the patient’s name matches exactly what appears on their insurance documentation. Even small discrepancies like “Robert” versus “Bob” can trigger a denial.

Consider implementing a patient check-in system that requires verification of key information before each appointment. This small step can prevent countless headaches down the road.

2. Authorization and Referral Issues

Many insurance plans require prior authorization for specific procedures, treatments, or specialist visits. When providers fail to obtain these authorizations or submit claims without proper referral documentation, denials are inevitable.

The challenge lies in keeping track of which procedures require authorization for each payer. Requirements change frequently, and what was approved yesterday might need authorization today. Establishing a robust authorization tracking system and maintaining regular communication with insurance companies about their requirements can help minimize these denials.

Some practices assign dedicated staff members to handle authorizations exclusively. This specialization ensures that authorization requirements don’t fall through the cracks during busy periods.

3. Coding Errors and Mismatches

Medical coding forms the language that translates your clinical work into billable services. When ICD-10 diagnosis codes don’t support the CPT procedure codes, or when modifiers are used incorrectly, claims get rejected.

The relationship between diagnosis and procedure codes must tell a coherent clinical story. For example, billing for a chest X-ray with a diagnosis code for a sprained ankle will raise red flags with any payer. Similarly, using outdated codes or failing to use the most specific code available can result in denials.

Regular training for coding staff and investing in coding software that flags potential mismatches can significantly reduce these types of errors. Many practices also benefit from periodic coding audits to identify patterns in their coding practices that might be causing denials.

4. Timely Filing Violations

Every insurance company has specific deadlines for claim submission, typically ranging from 90 to 365 days from the date of service. Miss these deadlines, and your claim will be denied regardless of how accurate or legitimate it might be.

Timely filing violations often occur when claims get lost in the shuffle during busy periods or when there are delays in obtaining necessary documentation. Creating a systematic approach to claim submission, with regular follow-up procedures, helps ensure that no claims slip through the cracks.

Many practice management systems can be configured to alert staff when claims are approaching filing deadlines. Taking advantage of these features can prevent costly missed deadlines.

5. Duplicate Claims Submission

Sometimes in an effort to expedite payment, practices accidentally submit the same claim multiple times. Insurance companies have sophisticated systems to detect duplicate submissions, and they’ll deny the subsequent claims automatically.

This often happens when there’s poor communication between different staff members handling the billing process, or when electronic and paper claims for the same service are submitted simultaneously. Maintaining clear records of what has been submitted and when can prevent these duplicate submissions.

6. Non-Covered Services

Not every service you provide will be covered by every insurance plan. When claims are submitted for services that fall outside the patient’s coverage, denials are certain. This includes experimental procedures, cosmetic treatments deemed non-medical, or services that exceed plan limitations.

Before providing services, especially expensive procedures or treatments, verify coverage with the patient’s insurance company. While this might seem time-consuming, it prevents the frustration of denied claims and protects patients from unexpected bills.

Creating a database of commonly non-covered services for major payers in your area can help your staff quickly identify potential coverage issues before services are rendered.

7. Provider Enrollment and Credentialing Problems

You can’t get paid by an insurance company if you’re not properly enrolled in their network or if your credentialing has lapsed. These administrative issues can bring your revenue cycle to a complete halt.

Credentialing requirements vary by payer and can include everything from medical licenses and malpractice insurance to hospital privileges and board certifications. Keeping track of renewal dates and maintaining current documentation with each payer requires dedicated attention.

Many practices struggle with credentialing because it’s not a daily task, making it easy to overlook until problems arise. Setting up calendar reminders well in advance of expiration dates and maintaining organized files for each provider can prevent these costly oversights.

8. Coordination of Benefits Errors

When patients have multiple insurance policies, determining which payer is primary and which is secondary becomes critical. Filing claims in the wrong order or failing to include information about other coverage can result in denials.

This is particularly common with Medicare patients who also have supplemental insurance, or in families where both spouses have employer-sponsored insurance that might cover dependents. Taking the time to properly identify the coordination of benefits during patient registration saves significant time and effort later.

9. Medical Necessity Documentation

Insurance companies don’t just pay for procedures because they were performed; they need evidence that the services were medically necessary. When documentation doesn’t adequately support the need for the services provided, claims get denied.

This means that clinical notes must clearly articulate the patient’s symptoms, the rationale for the chosen treatment, and how the services provided address the patient’s medical needs. Generic or incomplete documentation often leads to medical necessity denials.

Training providers on documentation requirements and implementing templates that prompt for necessary information can improve the quality of clinical documentation and reduce these types of denials.

10. Incorrect Place of Service Codes

Where you provide services matters to insurance companies. Using the wrong place of service code can result in claim denials, especially when the location doesn’t match what the payer expects for the specific procedure.

Common mistakes include:

- Using office codes for hospital procedures

- Mixing up inpatient and outpatient facility codes

- Incorrectly coding telehealth services

- Using outdated location codes

Staying current with place of service code requirements and double-checking that the codes match where services were actually provided can eliminate these denials.

11. Bundling and Unbundling Issues

Medical procedures often involve multiple components that may or may not be billable separately. The National Correct Coding Initiative (NCCI) edits and payer-specific bundling rules determine which procedures can be billed together and which are considered part of a larger service.

Unbundling occurs when providers bill separately for services that should be reported with a single code. Conversely, some providers fail to bill for services that can legitimately be reported in addition to primary procedures.

Staying current with coding guidelines and using software that checks for bundling issues before claims are submitted can help avoid these problems.

12. Lack of Supporting Documentation

Some claims require additional documentation beyond the standard claim form. This might include operative reports, pathology results, imaging studies, or other clinical information that supports the services billed.

When this supporting documentation is missing or inadequate, payers have no choice but to deny the claim. The challenge is knowing which claims require additional documentation and ensuring that the right information is included with the initial submission.

Creating checklists for procedures that commonly require additional documentation and training staff to recognize when extra information is needed can reduce these denials.

Taking Action Against Claim Denials

While this list might seem overwhelming, remember that knowledge is power. Identifying the most common reasons for denials in your practice enables you to develop targeted strategies to prevent them.

While this list might seem overwhelming, remember that knowledge is power. Identifying the most common reasons for denials in your practice enables you to develop targeted strategies to prevent them.

Start by analyzing your denial patterns. Look at the past six months of denials and categorize them by reason. You’ll likely find that a small number of issues are responsible for the majority of your denials. Focus your improvement efforts on these high-impact areas first.

Consider investing in denial management technology solutions that can catch errors before claims are submitted. Many practice management systems and clearinghouses offer real-time claim scrubbing that identifies potential problems before they reach the payer.

Don’t forget about staff training. Regular education sessions on coding updates, payer requirements, and best practices can significantly improve your first-pass claim acceptance rates. When your team knows what to look for, they can prevent problems before they occur.

Summary: The Top 12 Reasons Why Your Claims Keep Getting Denied

Claims denials are frustrating, but they don’t have to be inevitable. Addressing these twelve common issues systematically gives you the ability to dramatically improve your revenue cycle performance and reduce the administrative burden on your practice.

Claims denials are frustrating, but they don’t have to be inevitable. Addressing these twelve common issues systematically gives you the ability to dramatically improve your revenue cycle performance and reduce the administrative burden on your practice.

Preventing denials is always more efficient than appealing them after the fact. While appeals can be necessary and worthwhile, the time and resources required to overturn a denial are substantial. Focus your energy on getting claims right the first time.

For practices struggling with persistent denial issues, partnering with specialists who focus on revenue cycle management can provide valuable expertise. Companies like Medwave, which specialize in billing, credentialing, and payer contracting, can offer the dedicated attention and specialized knowledge needed to optimize your claims process and minimize denials.