Out-of-network billing presents one of healthcare’s most challenging administrative tasks. While in-network providers have contracted rates and streamlined processes, out-of-network providers face vague explanations, delayed payments, and constant battles for fair reimbursement. Insurance companies often take advantage of the confusion surrounding out of network claims, using unclear policies and difficult appeal processes to reduce what they pay. However, providers who learn the strategies and tactics for effective out of network billing can secure appropriate reimbursement and build profitable practices.

Why Out-of-Network Billing is Different

When providers join insurance networks, they agree to accept predetermined rates for their services. The payment process becomes relatively straightforward because both parties know the contracted amounts. Claims get processed according to established rules, and disputes typically involve clear contract language.

When providers join insurance networks, they agree to accept predetermined rates for their services. The payment process becomes relatively straightforward because both parties know the contracted amounts. Claims get processed according to established rules, and disputes typically involve clear contract language.

Out-of-network billing works completely differently. Without a contract, providers can set their own rates and bill their full charges. However, insurance companies respond by determining “usual and customary” rates, “allowed amounts,” or other calculated figures that often fall well below what providers charge. The insurance company sends payment based on their calculations, not your fees, and provides explanations that can be deliberately vague or confusing.

This creates an inherent conflict. You believe your charges are fair and appropriate. The insurance company claims they’re paying reasonable rates based on geographic data or other factors. Neither party has a contract to settle the dispute, so determining fair payment becomes a negotiation or battle depending on your approach and persistence.

How Insurance Companies Reduce Out-of-Network Payments

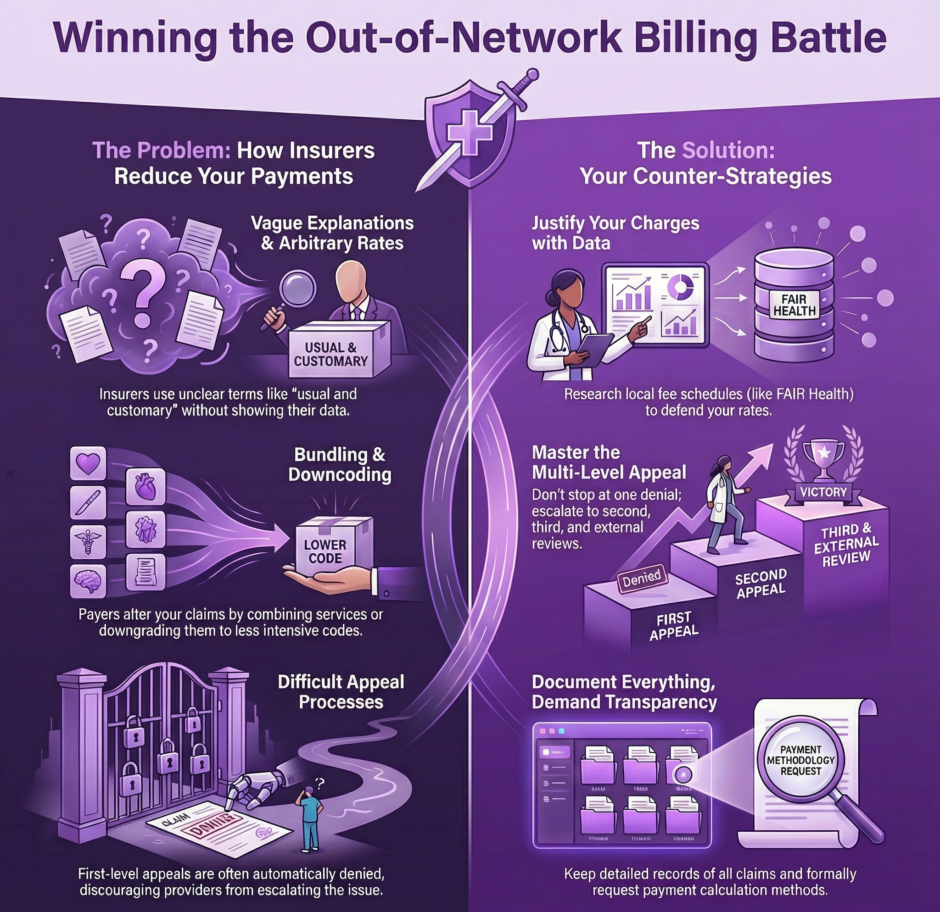

Knowledge of the tactics insurance companies use helps you counter them effectively. These strategies appear throughout the out-of-network billing process, from initial claim processing through appeals.

- Vague Explanation of Benefits statements represent one of the most common tactics. The EOB might say the payment is based on “usual and customary charges” without explaining how that amount was calculated. It might reference databases or methodologies without providing the actual data. This vagueness makes it nearly impossible to challenge the payment because you don’t know the specific reasoning behind it.

- Arbitrary allowable amounts create another challenge. Insurance companies might claim they’re using “the 80th percentile of charges in your area” but refuse to share the data supporting that calculation. Or, they might reference proprietary databases that providers cannot access. You receive payment that seems low, but you have no way to verify whether the payer’s calculations are accurate.

- Bundling and downcoding reduce payments by changing what was billed. The insurance company might bundle several procedures together and pay for one, claiming they’re typically performed as a single service. Or they might downcode a procedure to a less intensive service, reducing the reimbursement. These changes often happen without clear explanation, buried in payment adjustments that billing staff might miss.

- Coordination of benefits issues delay and reduce payments when patients have multiple insurance policies. The primary insurance might claim they’re paying as secondary because another policy should be primary. Meanwhile, the other insurance makes the opposite claim. Months pass while the policies point fingers at each other, and you struggle to collect from either one.

- Patient responsibility calculations that don’t match reality create collection problems. The insurance company might apply the charges to the patient’s deductible without clearly explaining this on the EOB. Or they might calculate patient coinsurance incorrectly, leaving you to collect the difference while the patient insists they don’t owe it based on what the insurance told them.

Key Strategies for Maximizing Out-of-Network Reimbursement

Fighting back against low payments requires knowledge, persistence, and strategic action.

Here are the most effective approaches for securing fair reimbursement on out-of-network claims:

Know Your Charges and Defend Them

- Research what other providers in your area charge for the same services

- Document the complexity and time required for procedures you perform

- Keep records of your overhead costs and operational expenses

- Be prepared to justify your fees with concrete data and explanations

- Don’t accept the insurance company’s assertion that your charges are “too high” without questioning their methodology

Demand Transparency

- Request detailed explanations of how allowed amounts were calculated

- Ask for the specific data and percentiles used in payment determinations

- Question vague references to databases without supporting information

- File complaints with state insurance departments when payers won’t provide explanations

- Use legal requirements for payment transparency to your advantage

Challenge Underpayments Immediately

- Review every EOB carefully for payment accuracy

- Compare payments to your charges and payer policies

- Identify patterns of underpayment across multiple claims

- Don’t let underpaid claims sit without action

- File appeals within the timeframes specified by payers

Document Everything

- Keep copies of all claims submitted with dates and tracking numbers

- Save all EOBs and correspondence from insurance companies

- Record phone calls or take detailed notes of conversations with payer representatives

- Create files for each appeal with all supporting documentation

- Track timelines to ensure you meet all deadlines

Use Multiple Appeal Levels

- Start with first-level appeals addressing specific payment issues

- Escalate to second and third-level appeals when initial appeals are denied

- Request peer-to-peer reviews for clinical disputes

- Consider external review options when internal appeals fail

- Don’t give up after one denial

The Appeal Process for Out-of-Network Claims

Most out-of-network payment disputes require formal appeals. Understanding the appeal process and using it effectively makes the difference between accepting low payments and securing fair reimbursement.

Most out-of-network payment disputes require formal appeals. Understanding the appeal process and using it effectively makes the difference between accepting low payments and securing fair reimbursement.

Insurance companies typically offer multiple levels of appeal, though they rarely make this process easy or transparent. The first-level appeal usually involves submitting a written request for reconsideration along with supporting documentation. You might need to explain why your charges are appropriate, provide evidence of usual and customary rates in your area, or demonstrate that the service was medically necessary.

First-level appeals often get denied almost automatically, especially for payment amount disputes. Insurance companies may send form letter responses that don’t address your specific concerns. Don’t let this discourage you. The real work often happens at the second and third appeal levels, where actual human review becomes more likely.

Second-level appeals require more detailed documentation and stronger arguments. At this point, you should be citing specific policy language, providing comparative fee data, and building a compelling case for why the payment should be increased. Reference fair market rates, geographic considerations, and the complexity of services provided. Include documentation from FAIR Health, Medicare fee schedules (as a baseline), or other authoritative sources showing that your charges align with market rates.

Third-level appeals may involve independent review organizations or state insurance department involvement. These external reviews can be powerful because they remove the decision from the insurance company’s internal process. However, they also require the most thorough documentation and preparation. Treat these appeals like legal proceedings, with organized exhibits, clear arguments, and professional presentation.

Common Out-of-Network Billing Mistakes to Avoid

Many providers inadvertently hurt their out-of-network reimbursement by making avoidable mistakes. Watch out for these common errors:

Failing to verify patient benefits before providing services leads to surprises later. Even though you’re out-of-network, you should still check whether the patient’s plan provides any out-of-network coverage. Some plans have no out-of-network benefits at all, meaning the patient will be responsible for the entire bill. Knowing this upfront allows you to discuss payment expectations before providing care.

Not collecting patient responsibility upfront creates collection challenges. When patients don’t pay their portion at the time of service, collecting later becomes significantly harder. They may dispute what they owe based on confusing insurance explanations, or they may simply not have the money available when the bill arrives weeks after their visit.

Accepting low payments without appeal sends a message that you’ll take whatever the insurance company offers. Over time, payers may reduce their out-of-network payments even further because they know you won’t fight back. Every underpayment you accept without challenge encourages continued underpayment.

Missing appeal deadlines closes the door on payment disputes. Insurance companies set strict timeframes for filing appeals, often 60 to 180 days from the date of the initial payment. Once that deadline passes, you typically cannot pursue additional payment regardless of how unfair the original reimbursement was.

Providing incomplete documentation in appeals gives insurance companies easy reasons to deny. If you claim your fees are appropriate but don’t provide supporting data, the payer will simply dismiss your appeal. Thorough documentation takes time to compile, but it’s essential for winning appeals.

Balance Billing and State Regulations

Balance billing, the practice of billing patients for the difference between your charges and what insurance pays, faces increasing regulation. Many states have laws limiting or prohibiting balance billing in certain situations, particularly for emergency services or when patients didn’t have a choice about receiving out-of-network care.

Balance billing, the practice of billing patients for the difference between your charges and what insurance pays, faces increasing regulation. Many states have laws limiting or prohibiting balance billing in certain situations, particularly for emergency services or when patients didn’t have a choice about receiving out-of-network care.

Understanding your state’s balance billing laws is critical for out-of-network providers. In some states, you can balance bill patients for most services. In others, balance billing is prohibited when patients receive emergency care or when in-network facilities use out-of-network providers without patient consent. Violating these laws can result in fines, license issues, and forced refunds.

The federal No Surprises Act, which took effect in 2022, also limits balance billing for emergency services and certain non-emergency services at in-network facilities. This law requires independent dispute resolution for payment disagreements between providers and insurers when balance billing is prohibited. Familiarize yourself with how this law affects your practice and use the IDR process when appropriate.

Even when balance billing is legally permitted, consider the patient relationship implications. Aggressive balance billing can damage your reputation and drive patients away. Some providers choose to write off certain balances or work out payment plans rather than pursuing full collection. This decision involves balancing fair compensation for your services against maintaining positive patient relationships and community standing.

Building Leverage with Insurance Companies

While you don’t have a contract with out-of-network payers, you can still build leverage that encourages fair payment. Insurance companies respond to pressure, especially when providers make low payments more trouble than they’re worth.

Filing complaints with state insurance departments puts official pressure on payers. Every state has an insurance commissioner or department that handles provider complaints about payment practices. When insurance companies receive complaints, they must respond and justify their actions. Multiple complaints about the same issues can trigger regulatory investigations.

Tracking patterns of underpayment across multiple claims strengthens your position. If you can show that a particular insurance company consistently pays 40% of your charges while other payers pay 60%, you build evidence of discriminatory or unfair payment practices. This pattern makes appeals and complaints more compelling.

Threatening to pursue legal action, when appropriate, sometimes motivates insurance companies to negotiate. While actually filing lawsuits over payment disputes is expensive and time-consuming, simply having an attorney send a demand letter can prompt better settlement offers. Insurance companies would rather negotiate than defend lawsuits, especially when their payment practices are questionable.

Joining provider advocacy groups creates collective pressure. Organizations like state medical societies or specialty associations often advocate for provider payment rights. When multiple providers raise the same concerns about a payer’s out-of-network practices, these organizations may take collective action that individual providers cannot.

Technology and Data in Out-of-Network Billing

Effective out-of-network billing increasingly relies on data and technology. Providers who leverage these tools secure better reimbursement than those relying on guesswork.

Effective out-of-network billing increasingly relies on data and technology. Providers who leverage these tools secure better reimbursement than those relying on guesswork.

Fee schedule databases like FAIR Health provide objective data on usual and customary charges by geographic area. These databases aggregate actual charges and payments from millions of claims, giving you credible evidence to support your fees. When appealing low payments, reference these databases to show that your charges fall within reasonable ranges.

Practice management software that tracks payment patterns helps identify underpayments quickly. If you bill $500 for a service and typically receive $300 from out-of-network payers, a payment of $150 immediately flags for review. Without systematic tracking, these underpayments might go unnoticed or unchallenged.

Automated appeal letter generation saves time when filing multiple appeals. While each appeal should be customized to address specific issues, having templates for common situations speeds the process. The faster you can file thorough appeals, the more likely you are to pursue every underpayment rather than letting some slide due to administrative burden.

Clearinghouses that specialize in out-of-network claims understand payer-specific quirks and requirements. They know which documentation each payer requires, how to format appeals for best results, and which escalation paths work for different issues. This expertise can significantly improve your success rate with out of network claims.

When to Consider Professional Billing Services

Managing out-of-network billing internally requires significant time, expertise, and persistence. Many providers find that outsourcing this function to specialists delivers better results with less stress.

Professional billing services that focus on out-of-network claims, like Medwave, which specializes in billing, credentialing, and payer contracting, bring experience and resources that most practices cannot maintain internally. They know the tactics insurance companies use, have relationships with payer representatives, and can escalate issues effectively. They also have the staff capacity to pursue appeals aggressively without pulling resources from patient care.

These services typically work on a percentage of collections, aligning their interests with yours. They succeed when they secure higher payments, so they’re motivated to fight for every dollar. This arrangement also means you don’t pay for billing services that don’t produce results.

Consider professional billing services when your internal team struggles with out-of-network claims, when underpayments and denials exceed 20% of claims, when you lack time to pursue appeals effectively, or when you’re expanding services that will be primarily out-of-network. The investment in professional services often pays for itself through improved collections.

Taking Control of Out-Of-Network Reimbursement

Out-of-network billing doesn’t have to be unprofitable or frustrating. While insurance companies will continue using tactics to reduce payments, providers who know how to fight back can secure fair reimbursement. This requires knowledge of the billing process, persistence in pursuing appeals, systematic tracking of payments, and strategic use of available tools and resources.

Out-of-network billing doesn’t have to be unprofitable or frustrating. While insurance companies will continue using tactics to reduce payments, providers who know how to fight back can secure fair reimbursement. This requires knowledge of the billing process, persistence in pursuing appeals, systematic tracking of payments, and strategic use of available tools and resources.

Don’t accept vague explanations or low payments without question. Challenge underpayments immediately with well-documented appeals. Build leverage through complaints, data, and collective action. Use technology and professional services strategically to maximize your results.

The effort pays off not just in increased revenue but in establishing your practice as one that won’t accept unfair treatment. Insurance companies will learn that low payments will be challenged, that appeals will be thorough and persistent, and that you expect fair reimbursement for the valuable care you provide. This reputation, combined with effective billing practices, transforms out-of-network billing from a frustrating struggle into a viable part of your practice’s revenue strategy.