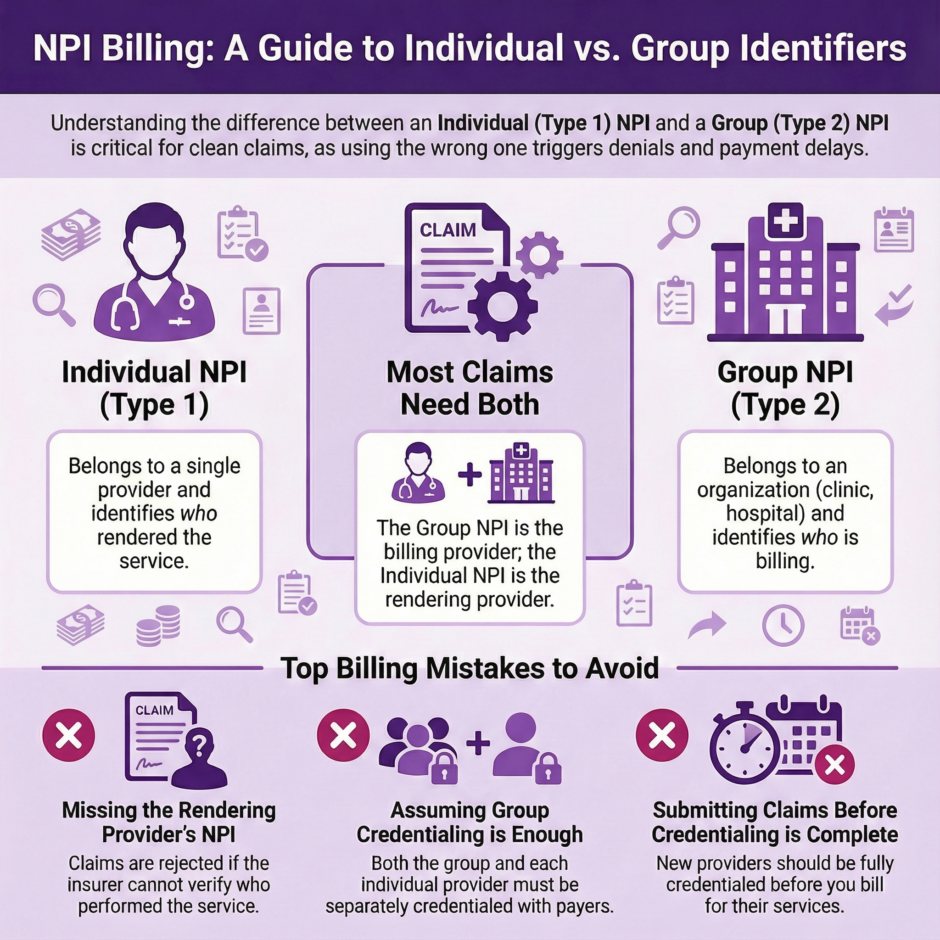

Small details can make or break your revenue cycle. One of the most common areas where practices struggle is deciding whether to bill under a Group NPI or an Individual NPI. Getting this wrong doesn’t just delay payments. It can trigger claim denials, compliance issues, and audit flags that hurt your bottom line.

The National Provider Identifier, or NPI, is a unique 10-digit number that CMS assigns to healthcare providers and organizations. Every claim you submit needs the right NPI in the right place. But which one do you use? When do you need both? And what happens if you get it wrong?

This guide will walk you through everything you need to know about Group NPIs versus Individual NPIs. We’ll cover when to use each one, how they work together on claims, what mistakes to avoid, and how to set up your practice for clean claims and faster reimbursements.

The Basics: Individual NPI vs Group NPI

Before we dig into billing scenarios, let’s clarify what these two types of NPIs actually represent.

An Individual NPI, also called Type 1, belongs to a single healthcare provider. This could be a physician, nurse practitioner, physical therapist, dentist, or any other licensed professional who delivers patient care. Your Individual NPI stays with you throughout your career, no matter where you work or how many times you change employers. It identifies you as the person who rendered the service.

A Group NPI, or Type 2, belongs to a healthcare organization. This includes group practices, clinics, hospitals, laboratories, and home health agencies. The Group NPI identifies the billing entity, the organization submitting the claim and receiving payment. It’s tied to the organization’s Employer Identification Number (EIN) rather than any single provider.

Here’s what trips people up the most. These two NPIs aren’t interchangeable, and in most cases, you need both on the same claim. The Group NPI shows who’s billing for the service, while the Individual NPI shows who actually performed it.

When a patient visits a group practice for a routine checkup, the practice submits the claim using their Group NPI as the billing provider. But they also include the treating physician’s Individual NPI as the rendering provider. This tells the insurance company that the practice is billing for the visit, but identifies exactly which provider saw the patient.

This dual-NPI system serves several purposes. It allows insurance companies to track individual provider performance and quality metrics. It helps prevent fraud by creating a clear paper trail. And it ensures that providers get proper credit for the services they deliver, which matters for things like credentialing, peer review, and participation in value-based payment programs.

When You Need Just an Individual NPI

Solo practitioners who aren’t incorporated often bill using only their Individual NPI. If you’re operating as a sole proprietor under your own name and Social Security Number, your Individual NPI functions as both your billing identifier and your rendering identifier.

A physician running a small independent practice without incorporation can submit claims with their Individual NPI appearing in both the billing provider field and the rendering provider field. The insurance company knows that the same provider both performed the service and is billing for it.

This setup is simple and works well for truly independent practitioners. You don’t need to maintain separate organizational credentials, and you have direct relationships with insurance companies under your own name. However, this approach has limitations. If you later want to hire other providers or expand your practice, you’ll need to get a Group NPI and restructure how you bill.

Even solo practitioners who incorporate their practices typically need both types of NPIs. If you form an LLC, professional corporation, or any other business entity with its own EIN, you’re now operating as an organization from a billing perspective. That means you need a Group NPI for your business, even though you’re still the only provider.

When You Need Both NPIs

Most practices that employ multiple providers or operate as incorporated entities need both Group and Individual NPIs working together. This is where claim forms get more detailed, and mistakes become more common.

On a standard CMS-1500 claim form, Box 33 is for the billing provider. This is where the Group NPI goes. Box 24J is for the rendering provider. This is where each individual provider’s NPI goes. Both boxes need to be filled out correctly for the claim to process smoothly.

Consider a multi-specialty clinic with ten physicians. The clinic has credentialed its Group NPI with all the insurance companies it works with. When any of those ten doctors sees a patient, the claim goes out under the clinic’s Group NPI as the billing provider. But each claim also includes that specific doctor’s Individual NPI in the rendering provider field.

This matters for several reasons. Firstly, insurance companies need to verify that the rendering provider is actually credentialed with them. Just because the group is in-network doesn’t automatically mean every provider who works there is approved. Secondly, payers track utilization patterns and quality metrics at the individual provider level. They need to know which doctor ordered which tests, prescribed which medications, and delivered which services.

Thirdly, proper NPI usage protects your practice during audits. If an insurance company questions a claim from six months ago, they need to see exactly who performed the service. Having both NPIs documented correctly creates an audit trail that supports your billing and demonstrates compliance.

The mistake many practices make is assuming that once their Group NPI is credentialed, they’re all set. But credentialing is a two-part process. Both the organization and each individual provider need to be enrolled and approved with every payer you bill. Missing this step leads to denials, even when your claim form is filled out correctly.

How Claims Get Processed With Different NPI Setups

The way insurance companies process your claims depends heavily on which NPIs you use and how they’re set up in the payer’s system. Let’s walk through a few common scenarios.

The way insurance companies process your claims depends heavily on which NPIs you use and how they’re set up in the payer’s system. Let’s walk through a few common scenarios.

In a solo practice billing scenario, an unincorporated sole proprietor submits a claim with only their Individual NPI. The payer sees that the billing provider and rendering provider are the same person. The system checks whether that individual is credentialed and in-network. If yes, the claim processes. If no, it gets denied.

Now look at a group practice scenario. The claim arrives with the group’s Type 2 NPI as the billing provider and a physician’s Type 1 NPI as the rendering provider. The insurance company first checks whether the group is in their network. Then they verify whether that specific physician is credentialed with them. Both checks need to pass for the claim to go through.

Here’s where things get tricky. Some practices bill under the group but forget to credential individual providers. The result is a denial stating the rendering provider is out of network, even though the group itself has a contract. This is one of the most common credentialing mistakes, and it can go unnoticed until claims start getting rejected.

Another scenario involves independent contractors working at multiple locations. A physical therapist who works at three different clinics will have their Individual NPI listed as the rendering provider on claims from all three locations. But each clinic bills under its own Group NPI. The therapist needs to make sure they’re credentialed with payers as an individual, and also that their Individual NPI is properly linked to each group they work with.

Locum tenens situations add another layer. When a temporary physician covers for someone on leave, the practice might bill under the regular provider’s name in certain circumstances, or they might need to credential the temporary provider separately. The rules vary by payer and state, but getting this wrong can lead to fraud allegations if you’re not careful.

Common Billing Mistakes and How to Avoid Them

Even experienced billing teams run into NPI-related problems. Let’s look at the most frequent errors and how to prevent them.

- Missing the rendering provider NPI is probably the number one mistake. Practices bill under their Group NPI but leave Box 24J blank on the CMS-1500 form. Insurance companies reject these claims immediately because they can’t verify who actually performed the service. Always include both NPIs when billing as a group.

- Using the wrong NPI in the wrong field causes confusion and denials. Sometimes billers accidentally put the Individual NPI in the billing provider field when they should use the Group NPI. Or they flip them around entirely. Double-checking claim forms before submission prevents this.

- Billing under an Individual NPI when the group contract requires Group NPI billing creates payment issues. If your practice has a contract with an insurance company under the group’s name and tax ID, claims need to go out under that Group NPI. Billing under individual providers instead can result in lower reimbursement or denial.

- Not updating payer files after adding new providers leaves gaps in your credentialing. When you hire a new physician, their Individual NPI needs to be added to your group’s profile with every insurance company. Until that happens, claims for their services will be rejected.

- Forgetting to update NPPES records when your practice address, specialty, or other details change creates mismatches between what payers have on file and what you’re submitting on claims. The National Plan and Provider Enumeration System needs to be updated within 30 days of any changes to your practice information.

- Submitting claims before credentialing is complete is a recipe for denials. New providers should be fully credentialed with all payers before they start seeing patients, or at least before you submit claims. The credentialing process typically takes 90-120 days, so plan ahead.

The best way to catch these mistakes is through claim scrubbing before submission. Modern billing software can flag missing NPIs, mismatched information, and other errors that would cause denials. Investing in good technology and training your staff properly pays for itself in reduced denials and faster payments.

Setting Up Your Practice for Clean Claims

Getting your NPI billing right from the start saves enormous headaches down the road. Here’s how to set up your practice properly.

- Make sure you have the correct NPIs for your situation. Solo practitioners need an Individual NPI at minimum. If you’re incorporated, get a Group NPI for your business entity. Group practices need a Group NPI plus Individual NPIs for every provider on staff.

- Credential both your group and your individual providers with every payer you plan to bill. Don’t assume that group credentialing covers everyone. Each provider needs their own credentialing application completed and approved. This process takes time, so start early.

- Verify that your billing software is set up correctly. Your practice management system should have fields for both billing provider NPI and rendering provider NPI. Make sure your staff knows how to fill these out properly for every claim. Run test claims to verify the NPIs are mapping to the correct boxes on the CMS-1500 form.

- Keep your NPPES records current. Log into the National Plan and Provider Enumeration System at least once a year to verify all your information is accurate. Update immediately when anything changes, like a new office location, additional specialties, or changes to your business structure.

- Establish a credentialing calendar that tracks when each provider’s credentials need renewal with each payer. Most payers require re-credentialing every two to three years. Missing these deadlines can result in suspension from the network and claim denials.

- Train your entire billing staff on proper NPI usage. Make sure they know the difference between billing and rendering providers, when to use which NPI, and how to verify credentialing status before submitting claims. Regular training sessions keep everyone up to date on payer rule changes.

- Consider working with a billing and credentialing specialist who can handle these details for you. Companies like Medwave specialize in billing, credentialing, and payer contracting. They keep track of all the moving parts so you can focus on patient care instead of worrying about whether your claims will process correctly.

Summary: Group NPI or Individual NPI

Knowledge of the difference between Group NPIs and Individual NPIs is essential for any healthcare practice that wants to get paid correctly and on time. Individual NPIs identify the rendering provider, the person who actually performed the service. Group NPIs identify the billing entity, the organization submitting the claim.

Knowledge of the difference between Group NPIs and Individual NPIs is essential for any healthcare practice that wants to get paid correctly and on time. Individual NPIs identify the rendering provider, the person who actually performed the service. Group NPIs identify the billing entity, the organization submitting the claim.

Most practices need both types of NPIs working together on claims. The Group NPI goes in the billing provider field, while the Individual NPI goes in the rendering provider field. Both the organization and each individual provider need to be credentialed separately with insurance companies.

Common mistakes include missing NPIs on claims, using the wrong NPI in the wrong field, and submitting claims before credentialing is complete. These errors cause denials that delay payment and create extra work for your billing staff.

Medicare, Medicaid, and private insurance companies all have specific requirements for NPI reporting. While the details vary, the general rule of thumb is to include both NPIs on claims unless you’re a solo practitioner billing only under your Individual NPI.

Setting up your practice correctly from the start, keeping your NPPES records current, and working with experienced billing and credentialing professionals helps ensure your claims process smoothly. The time and money you invest in proper NPI management pays for itself through faster reimbursements and fewer denials.