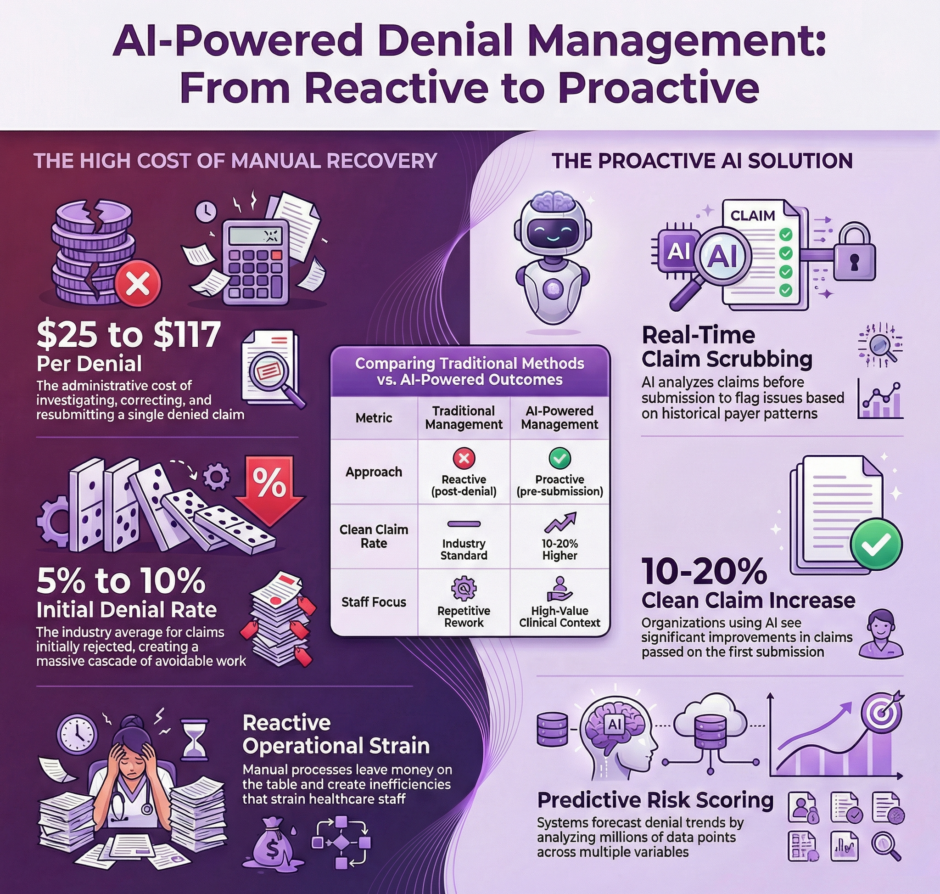

Healthcare revenue cycle management has reached a critical juncture. Medical practices and healthcare organizations lose billions of dollars annually due to claim denials, with industry estimates suggesting that between 5% and 10% of all claims submitted are initially denied. Even more concerning is that a significant portion of these denials could have been prevented entirely with the right tools and insights. This is where artificial intelligence steps in, transforming how healthcare organizations approach denial management and claim submissions.

The Current State of Claim Denials

The financial impact of denied claims extends far beyond the immediate loss of revenue. Each denial triggers a cascade of administrative work. The staff must investigate the reason for denial, gather additional documentation, correct errors, resubmit the claim, and follow up with payers. This process consumes valuable time and resources, with some estimates indicating that working a single denial can cost a practice anywhere from $25 to $117 in administrative expenses.

The financial impact of denied claims extends far beyond the immediate loss of revenue. Each denial triggers a cascade of administrative work. The staff must investigate the reason for denial, gather additional documentation, correct errors, resubmit the claim, and follow up with payers. This process consumes valuable time and resources, with some estimates indicating that working a single denial can cost a practice anywhere from $25 to $117 in administrative expenses.

Traditional denial management operates largely in reactive mode. Staff members receive denial notifications, categorize them, attempt to identify patterns manually, and then work to overturn the denials. This approach, while necessary, leaves money on the table and creates operational inefficiencies that strain healthcare organizations. The real question is how to prevent them from happening in the first place.

How AI Transforms Denial Management

Artificial intelligence brings a fundamentally different approach to managing claim denials. Rather than simply reacting to rejections after they occur, AI systems analyze vast amounts of historical claims data to identify patterns, predict potential issues, and flag problems before claims are ever submitted. This shift from reactive to proactive management represents a paradigm change in revenue cycle operations.

Machine learning algorithms can process millions of data points from past claims, payer responses, and denial codes to build predictive models. These models learn to recognize the specific combinations of factors that lead to denials for different payers, procedure codes, and patient scenarios. The system becomes smarter over time, continuously refining its predictions as it processes more claims and outcomes.

Consider a typical scenario: a practice submits a claim for a specific procedure with certain diagnosis codes. An AI-powered system can instantly compare this claim against thousands of similar historical claims, identify that this particular combination has a 78% denial rate with this specific payer, and alert staff before submission. The system might flag that the payer requires specific modifiers, pre-authorization documentation, or alternative coding to approve the claim.

Predictive Analytics in Action

Predictive analytics takes AI-powered denial management a step further by not just identifying problematic claims, but forecasting denial trends and revenue impacts. These systems can analyze seasonal patterns, payer policy changes, and coding updates to help organizations prepare for shifts in denial rates before they impact the bottom line.

Predictive analytics takes AI-powered denial management a step further by not just identifying problematic claims, but forecasting denial trends and revenue impacts. These systems can analyze seasonal patterns, payer policy changes, and coding updates to help organizations prepare for shifts in denial rates before they impact the bottom line.

The technology works by examining multiple variables simultaneously. Something that would be impossible for human staff to do manually at scale. A predictive model might consider the patient’s insurance plan, the rendering provider, the place of service, the diagnosis codes, the procedure codes, the time of service, historical payer behavior, recent policy updates, and dozens of other factors to generate a risk score for each claim.

When a claim receives a high-risk score, the system can automatically route it to specialized staff for review, suggest specific corrections, or even hold it for additional documentation before submission. This targeted approach ensures that staff focus their expertise where it’s most needed rather than reviewing every claim with equal scrutiny.

Real-World Benefits and ROI

Healthcare organizations implementing AI-powered denial management systems report substantial improvements across multiple metrics. Clean claim rates, the percentage of claims that pass through without any issues on the first submission, often increase by 10-20 percentage points. Days in accounts receivable typically decrease as fewer claims get stuck in the denial and appeal cycle. Staff productivity improves as team members spend less time on rework and more time on higher-value activities.

The financial impact can be substantial. For a mid-sized practice processing 10,000 claims monthly with a 7% denial rate, preventing just 30% of those denials could translate to hundreds of thousands of dollars in additional revenue annually. When you factor in the reduced administrative costs of not having to work those denials, the return on investment becomes even more compelling.

Perhaps more importantly, AI-powered healthcare systems help level the playing field when dealing with insurance companies. Payers have long used sophisticated algorithms to review and deny claims. Healthcare providers now have access to similar technology to anticipate payer behavior, optimize their submissions, and appeal denials more effectively.

Key Features to Look For

Not all AI-powered denial management solutions are created equal.

When evaluating systems, healthcare organizations should consider several critical capabilities:

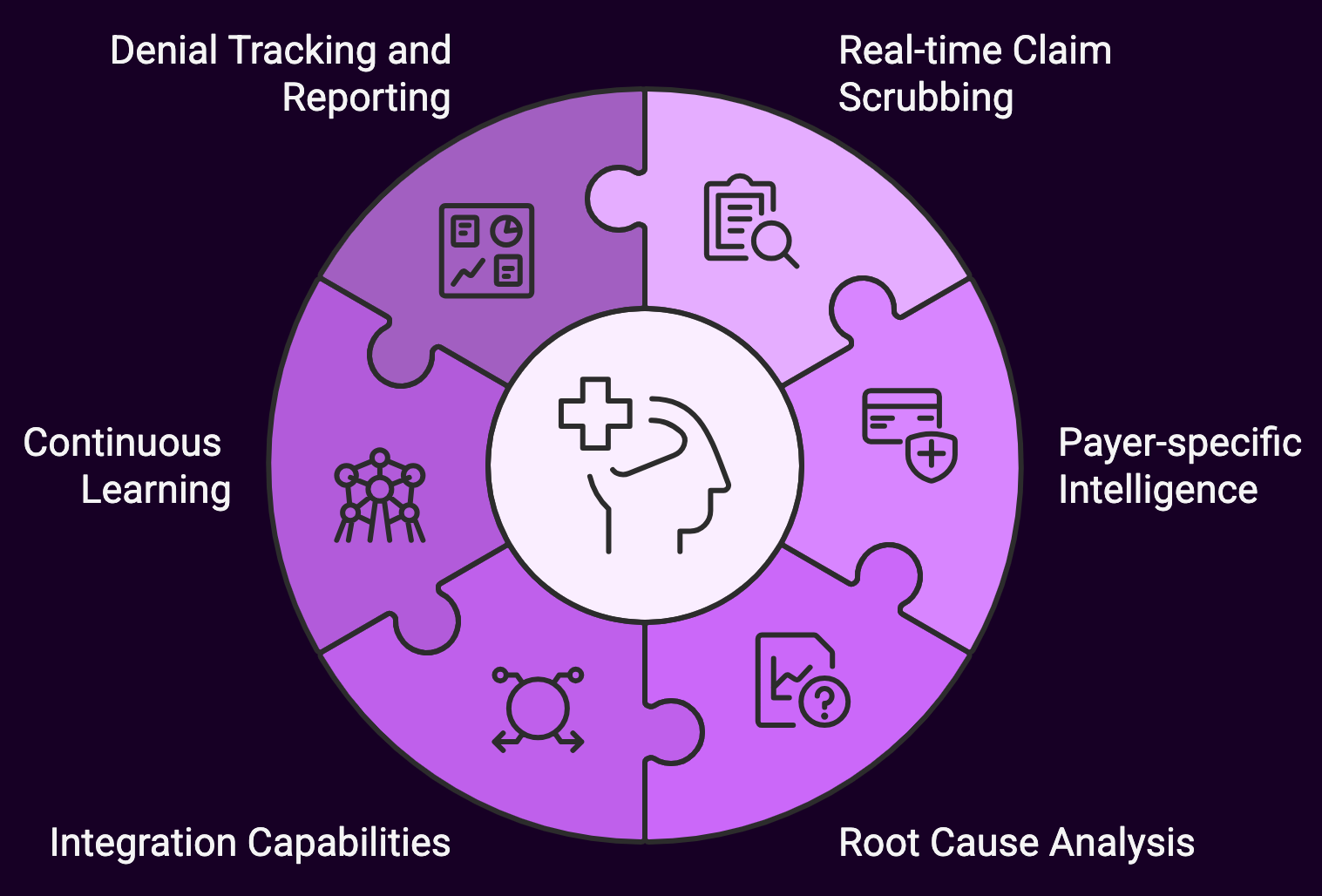

- Real-time claim scrubbing: The system should analyze claims before submission and flag potential issues immediately

- Payer-specific intelligence: Different insurance companies have different rules and preferences; the AI should learn and apply payer-specific patterns

- Root cause analysis: Beyond identifying that a claim will likely be denied, the system should explain why and suggest specific corrections

- Integration capabilities: The solution must work seamlessly with your existing practice management and electronic health record systems

- Continuous learning: The AI should improve its predictions over time as it processes more of your organization’s specific claims data

- Denial tracking and reporting: Detailed analytics help identify systemic issues and measure the impact of improvement initiatives

Installation Considerations

Adopting AI-powered denial management requires thoughtful implementation and change management. Staff members need training not just on how to use the new system, but on how to interpret its recommendations and when to override its suggestions based on their clinical and billing expertise.

Adopting AI-powered denial management requires thoughtful implementation and change management. Staff members need training not just on how to use the new system, but on how to interpret its recommendations and when to override its suggestions based on their clinical and billing expertise.

Data quality becomes paramount when implementing AI solutions. The predictive models are only as good as the data they’re trained on, which means organizations need to ensure their historical claims data is accurate and complete. Some practices find it beneficial to start with a data cleanup initiative before deploying AI tools.

Organizations should also set realistic expectations about timeline and results. While some improvements may be immediate, the full benefits of AI-powered denial management typically materialize over several months as the system learns from your specific claims patterns and payers. Early wins often come from catching obvious errors and known payer quirks, while more sophisticated predictions develop over time.

The Human Element Remains Critical

Despite the power of artificial intelligence, human expertise remains irreplaceable in denial management. AI excels at pattern recognition and processing vast amounts of data, but it can’t replace the nuanced judgment of experienced billing staff who grasp the clinical context of a claim or know how to handle unusual situations.

The most effective approach combines AI capabilities with human expertise. Let the technology handle the routine analysis, pattern detection, and flagging of potential issues. Let your skilled staff focus on investigating the flagged claims, making judgment calls on ambiguous situations, handling appeals that require detailed clinical explanations, and building relationships with payer representatives.

This partnership between human and machine creates a more efficient and effective revenue cycle operation. Staff members often report higher job satisfaction when AI tools remove tedious, repetitive work and allow them to apply their knowledge to more interesting challenges.

The AI of Tomorrow Will Be Awesome!

The capabilities of AI-powered denial management continue to advance rapidly. Natural language processing is enabling systems to read and interpret payer policies automatically, keeping up with constant changes without requiring manual updates. Some systems now generate appeal letters automatically, complete with relevant policy citations and clinical justifications. Others are beginning to predict which denials are worth appealing based on the likelihood of overturning them and the cost of the appeal process.

The capabilities of AI-powered denial management continue to advance rapidly. Natural language processing is enabling systems to read and interpret payer policies automatically, keeping up with constant changes without requiring manual updates. Some systems now generate appeal letters automatically, complete with relevant policy citations and clinical justifications. Others are beginning to predict which denials are worth appealing based on the likelihood of overturning them and the cost of the appeal process.

As healthcare moves toward value-based payment models and alternative payment arrangements, the role of denial management will shift but not disappear. AI systems will need to adapt to analyze different types of payment denials and opportunities, but the core principles of using data to predict and prevent revenue losses will remain relevant.

Making the Move

For healthcare organizations still managing denials manually or with basic rules-based systems, the time to explore AI-powered solutions is now. The technology has matured, the return on investment is proven, and the competitive advantage it provides becomes more significant as margin pressures increase across healthcare.

For healthcare organizations still managing denials manually or with basic rules-based systems, the time to explore AI-powered solutions is now. The technology has matured, the return on investment is proven, and the competitive advantage it provides becomes more significant as margin pressures increase across healthcare.

At Medwave, we specialize in billing, credentialing, and payer contracting, and we’ve seen firsthand how AI-powered denial management transforms revenue cycle operations for our clients. The organizations that embrace these tools today position themselves to thrive in an increasingly difficult reimbursement environment, while those that delay adoption risk falling further behind.

The question is whether your organization will be among the leaders leveraging this technology or playing catch-up in the years ahead. Claim denials showing no signs of decreasing and administrative costs continuing to rise, therefore AI-powered denial management and predictive analytics have moved from nice-to-have to essential for maintaining financial health in modern healthcare.

Contact us, we can assist your medical group with any healthcare-based artificial intelligence need and/or challenge.