Finding accurate information about health insurance companies operating in the United States can be frustrating. Most online lists either focus only on the biggest national brands or include every type of insurance provider, mixing major medical carriers with dental, vision, and supplemental plans. For healthcare providers, medical billing professionals, and practice administrators, this creates real problems when trying to determine which payers to credential with or how to process claims correctly.

This guide consolidates information about health insurance companies that provide major medical coverage, including Medicare, Medicaid, individual marketplace plans, and employer-sponsored insurance. Whether you’re a healthcare provider looking to expand your payer contracts or a billing specialist needing accurate payer information, this resource will help you identify the key players in the American health insurance market.

This guide consolidates information about health insurance companies that provide major medical coverage, including Medicare, Medicaid, individual marketplace plans, and employer-sponsored insurance. Whether you’re a healthcare provider looking to expand your payer contracts or a billing specialist needing accurate payer information, this resource will help you identify the key players in the American health insurance market.

Why Accurate Payer Information Matters

Healthcare providers need to know which insurance companies serve their geographic area and patient population. Getting credentialed with the right payers determines how many patients you can treat and how efficiently you receive payment. Choosing the wrong payers to credential with wastes time and resources on networks that won’t bring you patients.

Medical billing specialists rely on accurate payer details for claims submission. Every insurance company has specific requirements for how claims should be submitted, what information must be included, and where forms should be sent. Mistakes in payer information lead to claim denials, delayed payments, and hours of rework. Having a reliable reference for major health insurance companies saves time and prevents costly errors.

Practice administrators use payer information to make strategic decisions about network participation and contract negotiations. Knowing which insurance companies have the most members in your area helps you prioritize credentialing efforts. Information about payer size, market share, and reputation guides decisions about which contracts to pursue and which might not be worth the administrative effort.

The Top Health Insurance Companies by Market Share

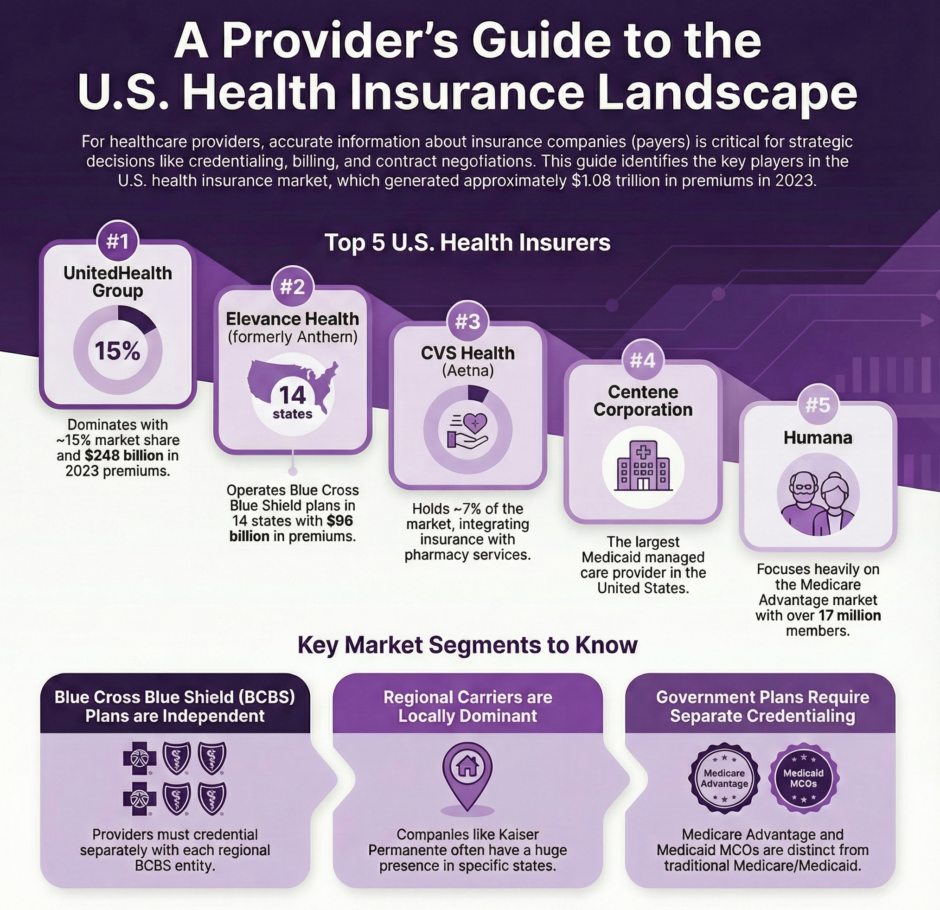

The United States health insurance market generated approximately $1.08 trillion in total net earned premiums in 2023, with the largest companies controlling significant portions of this market. Here are the major national carriers ranked by their market presence and premium revenue.

- UnitedHealth Group dominates the American health insurance market. UnitedHealth wrote roughly $248 billion in premiums in 2023 and holds about 15% of the total market share. The company operates through its UnitedHealthcare insurance division, which provides employer-sponsored plans, individual coverage, Medicare Advantage, and Medicaid managed care across all 50 states. With a network of over 1.5 million healthcare providers and more than 6,500 hospitals, UnitedHealthcare is often the first payer that healthcare providers seek to join.

- Elevance Health, formerly known as Anthem, ranks as the second-largest health insurer by market share. The company operates Blue Cross Blue Shield plans in 14 states and collected over $96 billion in premiums in 2023. Elevance provides employer-based coverage, individual plans, Medicare products, and Medicaid managed care. Their affiliation with the Blue Cross Blue Shield Association gives members access to a nationwide network through the BlueCard program.

- CVS Health has risen to become one of the top three health insurers after acquiring Aetna in 2018. This merger transformed CVS from a retail pharmacy chain into a healthcare giant with significant insurance operations. CVS Health now holds approximately 7% of the market and offers employer plans, Medicare Advantage products, and individual coverage. Their integrated model combines insurance coverage with pharmacy services and MinuteClinic locations.

- Centene Corporation specializes in government-sponsored healthcare programs and ranks as the fourth-largest insurer. The company is the largest Medicaid managed care provider in the United States, serving more than 28 million members across all 50 states. Centene also sells individual marketplace plans under the Ambetter brand and Medicare products through its WellCare subsidiary. For providers who treat Medicaid and marketplace patients, Centene networks are often essential.

- Humana focuses heavily on Medicare Advantage plans while also providing employer-sponsored coverage. The company serves more than 17 million members nationwide and has built a strong reputation in the senior market. Providers who specialize in treating older adults or manage chronic conditions common among Medicare beneficiaries should prioritize Humana credentialing.

Blue Cross Blue Shield Plans

The Blue Cross Blue Shield system represents a unique structure in American health insurance. While Anthem (Elevance Health) is the largest single company using the Blue Cross Blue Shield name, five of the ten health insurance companies with the most members are part of BCBS. These independent companies operate in specific territories under license from the Blue Cross Blue Shield Association.

- Health Care Service Corporation (HCSC) operates Blue Cross Blue Shield plans in Illinois, Montana, New Mexico, Oklahoma, and Texas. With over $64 billion in premiums collected in 2024, HCSC is the largest customer-owned health insurance company in the United States. They serve millions of members through employer plans, individual coverage, and Medicare products.

- Highmark provides Blue Cross Blue Shield coverage in Pennsylvania, West Virginia, and Delaware. The company offers group health insurance for employers, individual and family plans, and government-sponsored programs including Medicare and Medicaid. Highmark’s strong regional presence makes it a priority for providers practicing in its service areas.

- Florida Blue serves Florida residents exclusively and represents one of the largest health insurers in that state. The company provides individual, family, and employer-based coverage along with Medicare Advantage plans. Healthcare providers in Florida need Florida Blue credentials to access a significant portion of the patient population.

Each Blue Cross Blue Shield plan operates independently with its own credentialing requirements, provider networks, and payment policies. Being credentialed with Anthem in one state does not automatically grant you network participation with HCSC in Texas or Florida Blue in Florida. Providers must credential separately with each Blue plan operating in their area.

Regional and State-Based Carriers

Beyond the national giants and Blue Cross Blue Shield affiliates, numerous regional carriers play important roles in local markets. These companies often have deep community roots and strong relationships with area providers.

- Kaiser Permanente operates an integrated healthcare model in eight states and Washington, D.C. Kaiser Permanente is the largest health insurance company by enrollment for group and individual health insurance, serving over 12.5 million members. Unlike traditional insurers, Kaiser owns hospitals, employs physicians, and provides both insurance coverage and healthcare services. Their network includes about 25,000 physicians, 73,000 nurses, 40 hospitals, and 612 medical offices. Credentialing with Kaiser differs from other payers because the process is largely internal and focuses on their integrated care model.

- Cigna operates globally but maintains significant presence in the United States with approximately 19.5 million domestic members. The company offers health and dental policies, Medicare products, international coverage, and supplemental insurance in 16 states. Cigna delivers services through two business units: Cigna Healthcare for medical coverage and Evernorth Health Services for pharmaceutical and healthcare products.

- Molina Healthcare dedicates its services to government-sponsored programs for eligible families and individuals. The company specializes in Medicaid managed care and serves members in multiple states. Providers who work with underserved populations should consider Molina credentials essential.

Medicare Advantage Landscape

The Medicare Advantage market has grown dramatically, with more than half of Medicare beneficiaries now choosing MA plans instead of traditional Medicare. This growth has attracted numerous insurance companies into the Medicare Advantage space beyond the major national carriers.

- WellCare, now part of Centene, focuses on government-sponsored programs including Medicare and Medicaid. The company offers Medicare Advantage plans, Medicare Part D prescription drug coverage, and Special Needs Plans for beneficiaries with specific health conditions.

- Alignment Healthcare targets Medicare beneficiaries with a care model that emphasizes coordination and member support. The company operates in select markets and appeals to seniors looking for personalized attention and integrated care management.

- Devoted Health represents a newer entrant in the Medicare Advantage market, building plans with emphasis on technology, member experience, and provider support. The company aims to improve the traditional Medicare Advantage model through better communication and care coordination.

Healthcare providers should remember that Medicare Advantage requires separate credentialing from traditional Medicare. Accepting Medicare patients does not automatically mean you can see patients with Medicare Advantage plans. Each MA plan requires its own credentialing process and network participation.

Medicaid Managed Care Organizations

Most states now use managed care organizations to administer Medicaid benefits rather than operating traditional fee-for-service programs. These MCOs vary significantly from state to state, creating a patchwork of different payers across the country.

Most states now use managed care organizations to administer Medicaid benefits rather than operating traditional fee-for-service programs. These MCOs vary significantly from state to state, creating a patchwork of different payers across the country.

Centene operates Medicaid plans in numerous states under various brand names including Ambetter, Sunshine Health, and Coordinated Care. Molina Healthcare serves Medicaid populations in multiple states. UnitedHealthcare Community and State provides Medicaid managed care in many markets. Providers interested in serving Medicaid patients must research which MCOs operate in their specific state and county.

Some states have region-specific Medicaid MCOs that operate nowhere else. Community Health Choice serves Texas Medicaid beneficiaries. Passport Health Plan focuses on Kentucky. Health Partners Plans operates in Pennsylvania. LA Care and Health Net serve California’s Medicaid program called Medi-Cal. These local MCOs often have strong community connections and may offer competitive rates to attract provider participation.

Complete List of Major Health Insurance Companies

Here is a directory of major health insurance companies providing medical coverage in the United States, organized by category:

National Commercial Carriers:

- UnitedHealth Group / UnitedHealthcare

- Elevance Health / Anthem

- CVS Health / Aetna

- Cigna

- Humana

- Centene Corporation

Blue Cross Blue Shield Affiliates:

- Health Care Service Corporation (HCSC)

- Anthem / Elevance Health

- Highmark

- Florida Blue

- CareFirst BlueCross BlueShield

- Premera Blue Cross

- Blue Shield of California

- Independence Blue Cross

- Blue Cross Blue Shield of Michigan

- Blue Cross and Blue Shield of North Carolina

- Regence BlueShield

- Blue Cross Blue Shield of Massachusetts

- Blue Cross Blue Shield of Tennessee

- Blue Cross Blue Shield of Alabama

- Blue Cross of Idaho

- Blue Cross Blue Shield of Arizona

- Cambia Health Solutions

Medicare-Focused Carriers:

Regional Carriers:

- Kaiser Permanente

- Molina Healthcare

- Geisinger Health Plan

- Group Health Cooperative

- Harvard Pilgrim Health Care

- Tufts Health Plan

- HealthPartners

- Capital BlueCross

- Excellus BlueCross BlueShield

Medicaid Managed Care Organizations:

Summary: Major Health Insurance Companies Directory

The American health insurance market includes hundreds of companies ranging from massive national carriers to small regional plans. Healthcare providers need accurate information about which payers operate in their area to make smart credentialing decisions. This guide provides a starting point for identifying major health insurance companies across different market segments.

The American health insurance market includes hundreds of companies ranging from massive national carriers to small regional plans. Healthcare providers need accurate information about which payers operate in their area to make smart credentialing decisions. This guide provides a starting point for identifying major health insurance companies across different market segments.

Success in medical practice increasingly depends on strategic payer selection and efficient credentialing processes. Providers who invest time in researching payer options, choosing networks wisely, and maintaining current credentials position themselves to serve more patients and receive timely reimbursement. Whether handling credentialing internally or partnering with specialized services, accurate payer information forms the foundation for effective practice management.