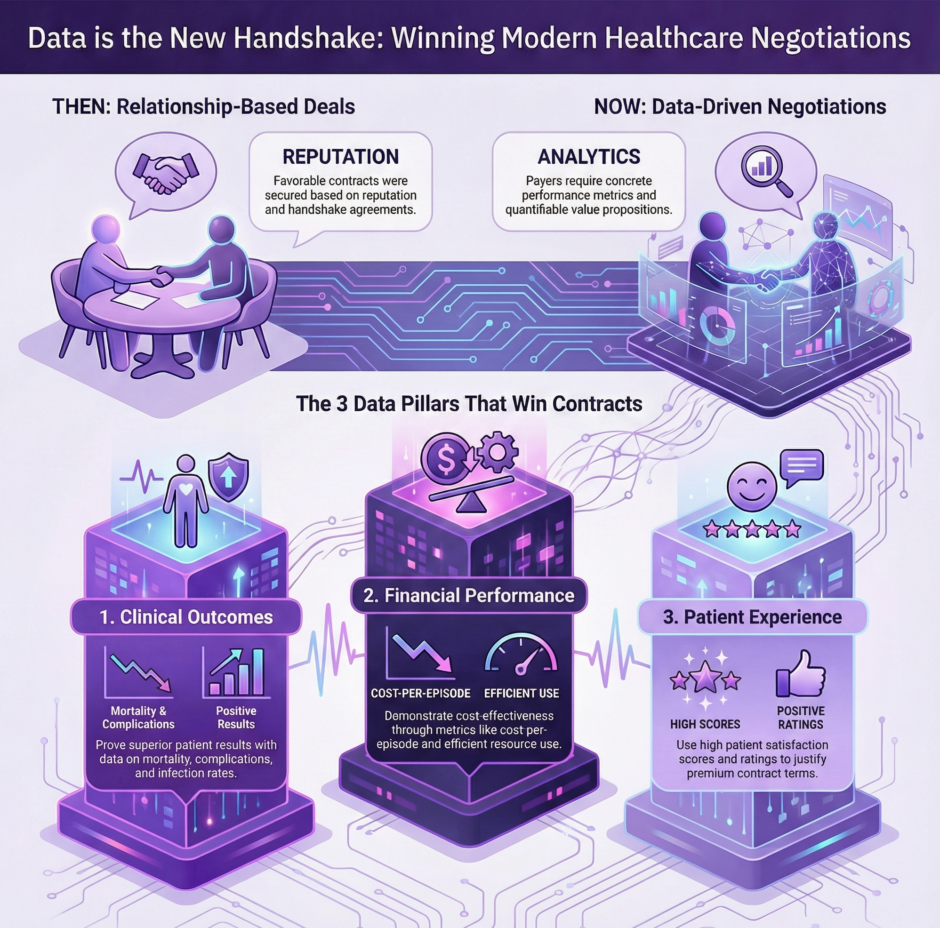

Healthcare contracting has shifted dramatically from relationship-based handshake deals to rigorous, data-centric negotiations. Today’s payer contracting process demands concrete evidence, measurable outcomes, and quantifiable value propositions. Gone are the days when providers could rely solely on reputation or historical relationships to secure favorable contract terms. Instead, payers now expect detailed performance metrics, cost-effectiveness analyses, and outcome data to justify reimbursement rates and network inclusion decisions.

This transformation reflects broader healthcare trends toward accountability, transparency, and value-based care. Insurance companies face mounting pressure from employers, regulators, and members to demonstrate cost control while maintaining quality standards. Consequently, they’ve adopted sophisticated analytics tools and data requirements that fundamentally change how contract negotiations unfold.

This transformation reflects broader healthcare trends toward accountability, transparency, and value-based care. Insurance companies face mounting pressure from employers, regulators, and members to demonstrate cost control while maintaining quality standards. Consequently, they’ve adopted sophisticated analytics tools and data requirements that fundamentally change how contract negotiations unfold.

For healthcare providers, this shift represents both challenge and opportunity. Organizations that embrace data-driven approaches and invest in robust analytics capabilities often secure better contract terms and stronger payer relationships. Meanwhile, those clinging to traditional negotiation methods increasingly find themselves at competitive disadvantages.

The Analytics Revolution in Healthcare Contracting

Modern payer contracting resembles financial markets more than traditional healthcare negotiations. Payers deploy teams of actuaries, data scientists, and clinical analysts who scrutinize provider performance across dozens of metrics. These professionals evaluate everything from clinical outcomes and patient satisfaction scores to cost per episode and readmission rates.

This analytical approach enables payers to identify high-performing providers who deliver superior value while spotting underperformers who may warrant rate reductions or network exclusions. The result is a more nuanced, performance-based contracting environment where data speaks louder than relationships.

This analytical approach enables payers to identify high-performing providers who deliver superior value while spotting underperformers who may warrant rate reductions or network exclusions. The result is a more nuanced, performance-based contracting environment where data speaks louder than relationships.

Healthcare providers must adapt by developing their own analytical capabilities. This means investing in data collection systems, analytics software, and staff training to compete effectively in data-driven negotiations. Organizations that view this investment as optional rather than essential risk falling behind competitors who embrace analytical approaches.

Key Performance Indicators That Drive Contract Decisions

Payers typically evaluate providers across multiple performance dimensions, each supported by specific metrics and benchmarks. Clinical quality indicators include patient outcome measures, safety scores, and adherence to evidence-based protocols. Financial efficiency metrics examine cost per case, resource utilization patterns, and total cost of care figures.

Patient experience data has gained particular prominence, with payers closely monitoring satisfaction surveys, complaint rates, and Net Promoter Scores. These metrics directly impact member retention and satisfaction, making them crucial factors in contract decisions.

Operational efficiency measures round out the evaluation framework, covering claim processing accuracy, prior authorization compliance, and administrative responsiveness. Payers prefer working with providers who minimize administrative friction and processing delays.

Clinical Outcomes as Negotiating Power

Perhaps no data category carries more weight in modern payer contracting than clinical outcomes. Providers who can demonstrate superior patient results across key health indicators gain significant leverage in rate negotiations and contract terms.

Outcome metrics vary by specialty and patient population, but common measures include mortality rates, complication frequencies, infection rates, and functional improvement scores. Payers particularly value outcomes data that shows consistent performance over time rather than isolated good results.

Building Robust Outcomes Tracking Systems

Effective outcomes tracking requires systematic data collection processes that capture relevant metrics consistently across all patient encounters. Many providers struggle with data fragmentation, where information sits in separate systems that don’t communicate effectively.

Successful outcomes tracking typically involves:

- Standardized data collection protocols for all relevant clinical encounters

- Electronic health record systems configured to capture outcome measures automatically

- Regular data quality audits to ensure accuracy and completeness

- Benchmarking processes that compare internal performance to national or regional standards

- Trending analysis that identifies performance improvements or deterioration over time

The investment in robust tracking systems pays dividends during contract negotiations, as payers increasingly demand real-time access to performance data rather than accepting periodic reports.

Financial Performance Metrics That Matter

While clinical outcomes grab headlines, financial performance data often determines actual contract terms and reimbursement rates. Payers analyze cost patterns, resource utilization, and total care expenses to identify providers who deliver value.

While clinical outcomes grab headlines, financial performance data often determines actual contract terms and reimbursement rates. Payers analyze cost patterns, resource utilization, and total care expenses to identify providers who deliver value.

Cost per episode calculations have become particularly important as payers shift toward bundled payment models and value-based contracts. These metrics examine the total cost of treating specific conditions or procedures, including all related services and potential complications.

Resource utilization analysis looks at how efficiently providers use diagnostic tests, procedures, and specialist referrals. Payers favor providers who achieve good outcomes while avoiding unnecessary or duplicative services.

Demonstrating Cost-Effectiveness

Effective cost-effectiveness demonstrations require sophisticated analysis that goes beyond simple per-unit pricing. Providers must show how their care delivery approaches reduce total healthcare spending while maintaining or improving quality.

This might involve demonstrating lower readmission rates that reduce overall episode costs, or showing how preventive interventions reduce expensive downstream complications. Some providers track avoided costs from early interventions or care coordination efforts that prevent emergency department visits.

The key is presenting financial data in ways that align with payer objectives. Insurance companies want to see how partnering with specific providers helps them manage medical costs and improve member outcomes simultaneously.

Patient Satisfaction and Experience Data

Patient experience metrics have gained tremendous importance in payer contracting as insurance companies recognize the connection between member satisfaction and plan retention. High patient satisfaction scores indicate providers who deliver positive healthcare experiences, which translates to satisfied insurance plan members.

Patient experience metrics have gained tremendous importance in payer contracting as insurance companies recognize the connection between member satisfaction and plan retention. High patient satisfaction scores indicate providers who deliver positive healthcare experiences, which translates to satisfied insurance plan members.

Common patient experience metrics include Communication with Nurses and Doctors scores, Hospital Rating scores, and Willingness to Recommend ratings. These standardized measures allow payers to compare providers objectively across their networks.

Beyond traditional satisfaction surveys, some payers now examine online reviews, complaint ratios, and social media sentiment as additional indicators of patient experience quality. This broader view of patient feedback provides more nuanced insights into provider performance.

Leveraging Patient Experience Data in Negotiations

Providers with consistently high patient experience scores can use this data to justify premium reimbursement rates or preferential contract terms. The argument is straightforward. Satisfied patients are more likely to remain with insurance plans and less likely to file complaints or seek care elsewhere.

Some progressive providers track patient experience improvements over time, demonstrating their commitment to continuous improvement. This trending data can be particularly powerful in negotiations, showing payers that the provider organization prioritizes member satisfaction.

Technology Integration and Data Sharing

Modern payer contracting increasingly involves technology integration requirements and data sharing capabilities. Payers want real-time access to provider performance data rather than waiting for periodic reports or annual submissions.

This trend toward real-time data sharing requires providers to invest in interoperable systems that can communicate seamlessly with payer platforms. Application programming interfaces (APIs), health information exchanges, and cloud-based data sharing platforms have become essential infrastructure for competitive contracting.

Some payers now require providers to participate in shared savings programs or value-based contracts that depend on continuous data monitoring. These arrangements are impossible without robust technology integration and real-time data flows.

Building Data Infrastructure for Contract Success

Successful data-driven contracting requires significant technology investments that many providers underestimate. The infrastructure needs go far beyond basic electronic health records to include analytics platforms, data warehouses, and integration tools.

Essential technology components include:

- Data aggregation systems that combine information from multiple sources

- Analytics platforms capable of generating real-time performance reports

- Integration tools that enable seamless data sharing with payer systems

- Quality assurance processes that ensure data accuracy and completeness

- Security measures that protect patient privacy while enabling data sharing

The return on these technology investments comes through improved contract terms, reduced administrative costs, and enhanced competitiveness in payer negotiations.

Predictive Analytics and Risk Assessment

Advanced healthcare organizations are moving beyond historical performance data to embrace predictive analytics that forecast future outcomes and costs. These capabilities provide powerful negotiating advantages by demonstrating proactive risk management and cost control.

Advanced healthcare organizations are moving beyond historical performance data to embrace predictive analytics that forecast future outcomes and costs. These capabilities provide powerful negotiating advantages by demonstrating proactive risk management and cost control.

Predictive models can identify patients at high risk for complications, readmissions, or expensive interventions. Providers who can show they’re actively managing these risks through targeted interventions gain credibility with payers focused on cost control.

Population health analytics that identify trends and risk factors across patient populations are particularly valuable. Payers want partners who can help them manage chronic conditions, prevent complications, and reduce overall medical spending through proactive interventions.

Benchmarking and Competitive Positioning

Data-driven negotiations require thorough benchmarking that positions provider performance relative to competitors and national standards. Payers routinely compare providers across their networks, making relative performance as important as absolute results.

Effective benchmarking involves identifying appropriate comparison groups, gathering reliable benchmark data, and presenting performance in context. Providers who rank in top percentiles for key metrics gain significant negotiating leverage.

Creating Compelling Performance Narratives

Raw data alone rarely wins contract negotiations. Providers must craft compelling narratives that explain their performance data and highlight competitive advantages. This storytelling aspect of data presentation can make the difference between successful and unsuccessful negotiations.

Effective performance narratives typically include:

- Clear explanations of why specific metrics matter to payer objectives

- Context that explains performance variations or outliers

- Improvement trends that show commitment to continuous enhancement

- Competitive comparisons that highlight relative advantages

- Future projections based on current performance trajectories

Quality Reporting and Regulatory Compliance

Healthcare quality reporting requirements continue expanding, with payers increasingly using regulatory compliance data in contract decisions. Providers who excel at quality reporting and maintain strong regulatory standings gain advantages in negotiations.

Common quality reporting programs include Hospital Quality Reporting, Physician Quality Reporting System requirements, and specialty-specific quality measures. Consistent high performance across these programs signals operational excellence to payers.

Some payers now incorporate quality bonus payments or penalties directly into contract terms, making regulatory compliance performance a direct financial factor. This trend toward pay-for-performance contracting makes quality data even more crucial for favorable negotiations.

Future Trends in Data-Driven Contracting

![]() The trend toward data-driven payer contracting shows no signs of slowing. Emerging technologies like artificial intelligence, machine learning, and advanced analytics promise to make contract negotiations even more data-intensive.

The trend toward data-driven payer contracting shows no signs of slowing. Emerging technologies like artificial intelligence, machine learning, and advanced analytics promise to make contract negotiations even more data-intensive.

Payers are beginning to experiment with real-time risk adjustment, dynamic pricing models, and automated contract modifications based on performance data. These innovations will require providers to develop even more sophisticated data capabilities and analytical expertise.

The organizations that thrive in this environment will be those that view data as a strategic asset and invest accordingly in collection, analysis, and presentation capabilities. Data-driven payer contracting isn’t just a trend, it’s the new reality of healthcare business relationships.

Healthcare providers can no longer afford to approach payer negotiations with intuition and relationships alone. Success requires robust data collection, sophisticated analytics, and compelling presentation of performance metrics. Organizations that embrace this data-driven approach will find themselves with stronger contracts, better reimbursement rates, and more sustainable payer relationships in an increasingly competitive marketplace.