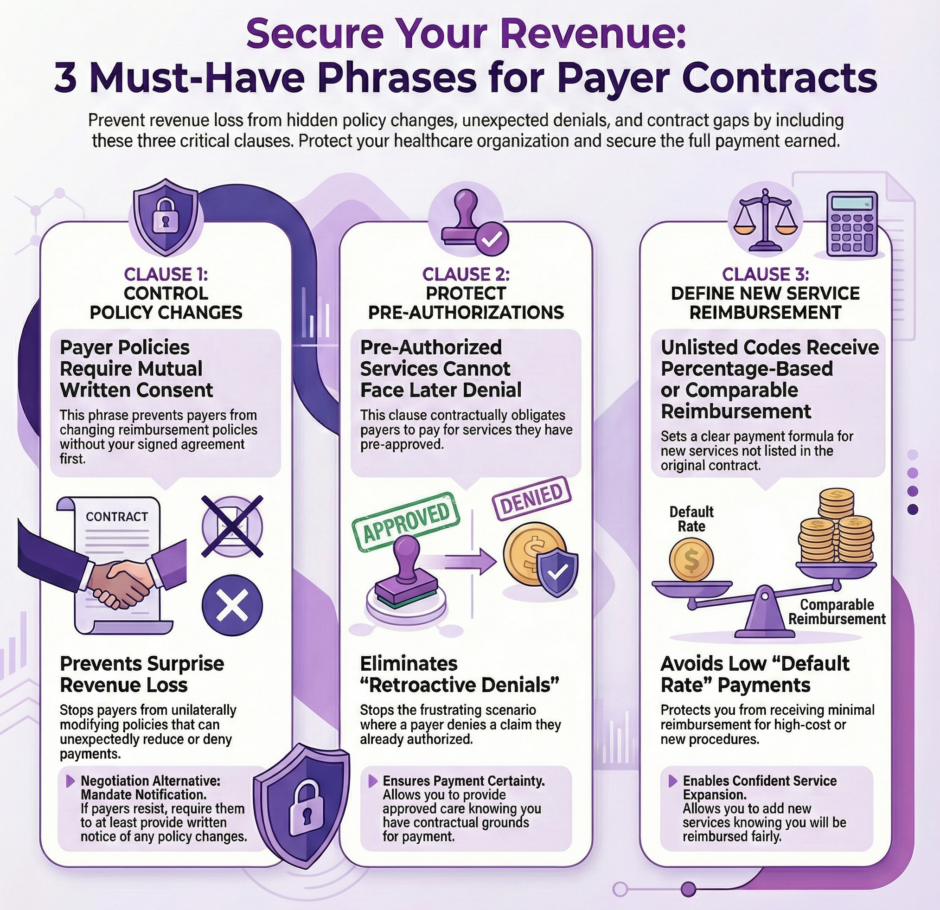

Reimbursements represent a significant source of revenue for healthcare organizations. Yet many providers don’t receive the full payment they’ve earned for services they deliver, even when both sides have agreed on rates. The culprit? Hidden policy changes, unexpected claim denials, and gaps in contract language that leave providers vulnerable to revenue loss.

Most healthcare organizations lack dedicated payer contracting experts who regularly analyze agreements and track policy modifications. This leaves practices exposed to surprise changes that can significantly impact their bottom line. However, there’s a straightforward solution, including three specific protective phrases in every payer contract you negotiate.

Most healthcare organizations lack dedicated payer contracting experts who regularly analyze agreements and track policy modifications. This leaves practices exposed to surprise changes that can significantly impact their bottom line. However, there’s a straightforward solution, including three specific protective phrases in every payer contract you negotiate.

These phrases act as shields against common tactics that reduce reimbursement. They address the most frequent sources of payment problems and give providers the contractual backing they need when disputes arise. Whether you’re negotiating a first-time agreement or renewing an existing contract, these clauses should become non-negotiable elements of your payer relationships.

Why Payer Contracts Deserve Your Full Attention

After providing medical care, healthcare organizations submit claims to payers and wait for payment processing. The payer then either approves and pays the claim or denies it. While you can’t control the payer’s internal processes, you absolutely can control the contract terms that govern your relationship.

Payer contracts establish guidelines both parties must follow regarding payment amounts, timing, policy change procedures, and numerous other operational details. Taking a strategic approach to these negotiations, especially by including specific protective language, helps organizations avoid denied claims and capture the full reimbursement they’ve earned.

The challenge is that healthcare organizations constantly juggle multiple contracts. You’re either negotiating new agreements or renewing existing ones, often with dozens of different payers. These processes can sometimes catch healthcare organizations unaware if they don’t have a specialized expert scrupulously reviewing contracts on a regular basis for modifications, including updates to the payment process and changes to the list of covered procedures.

To effectively negotiate the most beneficial payer contracts and avoid negative financial consequences, including denied claims with downstream revenue implications, organizations should include three key phrases in their next payer contracts.

The First Critical Phrase: “Payer Policies Require Mutual Written Consent”

Payers may change their policies without discussing the modifications with the healthcare organization or notifying the provider about the change. As a result, when it’s time to submit a claim for reimbursement, the organization can run into surprise policy changes that can have significant and often negative revenue repercussions.

Payers may change their policies without discussing the modifications with the healthcare organization or notifying the provider about the change. As a result, when it’s time to submit a claim for reimbursement, the organization can run into surprise policy changes that can have significant and often negative revenue repercussions.

These surprise policy changes can devastate your revenue projections. One month you’re receiving full payment for a service, the next month claims are getting denied because of a policy modification you never knew about. You’re left scrambling to figure out what changed and how to adjust your operations accordingly.

To avoid these hidden policy changes, healthcare organizations should include specific language in their contracts that require the payer to notify and discuss the alteration with the provider before the contract is updated. For example, organizations may state something like: “Provider is not obligated to follow payer policies without written agreement from both parties.”

This clause means exactly what it says. If the payer wants to modify policies that affect your reimbursement, they must get your written agreement first. This gives you the chance to review proposed changes, assess their impact on your operations and revenue, and negotiate modifications that work for both parties. You’re no longer at the mercy of unilateral decisions that can harm your financial stability.

In a worst-case scenario, payers will not agree to a contract that includes the phrase above. Some insurance companies want flexibility to update policies without provider approval for each change. In such cases, organizations should negotiate that the payer must notify the healthcare organization about policy updates and specify the method of communication.

Even a basic notification, such as an email, allows the organization to stay informed and make changes that align with new policies. You can train staff on new requirements, update your billing procedures, and avoid claim denials that result from following outdated guidelines. While not as strong as requiring written agreement, notification still gives you visibility into changes that affect your revenue.

The key is ensuring you’re not operating in the dark. Payer policies affect how you document services, what prior authorizations you need, and how you submit claims. Knowing about changes before they take effect protects your revenue and prevents the frustration of denied claims you couldn’t have anticipated.

The Second Critical Phrase: “Pre-Authorized Services Cannot Face Later Denial”

To ensure payment and avoid a denied claim, healthcare organizations will reach out to a payer before a procedure to verify that the payer will cover and authorize the procedure. This prior authorization process should provide certainty. Once you’ve received approval, payment should follow when you submit the claim.

However, payers will sometimes still deny a claim even after they have authorized the procedure. This creates one of the most frustrating scenarios in healthcare billing. You followed the rules, obtained the required authorization, provided the approved care, yet still face a denied claim and lost revenue.

For example, a patient has chest pain, and the cardiologist recommends a bypass. Before the bypass, the healthcare organization reaches out to the payer and receives authorization. The authorization number is documented. The approval is clear. After the bypass procedure, the organization submits the claim, but the payer denies the claim even though it authorized the procedure.

The healthcare organization inevitably feels exasperated because there was nothing it could have done to avoid the denied claim. Every proper step was followed. The authorization was obtained before providing care. The service was medically necessary and approved by the insurance company. Yet the claim is still denied, often with vague explanations or references to policies that weren’t mentioned during the authorization process.

To circumvent these frustrating scenarios that result in lost revenue, organizations should include language in the payer contract stating that payers and their agents cannot initially or subsequently deny authorized services, such as: “After approval of service authorization, denial cannot occur either initially or later.”

Contracts that include this language allow payers to change their reimbursement policies as needed, but prevent them from backing out of procedures they have already authorized. The payer maintains control over their authorization process and can establish whatever criteria they want for approving services. What they cannot do is approve a service and then deny payment after the fact.

Once the healthcare organization has received prior authorization with this contract protection in place, it can rest assured it will receive full payment. This certainty benefits everyone involved. Your organization can schedule procedures without revenue risk. Patients can receive necessary care without worry about coverage disputes arising after treatment. Your staff avoids the time-consuming process of appealing denials for services that were pre-approved.

This phrase also emphasizes the importance of thorough authorization documentation. Make sure your staff records authorization numbers, the date received, the representative’s name, and exactly what services were approved. This documentation becomes crucial evidence if a payer later tries to deny a claim despite having authorized the service.

With this contract language in place and proper documentation practices, you have strong leverage to overturn inappropriate denials quickly. The contract explicitly prohibits the very action the payer is attempting, giving you clear grounds for appeal and escalation if necessary.

The Third Critical Phrase: “Unlisted Codes Receive Percentage-Based or Comparable Reimbursement”

Adding new codes, expanding service lines, or looking to form joint ventures with new partners are very common activities for healthcare organizations. These growth initiatives are essential for meeting patient needs and remaining competitive. However, they create a potential revenue problem: how will payers reimburse services that aren’t specifically listed in your current contract?

Adding new codes, expanding service lines, or looking to form joint ventures with new partners are very common activities for healthcare organizations. These growth initiatives are essential for meeting patient needs and remaining competitive. However, they create a potential revenue problem: how will payers reimburse services that aren’t specifically listed in your current contract?

As organizations do their due diligence before engaging in any of these initiatives, they should determine how payers will reimburse them for the new changes to accurately calculate any return on investment. Without this information, you might invest significant resources in new capabilities only to discover you’ll receive minimal or no payment.

For example, if a healthcare organization is looking to form a partnership with a cancer center but does not have any way to recoup the high cost of the chemotherapy drugs in its contract, it would only receive minimal reimbursement likely related to the laboratory codes for appropriate blood draws. The actual chemotherapy administration and the expensive drugs could go largely unreimbursed, making the entire venture financially unsustainable.

This could be especially true in situations that have hierarchical case rates with “Default Rate” or “Other Rate” in the contract as a catch-all bucket. These default categories often pay significantly less than the actual cost of providing new or specialized services, leaving providers losing money on every case.

Including language around new codes, such as: “Codes not included in this agreement will receive reimbursement at a percentage of charges or at rates matching similar existing services,” protects healthcare organizations from performing new services without receiving appropriate reimbursement.

This protection also helps organizations confidently expand their service lines without fearing denied claims or inadequate payment. When you know that new services will be reimbursed at a specified percentage of your charges or at rates comparable to similar existing services, you can make informed decisions about expansion opportunities.

The phrase gives you two potential payment methods for unlisted codes. The first option, percentage of charges, means the payer will pay a predetermined percentage of what you bill for the service. If your contract specifies that unlisted codes receive payment at 150% of Medicare rates or 60% of charges, you can calculate expected revenue for new services based on this formula.

The second option, case rates of similar services, provides an alternative calculation method. If you’re adding a new procedure that closely resembles an existing service in your contract, the new procedure receives the same payment rate as the comparable service. This ensures fair treatment for services that require similar resources, time, and expertise as procedures already covered in your agreement. This protective contract language ensures that growth doesn’t come at the cost of your financial stability.

Without this clause, you’re taking a significant gamble every time you expand services. You might invest in new equipment, train staff on new procedures, and market new capabilities only to discover the payer will barely reimburse you for these services. The contract language eliminates this uncertainty and allows strategic planning based on known reimbursement rates.

Putting These Phrases Into Practice

Including these three phrases in your payer contracts requires advance planning and negotiation skill. Payers may initially resist language that limits their flexibility or provides strong protections for providers. However, these clauses protect reasonable expectations: that policy changes will be communicated, that authorized services will be paid, and that new services will receive fair reimbursement.

When negotiating contracts, present these phrases as standard provisions that benefit both parties. Clear communication about policy changes prevents disputes and administrative headaches for both organizations. Protection for authorized services reduces pointless appeals and rework. Fair reimbursement for new services encourages providers to expand offerings that serve patients and align with payer networks.

If a payer strongly resists one of these phrases, try to determine their specific concern. Sometimes rewording the clause slightly can address their objection while still providing you with necessary protection. For instance, if a payer won’t agree that all policy changes require written consent, perhaps they’ll agree that changes affecting reimbursement rates or major billing procedures require written notice and a reasonable implementation timeline.

Documentation becomes critical when you have these protective clauses in your contracts. Make sure your staff knows these provisions exist and what they mean for daily operations. Train your team to document authorizations thoroughly, track policy change notifications, and flag any situations where new codes or services are being billed.

When disputes arise, these contract clauses give you clear grounds for challenging inappropriate denials or payment reductions. Reference the specific contract language in your appeals. Provide documentation showing you complied with all requirements. Escalate to contract managers or senior payer representatives when frontline claims processors deny legitimate claims.

The Broader Context of Payer Contract Management

These three protective phrases represent just one aspect of effective payer contract management. Organizations also need to pay attention to reimbursement rates themselves, payment timelines, claim submission requirements, credentialing processes, and dispute resolution procedures.

These three protective phrases represent just one aspect of effective payer contract management. Organizations also need to pay attention to reimbursement rates themselves, payment timelines, claim submission requirements, credentialing processes, and dispute resolution procedures.

Regular contract review cycles ensure you’re not operating under outdated terms. Many practices let contracts auto-renew year after year without systematic evaluation. This approach leaves money on the table and exposes you to risks from accumulated policy changes and market shifts.

Data analysis supports stronger rate negotiations. When you can show payers concrete information about your patient volumes, quality outcomes, and how your rates compare to market benchmarks, you negotiate from a position of strength rather than hoping for the best.

Organizations that lack internal expertise in payer contracting often benefit from specialized support. Companies like Medwave offer services spanning medical billing, credentialing, and payer contracting. This integrated approach ensures all aspects of your revenue cycle work together effectively, with contract terms that support efficient billing and proper credentialing that enables contracting opportunities.

Summary: Protect Yourself in Payer Contract Negotiations with Three Essential Phrases

As organizations continue looking after their revenue streams, they should consider reexamining their current and new contracts with payers. Payer contracts have significant implications for financial standing, as they guide a major source of income: reimbursements for services rendered.

As organizations continue looking after their revenue streams, they should consider reexamining their current and new contracts with payers. Payer contracts have significant implications for financial standing, as they guide a major source of income: reimbursements for services rendered.

Healthcare organizations can approach the payer negotiating table with confidence by applying the three key phrases discussed here. Adding specific language to payer contracts about policy changes, prior authorization, and coding updates allows providers to deliver care with the peace of mind that they will receive full payment.

The first phrase, requiring written agreement for policy changes, protects you from surprise modifications that affect your revenue. The second phrase, preventing denial of authorized services, eliminates the frustration of doing everything right yet still facing claim denials. The third phrase, ensuring fair payment for unlisted codes, gives you confidence to expand services and meet changing patient needs.

These contract provisions don’t guarantee perfection in your payer relationships. Disputes will still arise. Claims will occasionally be denied. Negotiations will sometimes be difficult. However, these clauses give you contractual backing when problems occur and shift the balance of power toward a more equitable relationship between providers and payers.

Start implementing these phrases in your next contract negotiation. If you’re in the middle of a contract term, note these provisions for your next renewal. Review your current contracts to see if similar language already exists or if you’re operating without these protections.