Healthcare can be overwhelming, especially when it comes to understanding the various documents and statements that arrive in your mailbox or inbox after a medical visit. One of the most important yet frequently misunderstood documents is the Explanation of Benefits, commonly known as an EOB. This detailed statement serves as a crucial communication tool between your insurance company and you, providing essential information about how your healthcare claims have been processed and what you may owe for medical services.

What is an EOB?

An Explanation of Benefits is a statement sent by your health insurance company after you receive medical care. Contrary to what many people believe, an EOB is not a bill. Instead, it’s a detailed breakdown that explains what medical services were provided, how much the provider charged, what your insurance plan covered, and what portion, if any, you’re responsible for paying. Think of it as a financial summary and explanation of the insurance claim processing for your medical services.

The EOB serves multiple purposes in the healthcare system. It provides transparency into how your insurance benefits were applied to your medical care, helps you track your healthcare spending against deductibles and out-of-pocket maximums, and serves as a record of medical services received. Additionally, it acts as a tool for detecting potential errors in billing or fraudulent claims, making it an essential document for both healthcare consumers and the insurance industry.

Key Components of an EOB

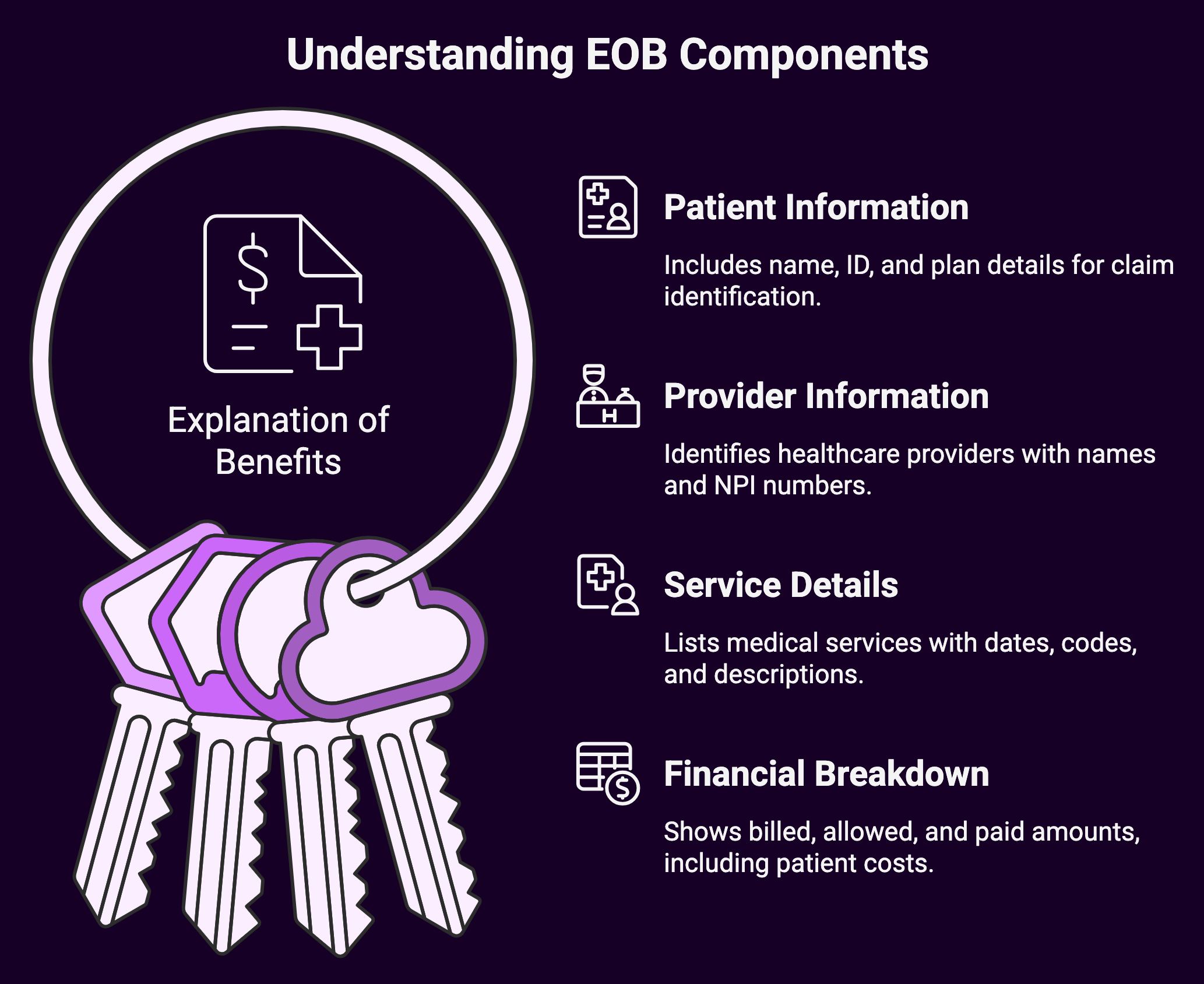

Knowing the various sections of an EOB is crucial for effectively managing your healthcare finances. While the format may vary slightly between insurance companies, most EOBs contain several standard elements that provide comprehensive information about your claim.

The patient information section typically appears at the top of the document and includes your name, member ID number, and the date the EOB was generated. This section also often contains information about your insurance plan and group number, which helps identify which specific benefits and coverage levels apply to your claim.

The provider information section identifies the healthcare provider who rendered services, including their name, address, and often their National Provider Identifier (NPI) number. This information is crucial for verifying that the services listed were actually received from the correct provider.

The service details section forms the heart of the EOB, listing each medical service provided during your visit. This includes the date of service, procedure codes (usually CPT codes), and descriptions of the services rendered. The level of detail can vary, but most EOBs provide enough information to understand what treatments or procedures were performed.

The financial breakdown section shows the monetary flow of your claim. This typically includes the provider’s billed amount, the insurance company’s allowed amount (which may be less than the billed amount due to contracted rates), the amount your insurance paid, and any amounts you’re responsible for paying. This section also breaks down your financial responsibility into categories such as deductibles, copayments, and coinsurance.

Types of Patient Responsibility

EOBs clearly outline different types of patient financial responsibility, each serving a specific purpose in your insurance plan’s structure. Breaking down these categories helps you better manage your healthcare budget and anticipate future costs.

Deductibles represent the amount you must pay out-of-pocket before your insurance begins to cover services. For example, if you have a $1,000 deductible and receive medical services early in the year, you’ll be responsible for paying the first $1,000 of covered services before your insurance starts contributing. Your EOB will show how much of your deductible has been met and how much remains.

Copayments are fixed amounts you pay for specific services, regardless of the total cost of the service. For instance, you might have a $25 copayment for primary care visits or a $10 copayment for generic prescription medications. These amounts are typically collected at the time of service, and your EOB will reflect when copayments have been applied.

Coinsurance represents your share of costs after you’ve met your deductible, expressed as a percentage. If your plan has 20% coinsurance, you’ll pay 20% of the allowed amount for covered services, while your insurance pays the remaining 80%. Your EOB will calculate these percentages and show exactly how much you owe based on your plan’s coinsurance requirements.

Reading and Interpreting Your EOB

Successfully interpreting your EOB requires understanding how to read the various codes and terminology used throughout the document. Medical procedure codes, typically Current Procedural Terminology (CPT) codes, identify specific services provided. These five-digit codes are standardized across the healthcare industry and help ensure accurate billing and processing.

Diagnosis codes, usually International Classification of Diseases (ICD) codes, explain why the services were necessary. These codes help insurance companies determine whether services were medically necessary and covered under your plan. These codes help you verify that the services listed accurately reflect your medical visit.

The allowed amount versus billed amount comparison is particularly important to understand. Healthcare providers often bill higher amounts than what insurance companies have agreed to pay through contracted rates. The allowed amount represents the maximum your insurance will consider for payment, and providers who are in-network with your insurance typically cannot bill you for the difference between their billed amount and the allowed amount.

Payment status codes indicate how your claim was processed. Common codes include “paid,” “denied,” “pending,” or “reduced.” Knowledge of these codes helps you know whether additional action is required on your part or if you should expect additional correspondence from your insurance company.

Common EOB Scenarios

Several common scenarios appear regularly on EOBs, each requiring different levels of attention and potential action from patients. When services are fully covered by insurance, your EOB will show the billed amount, allowed amount, and insurance payment, with little to no patient responsibility beyond any applicable copayments collected at the time of service.

Denied claims represent situations where your insurance company has determined that services are not covered under your plan. This could occur for various reasons, including services not being medically necessary, exceeding plan limitations, or being provided by out-of-network providers. When claims are denied, your EOB will explain the reason for denial and may provide information about appeal processes.

Partially covered services result in shared costs between you and your insurance company. This commonly occurs when you haven’t met your deductible, when coinsurance applies, or when services exceed plan limits. Your EOB will clearly break down how costs are shared and what portion you’re responsible for paying.

Out-of-network services typically result in higher patient responsibility. When you receive care from providers who don’t have contracts with your insurance company, you may face higher deductibles, higher coinsurance rates, and potential balance billing for amounts exceeding your plan’s allowed amounts.

Using EOBs for Healthcare Financial Management

EOBs serve as valuable tools for managing your healthcare finances throughout the year. By regularly reviewing your EOBs, you can track your progress toward meeting annual deductibles and out-of-pocket maximums. This information helps you plan for upcoming medical expenses and make informed decisions about timing non-urgent procedures.

Maintaining organized records of your EOBs also supports tax preparation efforts. Many healthcare expenses are tax-deductible, and EOBs provide the documentation needed to support these deductions. Additionally, EOBs help you maintain accurate records for Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs), ensuring you can substantiate expenses when required.

Identifying and Addressing Errors

EOBs occasionally contain errors that can result in incorrect billing or payment issues. Common errors include incorrect patient information, services listed that weren’t received, duplicate charges, or incorrect application of benefits. Regularly reviewing your EOBs helps identify these issues before they become larger problems.

EOBs occasionally contain errors that can result in incorrect billing or payment issues. Common errors include incorrect patient information, services listed that weren’t received, duplicate charges, or incorrect application of benefits. Regularly reviewing your EOBs helps identify these issues before they become larger problems.

When you identify errors on your EOB, contact your insurance company’s customer service department first. They can investigate the claim and make corrections if necessary.

If the error involves provider billing, you may also need to contact the healthcare provider’s billing department to resolve discrepancies.

Digital EOBs and Modern Healthcare

Many insurance companies now offer digital EOBs through online portals or mobile applications. These digital versions often provide additional features such as cost estimation tools, provider directories, and claims tracking capabilities. Digital EOBs also offer environmental benefits and can be more easily organized and searched than paper versions.

However, it’s important to ensure you’re receiving and reviewing your EOBs regardless of format. Some people overlook digital notifications, potentially missing important information about their healthcare costs or coverage issues.

Summary: A Guide to EOBs

Knowing all about your EOB is essential for effective healthcare financial management. These documents provide crucial information about your insurance coverage, help you track healthcare expenses, and serve as important records for tax and reimbursement purposes. Review and understand your EOBs, you’ll become a more informed healthcare consumer, better equipped to manage costs, identify errors, and make strategic decisions about your medical care.

Knowing all about your EOB is essential for effective healthcare financial management. These documents provide crucial information about your insurance coverage, help you track healthcare expenses, and serve as important records for tax and reimbursement purposes. Review and understand your EOBs, you’ll become a more informed healthcare consumer, better equipped to manage costs, identify errors, and make strategic decisions about your medical care.

The intricacies of billing and insurance processing can seem daunting, but EOBs are designed to provide clarity and transparency in this process. Regular review of these documents, combined with proactive communication with your insurance company and healthcare providers when questions arise, helps ensure you’re receiving the full benefits of your insurance coverage while managing your healthcare costs effectively.

EOBs are not bills, but rather explanations of how your insurance benefits were applied to your medical care. When you do receive actual bills from healthcare providers, comparing them to your EOBs helps verify accuracy and ensures you’re only paying for services you received and amounts you’re actually responsible for under your insurance plan.

Contact us to tackle your medical reimbursement needs and/or challenges.