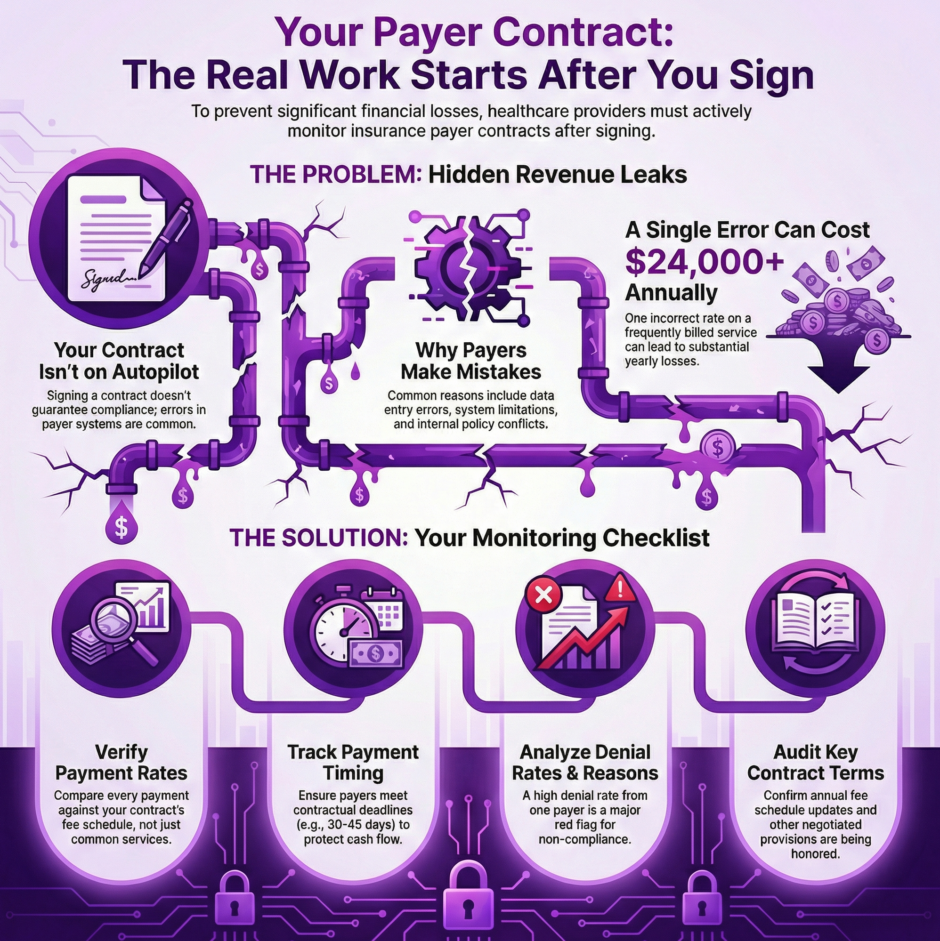

Signing a contract with an insurance company feels like a victory. You’ve negotiated rates, agreed to terms, gotten credentialed, and can finally start billing for services. Many healthcare providers treat contract signing as the finish line, filing the agreement away and moving on to see patients. But that’s where a critical mistake happens. The real work of managing payer contracts begins after the signature, not before it.

Post-contract performance monitoring means actively tracking whether insurance companies are living up to the agreements they signed. It means verifying that the rates you negotiated are actually what you’re being paid. It means confirming that claims are being processed within the timeframes promised. It means catching problems early before they turn into significant revenue losses.

Most practices don’t do this monitoring systematically. They assume that if they signed a contract saying they’d be paid $120 for a specific service, they’ll automatically receive $120 when they bill for that service. They trust that if the contract promises payment within 30 days, checks will arrive on schedule. This trust is often misplaced, and the financial consequences can be substantial.

Why Insurance Companies Don’t Always Follow Their Own Contracts

Insurance companies are large organizations with thousands of providers, millions of claims, and incredibly intricate systems for processing payments. Mistakes happen frequently, and not all of them favor the provider. Sometimes these errors are genuinely accidental. Other times, they reflect systemic problems in how payers implement contracts.

Payment errors occur for several common reasons:

Data Entry Problems

- New rates don’t get entered into the payer’s system

- Rates are entered incorrectly

- Updates happen with significant delays

- You negotiate a January 1st rate increase, but the system doesn’t update until March

Interpretation Issues

- Contract language gets interpreted differently by claims processors

- Terms that seemed clear during negotiations get applied inconsistently

- Different departments within the same insurance company apply different standards

System Limitations

- The payer’s billing system can’t handle certain negotiated terms

- Rather than fix their technology, they pay according to system capabilities

- Special provisions in your contract get ignored because the system can’t process them

Policy Conflicts

- New company-wide policies override existing contract terms

- Changes get applied to your claims without notification

- Internal policies take precedence over negotiated agreements

Organizational Changes

- Mergers and acquisitions disrupt payment systems

- Contract terms get lost during system integrations

- Provider agreements don’t transfer correctly to new platforms

What to Monitor After Contract Signing

Payment Rates

The most basic monitoring task is verifying that you’re being paid the rates specified in your contract. This sounds simple but requires detailed attention. You need to compare what your contract says you should receive for each service code against what actually appears on your explanation of payment forms.

The most basic monitoring task is verifying that you’re being paid the rates specified in your contract. This sounds simple but requires detailed attention. You need to compare what your contract says you should receive for each service code against what actually appears on your explanation of payment forms.

Many practices check a few high-volume services but ignore lower-volume codes. This is a mistake. Insurance companies sometimes pay common procedures correctly while systematically underpaying less frequent services, banking on the fact that providers won’t notice small discrepancies on services they only bill occasionally.

Rate verification should happen at multiple points. Check immediately after a new contract takes effect to confirm the rates were loaded correctly into the payer’s system. Check again quarterly to catch any changes or errors that develop over time. Check whenever the payer implements a system upgrade or goes through organizational changes.

Payment Timing

Contracts typically specify how quickly claims should be paid. Common terms include “within 30 days of receipt of a clean claim” or “within 45 days.” These aren’t suggestions. They’re contractual obligations, and in many states, they’re also legal requirements backed by prompt payment laws.

Track your average days to payment for each payer. If your contract says 30 days but you’re consistently seeing 50 or 60 days, the payer is violating the agreement. These delays create cash flow problems and may entitle you to interest payments under state law.

Be aware that some payers will claim a higher percentage of claims are “not clean” to avoid prompt payment requirements. They’ll find minor issues to justify holding claims beyond the contractual timeline. If your clean claim rate with other payers is 95% but one payer is claiming only 70% of your claims are clean, that’s a red flag worth investigating.

Denial Rates and Denial Reasons

Every payer will deny some claims, but denial rates should be relatively consistent across payers for the same services. If one insurance company is denying 15% of your claims while others deny 3 to 5%, something is wrong.

Every payer will deny some claims, but denial rates should be relatively consistent across payers for the same services. If one insurance company is denying 15% of your claims while others deny 3 to 5%, something is wrong.

Track not just the rate of denials but also the reasons given. Are you seeing denials for lack of medical necessity on services that other payers routinely approve? Are you getting denials for authorization issues when you obtained proper authorization? Are denials citing policy provisions that contradict your contract language?

High denial rates or unusual denial reasons often indicate that the payer’s claims processors aren’t applying your contract correctly. They may be using standard policies instead of the specific terms you negotiated.

Contract Terms Compliance

Beyond rates and timing, contracts include numerous other terms that payers must follow. These might include provisions about authorization requirements, referral processes, appeal timelines, credentialing procedures, and network adequacy standards.

Monitor whether authorization requests are being processed within the timeframes specified in your contract. Track whether appeals are being decided within contractual deadlines. Verify that the payer is maintaining adequate provider directories and updating your information correctly.

Some contracts include specific provisions you negotiated, such as carve-outs for certain services, special handling for specific situations, or commitments about network size. Don’t assume these are being honored just because they’re in the contract. Verify compliance regularly.

Fee Schedule Updates

Many contracts include annual fee schedule updates tied to inflation indices, Medicare rate changes, or other factors. These updates should happen automatically on the specified date. Often, they don’t.

Keep a calendar of when fee schedule updates should occur according to your contracts. When the update date arrives, verify that your rates actually increased. Calculate what the increase should be and confirm that the math is correct. Don’t rely on the insurance company to implement increases without checking.

Building a Monitoring System

Effective post-contract monitoring requires a systematic approach, not random spot-checking when you happen to notice a problem.

Effective post-contract monitoring requires a systematic approach, not random spot-checking when you happen to notice a problem.

Start by creating a master list of all your payer contracts with key terms documented. For each payer, record the rates for your most common service codes, payment timelines, fee schedule update provisions, and any special terms you negotiated. This becomes your reference document for monitoring.

Establish a regular review schedule. Monthly reviews should include checking a sample of payments against contracted rates, calculating average days to payment for each payer, and reviewing denial reports. Quarterly reviews should be more thorough, examining all service codes and investigating any trends or anomalies. Annual reviews should involve a full contract compliance audit.

Use your practice management system and billing software to generate useful reports. Most systems can produce reports showing payments by payer and service code, average days to payment, denial rates and reasons, and aging of accounts receivable. Learn to run these reports and read them critically.

Create a tracking spreadsheet or database to log problems as you find them. When you notice an incorrect payment, record the date, the claim number, what you should have been paid, what you actually received, and the difference. This documentation becomes essential when you need to request corrections or escalate issues.

Assign responsibility for monitoring. In smaller practices, this might be the office manager or billing coordinator. In larger organizations, it might be a dedicated revenue cycle analyst. Whoever handles it needs adequate time and training to do the job properly. Monitoring contracts can’t be something someone does “when they have time” because there will never be time.

What to Do When You Find Problems

Finding payment errors or contract violations is only useful if you act on that information. Many practices notice problems but never follow up, essentially accepting losses rather than fighting for what they’re owed.

Start with documentation. Gather evidence showing the discrepancy between what the contract requires and what actually happened. Pull the relevant contract language, the explanation of payment showing the incorrect amount or delay, and your calculations showing what you should have received.

Contact the payer through the appropriate channel. Many contracts specify procedures for disputing payments or raising compliance issues. Follow these procedures. Your first contact should be professional and factual, explaining the problem and requesting correction.

For rate errors, you’ll typically need to request a retroactive adjustment. If you were underpaid on 50 claims over three months due to an incorrect rate, you’re entitled to receive the difference. The payer should reprocess those claims at the correct rate.

For timing violations, you may be entitled to interest under state prompt payment laws. Many providers don’t realize this or don’t bother claiming it. If you’re owed it, claim it. It compensates you for the cash flow impact of delayed payments.

Keep detailed records of all communications with the payer about performance issues. Note the date, who you spoke with, what was discussed, and what they promised to do. Follow up phone calls with written confirmation via email or fax.

If the payer doesn’t resolve the problem at the provider relations level, escalate according to your contract’s dispute resolution procedures. This might involve formal written complaints to senior management, requests for mediation, or ultimately, consideration of contract termination if violations are serious and ongoing.

The Cost of Not Monitoring

Failing to monitor post-contract performance costs practices real money. A single incorrectly loaded rate can result in underpayments of $5 to $20 per claim. If you’re billing that service 100 times per month, that’s $6,000 to $24,000 annually in lost revenue. Multiply that across multiple services with rate errors, and the losses become substantial.

Failing to monitor post-contract performance costs practices real money. A single incorrectly loaded rate can result in underpayments of $5 to $20 per claim. If you’re billing that service 100 times per month, that’s $6,000 to $24,000 annually in lost revenue. Multiply that across multiple services with rate errors, and the losses become substantial.

Payment delays create cash flow problems that force practices to carry higher lines of credit, pay more in interest, and struggle to meet payroll and expenses. The cost isn’t just the delayed revenue but the financing costs to bridge the gap.

High denial rates that go unchallenged mean you’re providing services and not getting paid for them. If 10% of your claims are being denied inappropriately and you’re not appealing them, you’re accepting a 10% cut in revenue for no legitimate reason.

Beyond direct financial losses, poor contract performance monitoring affects your ability to negotiate effectively in the future. If you don’t track whether current contracts are being honored, you have no data to bring to the table when renegotiating. Payers know which providers pay attention and which don’t, and they’re more careful with the ones who monitor closely.

When to Seek Professional Help

Post-contract monitoring is time-consuming and requires specific expertise. Many practices lack the staff capacity or knowledge to do it effectively. This is where specialized services become valuable.

Companies like Medwave that provide billing, credentialing, and payer contracting services often include post-contract monitoring as part of their offerings. We have dedicated staff who track payer performance across multiple practices, giving us the data and experience to spot problems quickly. We know what normal payment patterns look like and can immediately identify outliers.

Professional monitoring services bring economies of scale. We’re reviewing hundreds or thousands of claims daily across multiple clients, so we quickly notice when a particular payer starts underpaying a specific service code. We can alert all affected clients and address the issue systematically.

We also bring established relationships with insurance company representatives and know how to escalate issues effectively. When we contact a payer about a performance problem, they know we have the documentation and expertise to back up our claims.

For practices that want to maintain some internal monitoring but need support, a hybrid approach can work. The practice handles day-to-day tracking while a professional service conducts quarterly audits and handles escalations with payers.

Making Monitoring Part of Your Routine

The key to effective post-contract performance monitoring is making it routine rather than reactive. Don’t wait until you notice a problem to start checking whether payers are honoring contracts. By the time you notice, you may have already lost months of revenue to incorrect payments.

The key to effective post-contract performance monitoring is making it routine rather than reactive. Don’t wait until you notice a problem to start checking whether payers are honoring contracts. By the time you notice, you may have already lost months of revenue to incorrect payments.

Build monitoring into your regular business processes. When you post payments, spot-check rates. When you review financial reports, look at days to payment. When you run denial reports, analyze patterns. These checks should become as automatic as verifying patient eligibility before appointments.

Train your staff to recognize warning signs. Front desk staff who field patient calls about billing should know to flag certain types of complaints. Billing staff should know which discrepancies warrant investigation versus which are normal variations.

Treat post-contract monitoring as an investment, not an expense. The revenue you protect and recover through diligent monitoring typically far exceeds the cost of the time spent doing it. One caught rate error can pay for months of monitoring effort.

The best payer contracts in the world are worthless if insurance companies don’t honor them. Post-contract performance monitoring ensures that the terms you negotiated actually translate into the payments you receive. It’s not glamorous work, but it’s essential to your practice’s financial health. Whether you handle it internally or partner with a service like Medwave, make sure it’s happening consistently and effectively. Your bottom line depends on it.