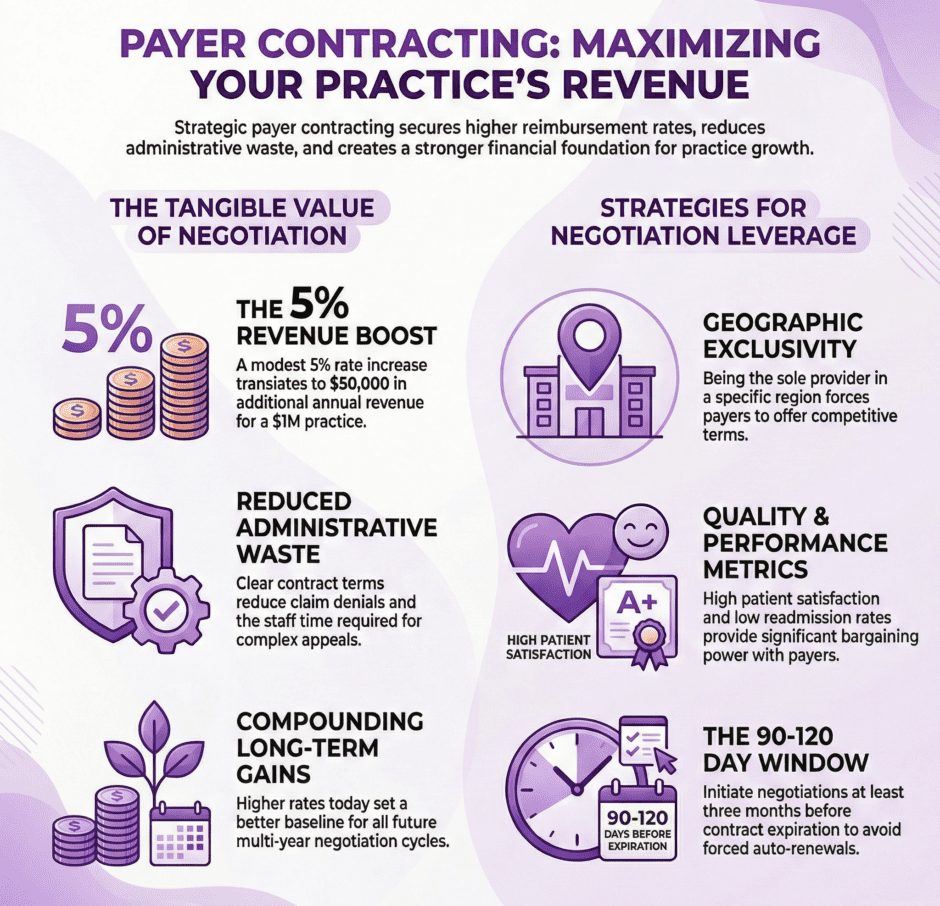

Most medical providers accept the first insurance contract they’re offered without realizing how much money they’re leaving on the table. Payer contracting creates direct value for your practice by securing better reimbursement rates, clearer payment terms, and favorable contract language that protects your financial interests. Let’s explore how strategic payer contracting delivers tangible value to medical providers.

Why Do Insurance Contracts Matter So Much?

Insurance contracts determine exactly how much you get paid for every service you provide.

Insurance contracts determine exactly how much you get paid for every service you provide.

These agreements set reimbursement rates, define payment timelines, establish claim submission requirements, and outline appeal processes when claims get denied. The difference between a poorly negotiated contract and a strong one can mean hundreds of thousands of dollars annually for an average practice.

A 5% rate increase across all services might sound small, but it translates to $50,000 more revenue on a practice billing $1 million per year. Contract terms affect more than just rates. Language about timely filing limits, coordination of benefits, and bundling rules impacts how often you actually receive payment for services rendered. Vague terms create disputes that delay payments and require staff time to resolve.

What Makes a Payer Contract Valuable?

Valuable payer contracts balance fair reimbursement with reasonable administrative requirements. The most obvious value comes from reimbursement rates. Higher rates per procedure mean more revenue without seeing additional patients or working longer hours.

Even modest rate improvements compound significantly over the life of a multi-year contract.

Clear payment terms create value by reducing confusion and disputes. When contracts specify exactly how bundling works, what modifiers are recognized, and how timely filing is calculated, your billing team can submit clean claims that get paid quickly without back-and-forth questions.

Favorable credentialing provisions allow you to add new providers to existing contracts quickly. Some contracts make adding providers simple, while others require lengthy re-negotiations or restrict which specialties can join your group. Strong appeal language protects your practice when claims are denied incorrectly.

How Much Money Can Better Contracts Really Save?

The financial impact of contract negotiations often surprises providers who’ve never challenged their rates. Consider a family practice that negotiates a 3% rate increase with their top three payers.

If those payers represent 60% of the practice’s $2 million annual collections, that’s $36,000 in additional revenue every single year. Over a three-year contract term, that’s $108,000, enough to hire additional staff, invest in new equipment, or increase provider compensation.

Specialty practices see even larger impacts. An orthopedic surgeon who negotiates better rates for total joint replacements might gain $500-1,000 per procedure. Performing just 100 of these procedures annually creates $50,000-100,000 in additional revenue.

Better contract terms also save money by reducing administrative waste. When contracts clearly define requirements, billing staff spend less time on appeals and resubmissions.

This efficiency translates directly to lower operational costs.

When Should You Negotiate Your Contracts?

Timing matters tremendously in contract negotiations.

The best time to negotiate is before you sign a new contract or during scheduled renewal periods. These are the moments when payers expect negotiation discussions and have systems in place to consider rate adjustments. Contract renewal notices typically arrive 90-120 days before the current contract expires. This window represents your prime negotiation opportunity.

Significant practice changes also create negotiation opportunities. Opening a new location, adding providers, or acquiring another practice changes your value to the payer network.

Market changes can trigger renegotiation opportunities too. When Medicare adjusts reimbursement rates significantly or when competitors negotiate better terms, these factors strengthen your position to request improved rates. Don’t wait until you’re struggling financially to address inadequate contracts. Proactive negotiation from a position of strength yields better results than desperate last-minute discussions when your practice is already hurting.

What Leverage Do Medical Providers Have?

Many providers mistakenly believe they have no negotiating power against large insurance companies. In reality, practices possess more leverage than they realize.

Many providers mistakenly believe they have no negotiating power against large insurance companies. In reality, practices possess more leverage than they realize.

Geographic exclusivity creates leverage. If you’re the only cardiologist within 30 miles accepting a particular insurance, that payer needs you in their network to serve members in your area.

Quality metrics strengthen your position. Providers with high patient satisfaction scores, low readmission rates, and strong clinical outcomes bring value that payers recognize. They’d rather keep high-performing providers in-network even if it means paying slightly higher rates.

Patient volume matters. If hundreds of a payer’s members use your practice regularly, removing you from the network would upset those members and potentially trigger complaints to employers who purchase the insurance plans.

Specialty expertise provides leverage too. Providers offering unique services or treating complex conditions have more negotiating power because payers need specialists to round out their networks. Group size affects leverage as well. Larger practices representing multiple providers carry more weight than solo practitioners.

What Contract Terms Should You Focus On?

While reimbursement rates get the most attention, other contract terms create significant value or hidden costs.

- Fee Schedule Language – Determine whether rates are tied to a percentage of Medicare or use a fixed fee schedule. Percentage-based contracts fluctuate with Medicare changes, while fixed schedules remain stable but may lag behind market rates.

- Annual Rate Adjustments – Some contracts include automatic rate increases tied to inflation or Medicare updates. Others freeze rates for years at a time, eroding your real income as costs increase.

- Timely Filing Limits – These clauses define how long you have to submit claims after providing services. Longer timely filing periods (180-365 days) give you more flexibility than shorter periods (90 days).

- Clean Claim Definitions – Contracts should clearly define what constitutes a clean claim and how quickly payers must process them. Specific timelines (30 days) protect you better than vague language like “reasonable time.”

- Fee Schedule Updates – Understand how often the payer updates fee schedules and whether they notify you of changes. Surprise fee schedule reductions can devastate practice finances if you don’t catch them quickly.

- Termination Provisions – Review how much notice you must give to leave the contract and what happens to pending claims after termination.

How Do You Prepare for Contract Negotiations?

Successful negotiations require preparation and data. Start by analyzing your current performance with each payer.

Successful negotiations require preparation and data. Start by analyzing your current performance with each payer.

Pull reports showing total claims submitted, total payments received, denial rates, and average reimbursement per procedure. This baseline helps you identify which relationships need improvement most urgently. Research market rates in your area. Contact your state medical association or specialty society for fee schedule surveys showing what other providers receive for common procedures.

Calculate your costs for high-volume procedures. Knowing your true cost to deliver services helps establish your minimum acceptable rates. You can’t sustain providing care at a loss indefinitely.

Document your value to the payer network. Gather data on patient satisfaction scores, clinical outcomes, volume of members served, and any unique services you provide.

Identify your priorities before negotiations begin. Would you accept a smaller rate increase in exchange for better payment terms? Is expanding the contract to include new providers more important than rate improvements?

What Mistakes Should You Avoid?

Common negotiation mistakes cost practices real money. Don’t accept lowball initial offers.

Payers expect negotiation and often start with offers below what they’re actually willing to pay. Providers who accept first offers leave money on the table. Avoid negotiating without data, emotional arguments about fairness don’t persuade payers. Specific data about market rates, practice costs, and patient volumes carry weight in negotiations.

Don’t sign auto-renewal clauses without careful review. These provisions extend contracts automatically unless you provide written termination notice during a specific window. Missing that window locks you into unfavorable terms for another contract cycle.

Avoid focusing exclusively on rates while ignoring other contract terms.

Don’t negotiate alone if you lack experience. Payer contracting requires specific expertise. Attempting complex negotiations without professional help often results in missed opportunities and unfavorable agreements.

How Long Do Negotiations Typically Take?

Contract negotiation timelines vary based on multiple factors. Simple rate adjustment discussions might conclude within 30-60 days.

Contract negotiation timelines vary based on multiple factors. Simple rate adjustment discussions might conclude within 30-60 days.

If you’re requesting a modest increase and have strong data supporting your position, payers can often approve changes relatively quickly. More extensive negotiations involving multiple contract terms typically take 90-120 days. When you’re requesting rate increases, modified payment terms, and updated provider rosters simultaneously, expect longer discussions as proposals move through multiple approval levels within the insurance company.

New contracts for practices joining a network for the first time often take 120-180 days.

Negotiations can stall for various reasons. Payers might delay responding to proposals, especially if they’re not approaching a contract renewal deadline. Your practice might need time to gather additional data or consult with advisors before responding to counter-offers. Building extra time into your negotiation schedule prevents forced decisions under deadline pressure.

Should You Ever Walk Away From a Contract?

Sometimes terminating a payer relationship makes financial sense. If a payer consistently reimburses below your cost to provide services, continuing that relationship loses money on every patient visit.

When administrative burdens exceed the revenue a payer brings, termination might be justified. Some payers create excessive documentation requirements, have lengthy prior authorization processes, or maintain confusing billing rules that consume staff time disproportionate to the collections they generate.

Payers with extremely high denial rates and poor appeal processes damage practice cash flow.

Market alternatives affect termination decisions. If leaving one payer means losing access to 50% of potential patients in your area with no other insurance options, you might need to tolerate less-than-ideal terms. If patients have multiple insurance choices, you have more freedom to terminate poor relationships.

Before terminating any contract, model the financial impact carefully. Consider how many current patients would need to switch insurance or find new providers, and whether you can fill those appointment slots with better-paying patients.

How Does Technology Impact Contract Management?

Modern technology tools make contract management more efficient and effective. Contract management software stores all your payer agreements in one centralized location.

Modern technology tools make contract management more efficient and effective. Contract management software stores all your payer agreements in one centralized location.

Rather than hunting through file cabinets or email folders, you can instantly access any contract to verify terms when billing questions arise. Automated alerts notify you when contracts are approaching renewal dates, giving you ample time to prepare for negotiations. These reminders prevent missed renewal windows that could lock you into auto-renewals of unfavorable terms.

Fee schedule comparison tools highlight rate differences across payers for specific procedures.

Performance tracking dashboards show key metrics for each payer relationship. Total collections, denial rates, days in accounts receivable, and payment trends over time. This visibility helps you prioritize which contracts to renegotiate first based on financial impact. Some practices integrate contract terms directly into their practice management systems, allowing billing staff to verify whether specific services are covered and at what rate before submitting claims.

Can Small Practices Negotiate Effectively?

Small practices absolutely can negotiate better contracts despite limited size. Solo practitioners and small groups should emphasize quality over volume.

Highlight patient satisfaction scores, clinical outcomes, and specialized expertise that large groups can’t necessarily claim. Payers value quality providers who enhance their network reputation. Consider joining independent practice associations (IPAs) that negotiate collectively on behalf of multiple small practices.

Rural practices often have geographic leverage that urban practices lack.

If you’re the only provider of your specialty in a wide area, that exclusivity gives you significant negotiating power regardless of your practice size. Small practices should focus negotiations on their highest-volume procedures rather than trying to improve rates across hundreds of codes simultaneously. Winning better reimbursement for your top 10-20 procedures generates meaningful financial impact.

Don’t hesitate to seek professional help. At Medwave, we provide payer contracting services alongside medical billing and credentialing, helping practices of all sizes negotiate better agreements.

What Role Do Contract Analytics Play?

Data-driven contract analysis reveals opportunities that gut feeling misses. Start by identifying your most profitable payer relationships. Calculate the profit margin for each payer by comparing their average reimbursement rates to your cost of providing services.

Analyze procedure-specific reimbursement across all payers. You might discover that Payer A reimburses your most common procedure well but pays poorly for your second-most common service, while Payer B shows the opposite pattern.

Track denial patterns by payer. If one insurance company denies 20% of claims while others average 5%, that relationship needs attention.

Monitor days in accounts receivable by payer. Slow-paying insurance companies hurt cash flow even if their rates are competitive. Contract negotiations should address payment timelines, not just reimbursement amounts. Compare your rates to regional and national benchmarks to establish concrete targets for rate improvement requests.

What’s the Long-Term Value of Good Contracts?

Strong payer contracts create compounding value over many years. Better reimbursement rates set a higher baseline for all future years.

Strong payer contracts create compounding value over many years. Better reimbursement rates set a higher baseline for all future years.

If you negotiate a 5% increase now, that improvement persists through the contract term and forms the starting point for the next negotiation cycle. Favorable contract terms reduce administrative costs year after year. Every hour your billing staff doesn’t spend fighting inappropriate denials or clarifying vague contract language is time they can spend on productive revenue cycle activities.

Well-structured contracts support practice growth. When you can easily add new providers to existing payer agreements, you can expand your practice without lengthy credentialing delays or contract renegotiations that slow down your growth plans.

Strong relationships with payers, built on fair contracts, create collaborative problem-solving when issues arise.

Good contracts provide financial stability that allows long-term strategic planning. When you know what your reimbursement rates will be for the next three years, you can make confident decisions about hiring, equipment purchases, and facility expansions.

The value of strategic payer contracting extends far beyond the immediate rate improvements you negotiate. These agreements form the financial foundation of your practice, affecting everything from daily operations to long-term growth strategies.