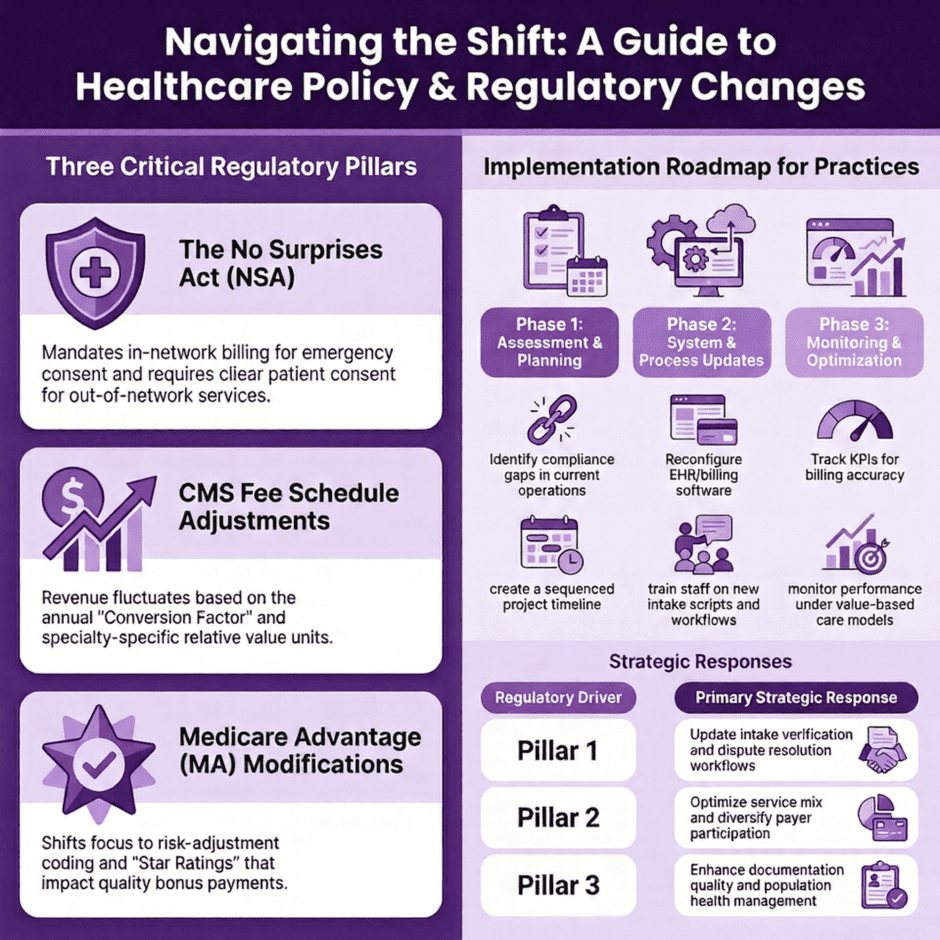

Healthcare regulatory updates arrive with clockwork regularity, each bringing new requirements that practices must decode and implement. Rather than getting lost in bureaucratic language, medical practices need clear guidance on what these changes mean for daily operations, revenue cycles, and patient care.

This analysis examines three critical regulatory areas that demand immediate attention:

- No Surprises Act implementation – New billing requirements and patient protection measures that reshape out-of-network service delivery

- CMS fee schedule updates – Annual payment adjustments that directly impact practice revenue and service planning

- Medicare Advantage payment modifications – Changes to risk-based payments and quality incentives affecting contract negotiations

Each section provides actionable strategies practices can deploy immediately to ensure compliance while maximizing operational efficiency.

The No Surprises Act: From Patient Protection to Practice Preparation

The No Surprises Act fundamentally altered how medical billing works, particularly for out-of-network services and emergency care. The legislation aims to shield patients from unexpected medical bills, but the operational burden falls squarely on healthcare providers to navigate new compliance requirements.

Key Provisions and Their Impact

The Act establishes several core protections that directly affect practice operations. Emergency services must now be billed at in-network rates regardless of the provider’s network status. Non-emergency services at in-network facilities require specific patient consent processes when out-of-network providers are involved. The legislation also creates an independent dispute resolution process for payment disagreements between providers and insurers.

The Act establishes several core protections that directly affect practice operations. Emergency services must now be billed at in-network rates regardless of the provider’s network status. Non-emergency services at in-network facilities require specific patient consent processes when out-of-network providers are involved. The legislation also creates an independent dispute resolution process for payment disagreements between providers and insurers.

These changes create immediate operational challenges. Front desk staff must now verify network status more thoroughly before scheduling procedures. Billing departments need new workflows to handle the independent dispute resolution process. Clinical teams must understand when additional patient disclosures are required.

Immediate Implementation Steps

Practice administrators should focus on four critical areas for immediate compliance:

- Update patient intake processes to include network status verification at multiple touchpoints, initial scheduling, pre-registration, and day-of-service check-in.

- Develop standardized scripts for staff to explain potential out-of-network charges and obtain required patient acknowledgments.

- Establish workflows for submitting disputes through the independent resolution process, including timeline tracking and documentation requirements.

- Modify billing software to flag potential No Surprises Act cases before claims submission.

Documentation becomes particularly crucial under the new requirements. Practices must maintain records showing they provided required notices to patients, obtained proper acknowledgments for out-of-network services, and followed dispute resolution procedures correctly. Creating template forms and checklists helps ensure consistent compliance across all patient encounters.

Financial Planning Considerations

The Act’s payment provisions create both opportunities and risks for practice revenue. While emergency services now receive in-network payment rates, the dispute resolution process can delay payments and create administrative costs. Practices should budget for increased staffing needs in verification and billing departments, as well as potential fees for independent dispute resolution cases.

Revenue forecasting becomes more challenging when payment amounts depend on dispute resolution outcomes rather than standard contracted rates. Practices need robust financial modeling to account for these variables and maintain adequate cash flow during extended payment timelines.

CMS Fee Schedule Updates: Decoding Payment Changes

The Centers for Medicare and Medicaid Services publishes annual fee schedule updates that directly impact practice revenue. These changes reflect adjustments for inflation, practice costs, and policy priorities, but the technical presentation often obscures the real-world implications for healthcare providers.

Knowing the Conversion Factor

The Medicare Physician Fee Schedule relies on a conversion factor that translates relative value units into dollar amounts. This single number drives payment rates for thousands of procedures and services. Recent years have seen minimal increases or even decreases in the conversion factor, creating financial pressure on practices that rely heavily on Medicare patients.

The Medicare Physician Fee Schedule relies on a conversion factor that translates relative value units into dollar amounts. This single number drives payment rates for thousands of procedures and services. Recent years have seen minimal increases or even decreases in the conversion factor, creating financial pressure on practices that rely heavily on Medicare patients.

For 2024 and beyond, practices must understand how conversion factor changes interact with relative value unit adjustments. Some specialties benefit from increased RVU values for specific procedures, while others face reductions. The net effect varies significantly based on a practice’s service mix and patient demographics.

Specialty-Specific Impacts

Different medical specialties experience varying effects from fee schedule changes. Primary care services often receive preferential treatment in policy adjustments, with increased payments for evaluation and management codes. Procedural specialties may see mixed results, with some procedures receiving increases while others face reductions.

Practices should analyze their top 20 procedure codes by volume and revenue to understand how fee schedule changes affect their specific situation. This analysis reveals which services drive the most financial impact and helps prioritize operational adjustments.

Strategic Response Options

Several strategies help practices adapt to fee schedule changes effectively:

- Service mix optimization: Shift resources toward services with favorable payment adjustments while maintaining quality care standards

- Efficiency improvements: Streamline workflows to maintain profitability despite payment reductions

- Payer mix diversification: Reduce dependence on Medicare by expanding commercial insurance participation

- Value-based care participation: Explore alternative payment models that provide more predictable revenue streams

Practices must also consider longer-term trends in Medicare payments. The sustainable growth rate mechanism and its replacement with the Medicare Access and CHIP Reauthorization Act created ongoing payment pressures that require strategic planning beyond annual fee schedule updates.

Technology and Documentation Requirements

CMS continues expanding quality reporting and documentation requirements that affect payment rates. The Merit-based Incentive Payment System and Alternative Payment Models create additional compliance obligations that practices must manage alongside fee schedule changes.

Electronic health record systems need configuration updates to capture required quality measures and support new documentation standards. Practices should evaluate their technology capabilities and budget for necessary upgrades or training to maintain compliance with reporting requirements.

Medicare Advantage Payment Modifications: Navigating Plan Changes

Medicare Advantage plans operate under different payment mechanisms than traditional Medicare, creating unique challenges for healthcare providers. Recent modifications to these payment systems affect how plans compensate providers and manage patient care, requiring practices to adapt their contracting and operational strategies.

Risk Adjustment and Quality Bonuses

Medicare Advantage plans receive payments based on the health status of their enrolled members, creating incentives for thorough documentation and care management. Recent changes to risk adjustment methodologies affect how plans calculate provider payments and shared savings distributions.

Medicare Advantage plans receive payments based on the health status of their enrolled members, creating incentives for thorough documentation and care management. Recent changes to risk adjustment methodologies affect how plans calculate provider payments and shared savings distributions.

Practices participating in Medicare Advantage contracts must understand how documentation quality affects plan payments and, ultimately, provider compensation. Accurate coding of patient conditions, particularly chronic diseases and comorbidities, directly impacts revenue under value-based arrangements.

Star Ratings Impact on Practice Operations

The Medicare Advantage Star Ratings system affects plan bonus payments and marketing capabilities. Poor-performing plans may reduce provider payments or implement additional administrative requirements. High-performing plans often share quality bonuses with participating providers.

Knowledge of Star Ratings metrics helps practices align their operations with plan priorities. Key measures include medication adherence, preventive care completion, and patient satisfaction scores. Practices can implement specific programs targeting these metrics to improve both patient outcomes and financial performance.

Contract Negotiation Strategies

Medicare Advantage contract terms vary significantly between plans and markets. Recent payment modifications create opportunities for practices to negotiate more favorable terms, particularly around risk-sharing arrangements and quality incentives.

Practices should focus on several key contract elements:

- Capitation rates and risk corridors: Understand how payment amounts are calculated and what financial risks the practice assumes

- Quality measure requirements: Negotiate realistic targets and ensure adequate resources for reporting and improvement

- Administrative fee structures: Minimize unnecessary administrative costs while maintaining compliance requirements

- Termination and renewal provisions: Protect practice flexibility while ensuring payment continuity

Operational Adjustments for Value-Based Care

Medicare Advantage plans increasingly emphasize value-based care models that reward outcomes over volume. Practices must adjust their operations to succeed under these arrangements while maintaining financial stability.

Care coordination becomes essential under value-based models. Practices need systems to track patient outcomes across multiple providers and settings. This requires investment in care management staff, technology platforms, and provider collaboration tools.

Population health management also takes on greater importance under Medicare Advantage arrangements. Practices must identify high-risk patients, implement preventive interventions, and monitor population-wide health trends. These capabilities require data analytics tools and clinical protocols that many practices lack.

Technology Requirements and Data Management

Medicare Advantage plans often require specific technology capabilities for participation in value-based arrangements. Electronic health record systems must support quality reporting, risk adjustment documentation, and care gap identification. Practice management systems need integration with plan portals and data reporting platforms.

Data security and privacy protections become more important as practices share information with plans and third-party vendors. Practices must ensure their technology infrastructure meets HIPAA requirements while supporting the data exchange necessary for value-based care participation.

Implementation Roadmap for Practices

Healthcare practices face the challenge of implementing multiple regulatory changes simultaneously while maintaining day-to-day operations. A structured approach helps ensure compliance while minimizing operational disruption.

Phase One: Assessment and Planning

Begin with a thorough assessment of current operations and compliance status. Review existing policies and procedures against new regulatory requirements. Identify gaps and prioritize changes based on compliance risk and implementation complexity.

Begin with a thorough assessment of current operations and compliance status. Review existing policies and procedures against new regulatory requirements. Identify gaps and prioritize changes based on compliance risk and implementation complexity.

Create a project timeline that sequences changes logically and allows adequate time for staff training and system modifications. Consider external resources, such as consultants or technology vendors, that can accelerate implementation.

Phase Two: System and Process Updates

Focus on updating systems and processes to support new regulatory requirements. This includes modifying electronic health records, updating billing software, and revising patient intake procedures. Train staff on new workflows and provide ongoing support during the transition period.

Document all changes to ensure consistent implementation and facilitate future audits or compliance reviews. Create monitoring procedures to track compliance metrics and identify areas needing additional attention.

Phase Three: Monitoring and Optimization

Establish ongoing monitoring procedures to ensure sustained compliance with regulatory requirements. Track key performance indicators related to billing accuracy, patient satisfaction, and financial performance. Use this data to identify opportunities for process improvements and operational optimization.

Regular review and updates help practices stay current with regulatory changes and maintain optimal performance under new requirements. This includes staying informed about future regulatory developments and planning proactive responses.

Summary: Turning Regulatory Challenges into Operational Advantages

![]() Healthcare regulatory changes create both challenges and opportunities for medical practices. While compliance requirements demand significant attention and resources, practices that implement changes thoughtfully can gain operational advantages and improve financial performance.

Healthcare regulatory changes create both challenges and opportunities for medical practices. While compliance requirements demand significant attention and resources, practices that implement changes thoughtfully can gain operational advantages and improve financial performance.

The key lies in viewing regulatory compliance as an investment in operational excellence rather than simply a cost of doing business. Practices that excel at regulatory adaptation often discover improvements in patient care, staff efficiency, and financial management that extend well beyond compliance requirements.

Focusing on immediate implementation steps while maintaining awareness of longer-term trends sets up healthcare practices to manage regulatory changes while positioning themselves for continued growth and stability in an increasingly regulated healthcare environment.