The Centers for Medicare and Medicaid Services recently announced major price reductions for 15 widely prescribed medications, including popular drugs like Ozempic and Wegovy. These negotiated prices will take effect in 2027 and represent significant savings for both the Medicare program and the millions of patients who rely on these medications. For healthcare providers and medical billing professionals, these changes will have important implications for patient care and practice operations.

The Background on Medicare Drug Negotiations

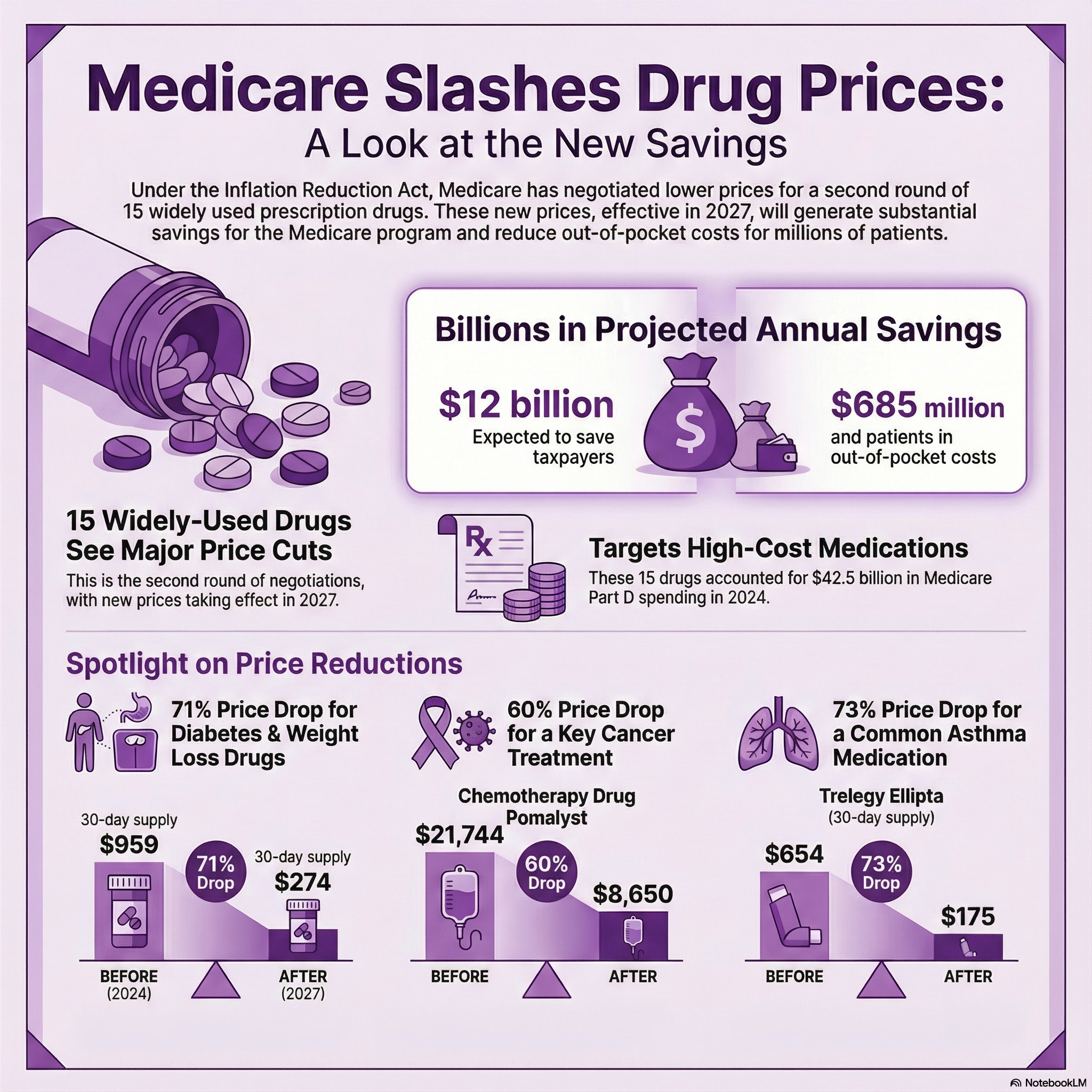

This announcement represents the second round of Medicare’s drug price negotiation program, which was created under the Inflation Reduction Act signed into law in 2022. The first round of negotiations covered 10 medications, with those price cuts scheduled to begin in 2026. This second round adds 15 more drugs to the list of negotiated medications.

This announcement represents the second round of Medicare’s drug price negotiation program, which was created under the Inflation Reduction Act signed into law in 2022. The first round of negotiations covered 10 medications, with those price cuts scheduled to begin in 2026. This second round adds 15 more drugs to the list of negotiated medications.

The program works by allowing Medicare to directly negotiate prices with pharmaceutical manufacturers. While drug companies can choose not to participate in these negotiations, refusing would likely mean pulling their medications from Medicare entirely. Since Medicare represents one of the largest markets in the United States, most manufacturers have opted to come to the negotiating table rather than lose access to millions of potential customers.

These negotiated prices reflect what Medicare will pay drugmakers for the medications, not necessarily what patients will pay out of pocket. However, lower prices for the Medicare program generally translate to lower costs for enrollees as well. According to CMS estimates, these new prices will save taxpayers $12 billion and reduce out-of-pocket costs for Medicare enrollees by $685 million in 2027.

The 15 Drugs with New Negotiated Prices

The medications included in this round cover a wide range of conditions, from diabetes and weight management to cancer and respiratory diseases.

Here’s the breakdown of the negotiated prices for a 30-day supply compared to the 2024 list prices:

Diabetes and Weight Management:

- Ozempic, Rybelsus, and Wegovy: $274 (down from $959)

- Tradjenta: $78 (down from $488)

- Janumet and Janumet XR: $80 (down from $526)

Cancer Treatments:

- Xtandi (prostate cancer): $7,004 (down from $13,480)

- Pomalyst (chemotherapy): $8,650 (down from $21,744)

- Ibrance (breast cancer): $7,871 (down from $15,741)

- Calquence: $8,600 (down from $14,228)

Respiratory Conditions:

- Trelegy Ellipta (asthma): $175 (down from $654)

- Breo Ellipta (COPD): $67 (down from $397)

Other Conditions:

- Ofev (pulmonary fibrosis): $6,350 (down from $12,622)

- Linzess (chronic constipation): $136 (down from $539)

- Austedo and Austedo XR (Huntington’s disease): $4,093 (down from $6,623)

- Xifaxan (diarrhea and IBS): $1,000 (down from $2,696)

- Vraylar (antipsychotic): $770 (down from $1,376)

- Otezla (psoriatic arthritis): $1,650 (down from $4,722)

These 15 medications accounted for $42.5 billion in Medicare Part D spending during 2024, representing about 15% of the program’s total drug costs. Medicare Part D covers medications that patients take at home, as opposed to drugs administered in medical facilities like IV chemotherapy treatments.

The Impact of Weight Loss Medications

One of the most notable inclusions in this round of negotiations is the group of medications used for Type 2 diabetes and weight loss: Ozempic, Rybelsus, and Wegovy. These drugs have exploded in popularity over the past few years, with demand often outstripping supply.

One of the most notable inclusions in this round of negotiations is the group of medications used for Type 2 diabetes and weight loss: Ozempic, Rybelsus, and Wegovy. These drugs have exploded in popularity over the past few years, with demand often outstripping supply.

The negotiated price of $274 for a 30-day supply represents a significant reduction from the $959 list price. For higher doses of Wegovy specifically used for weight management, the negotiated price will be $385. These reductions could make these medications more accessible to Medicare beneficiaries who have struggled to afford them.

Health policy experts have noted that this negotiated price is actually higher than a separate deal announced by the Trump administration with Novo Nordisk, the manufacturer of these drugs. That deal, which relies on voluntary agreements and tariff relief rather than legislation, set a price of $250. Some experts have questioned why the Medicare negotiation didn’t achieve the lower price point.

What This Means for Healthcare Practices

For medical practices, these price changes will affect several aspects of patient care and practice management. First and foremost, providers may see increased access to these medications among their Medicare patients. When drugs become more affordable, patients are more likely to fill prescriptions and maintain their treatment regimens.

This improved medication adherence can lead to better health outcomes. Patients who can afford their medications are more likely to take them as prescribed, which means better disease management and potentially fewer complications or hospitalizations. For chronic conditions like diabetes, asthma, and cancer, consistent medication use makes a significant difference in patient quality of life and long-term health.

From a billing and administrative perspective, practices need to stay informed about these pricing changes. While the new prices don’t take effect until 2027, planning ahead will help ensure smooth transitions. Medical billing specialists should prepare for questions from patients about drug costs and coverage. They should also be ready to verify coverage and prior authorization requirements, which may change as these new prices roll out.

The Bigger Picture on Drug Affordability

These Medicare negotiations address a pressing concern for many Americans. Research shows that about one in five adults have skipped filling a prescription because they couldn’t afford it. About one in seven people have cut pills in half or skipped doses to make their medications last longer due to cost concerns. These behaviors can lead to serious health consequences and often result in more expensive emergency care or hospitalizations down the line.

These Medicare negotiations address a pressing concern for many Americans. Research shows that about one in five adults have skipped filling a prescription because they couldn’t afford it. About one in seven people have cut pills in half or skipped doses to make their medications last longer due to cost concerns. These behaviors can lead to serious health consequences and often result in more expensive emergency care or hospitalizations down the line.

By reducing drug prices for Medicare beneficiaries, this program aims to eliminate some of the financial barriers that prevent patients from taking their medications as prescribed. The savings are substantial. For example, a patient taking Ozempic will see their medication cost drop by more than $685 per month at list price. Even after insurance coverage, the reduced prices should translate to lower copays and out-of-pocket expenses.

Healthcare providers often witness firsthand how drug costs affect patient decisions. Many doctors have had to alter treatment plans or switch to less effective but more affordable alternatives because patients simply cannot pay for the best option. These Medicare negotiations may give providers more flexibility to prescribe the most appropriate medications without cost being the primary determining factor.

Challenges and Legal Battles

The Medicare drug negotiation program hasn’t been without controversy. Several pharmaceutical manufacturers have challenged the program in court, arguing that it violates their rights or amounts to government price controls rather than true negotiations. So far, these legal challenges have not been effective in stopping the program, but the litigation continues.

Drug companies argue that these negotiated prices may reduce their ability to invest in research and development for new medications. They contend that high drug prices in the United States help fund the creation of innovative treatments that benefit patients worldwide. Critics of this argument point out that pharmaceutical companies spend more on marketing than on research, and that many breakthrough drugs originate from government-funded research.

The political landscape around drug pricing remains fluid. While the Inflation Reduction Act that created this program was signed under the Biden administration, the current Trump administration has continued implementing it. Health and Human Services Secretary Robert F. Kennedy Jr. has stated that the administration will use every available tool to lower healthcare costs for Americans.

Implications for Medical Billing and Credentialing

For companies that handle medical billing, credentialing, and payer contracting like Medwave, these drug price changes create both opportunities and challenges. Billing professionals need to stay current on Medicare pricing updates to ensure accurate claims submission and reimbursement. They must also be prepared to answer questions from healthcare providers and patients about how these changes affect coverage and out-of-pocket costs.

For companies that handle medical billing, credentialing, and payer contracting like Medwave, these drug price changes create both opportunities and challenges. Billing professionals need to stay current on Medicare pricing updates to ensure accurate claims submission and reimbursement. They must also be prepared to answer questions from healthcare providers and patients about how these changes affect coverage and out-of-pocket costs.

Credentialing specialists should be aware that as drug prices change, payer policies and formularies may also shift. Prior authorization requirements might be updated, and preferred drug lists could be modified. Staying ahead of these changes helps ensure that healthcare providers maintain smooth operations and that patients receive their medications without unnecessary delays.

The intersection of drug pricing, billing, and patient care becomes increasingly important as these negotiations expand. The first round covered 10 drugs, the second round adds 15 more, and future rounds are expected to include additional medications. This growing list of negotiated drugs will require ongoing attention from everyone involved in healthcare administration.

Looking Ahead to 2027 and Beyond

While the negotiated prices announced in this second round won’t take effect until 2027, healthcare practices should start preparing now. This preparation includes educating staff about the upcoming changes, updating patient communication materials, and working with billing partners to ensure systems are ready to handle the new pricing structure.

For patients currently struggling to afford these medications, the wait until 2027 may seem long. However, the first round of negotiated prices taking effect in 2026 will provide some relief, and these subsequent rounds demonstrate Medicare’s ongoing commitment to making prescription drugs more affordable.

Healthcare providers should also watch for announcements about future negotiation rounds. As the program expands to cover more medications, additional opportunities for patient savings will emerge. Practices that stay informed about these changes will be better positioned to help their patients access the treatments they need.

Patient Communication Strategies

As 2027 approaches, healthcare practices should develop strategies for communicating these changes to patients. Many Medicare beneficiaries may not be aware of the negotiated prices or how these changes will affect their out-of-pocket costs. Clear, straightforward communication can help patients plan for their healthcare expenses and make informed decisions about their treatment options.

Front office staff should be trained to answer basic questions about the new pricing, while clinical staff should be prepared to discuss how these changes might affect treatment plans. Having informational materials available in waiting rooms or on practice websites can help patients learn about the savings they can expect.

The Role of Healthcare Administration

The success of these drug price negotiations ultimately depends on effective implementation by healthcare providers, pharmacies, insurance companies, and administrative service providers. Each plays a role in ensuring that the negotiated savings actually reach patients and that the billing and reimbursement processes work smoothly.

The success of these drug price negotiations ultimately depends on effective implementation by healthcare providers, pharmacies, insurance companies, and administrative service providers. Each plays a role in ensuring that the negotiated savings actually reach patients and that the billing and reimbursement processes work smoothly.

For healthcare practices that partner with specialized billing and credentialing services, these relationships become even more valuable during times of significant change. Experienced partners can help practices work through the details of new pricing structures, updated payer policies, and changing coverage requirements. This support allows healthcare providers to focus on patient care while administrative experts handle the details.

The announcement of negotiated prices for these 15 drugs represents a significant step toward making prescription medications more affordable for Medicare beneficiaries.