Telehealth has become an increasingly popular way for patients to access healthcare services remotely. With telehealth, patients can consult with doctors, therapists, and other providers through video chat, phone calls, or mobile apps instead of going into a clinic or hospital.

As telehealth usage grows, understanding how to bill and get reimbursed for these virtual visits is crucial for providers. Telehealth billing follows many of the same rules and procedures as in-person visits, but with some key differences. This content covers everything medical practices need to know about telehealth billing and revenue cycle management.

Overview of Telehealth Billing

Telehealth refers to remote clinical services delivered through telecommunications technology.

Some common telehealth services include:

- Video visits: Live, face-to-face consultations between patients and providers using video conferencing software.

- Remote patient monitoring: Collecting health data from patients remotely through connected devices like blood pressure cuffs or glucose monitors.

- Store and forward services: Transmitting recorded health history like images or video to a provider to review at a later time.

- E-visits: Non-face-to-face patient assessments via online patient portals.

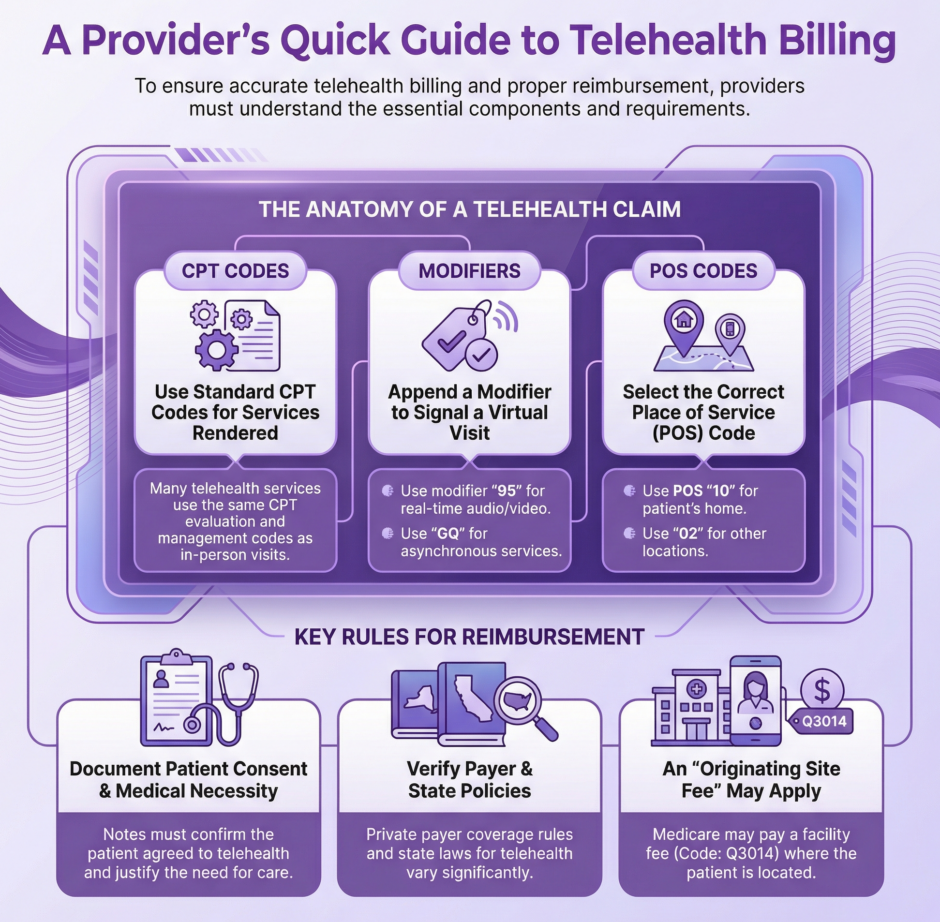

Telehealth services are billed similarly to regular in-person medical visits. Practices submit claims to payers with CPT codes for the type of service, modifiers to indicate it was virtual, and a place of service code to show it was delivered through telehealth.

However, telehealth claims must meet certain requirements around technology, interfacing with patients, and documentation to get paid by Medicare, Medicaid, and private insurers. Knowledge of the latest telehealth billing guidelines is key for practices new to offering virtual care services.

Telehealth Billing Codes

Billing for telehealth uses many of the same CPT codes as in-person visits, along with a couple specific codes for virtual services:

Evaluation and Management Codes

- 99201-99215 for outpatient E/M visits

- 99421-99423 for online digital E/M services

- 99231-99233 for subsequent inpatient hospital care

- 99307-99310 for subsequent nursing facility care

These are billed like regular E/M codes but also require a telehealth modifier and place of service code.

Virtual Check-in Codes

- G2010 for remote evaluation of recorded video and/or images

- G2012 for brief virtual communication under 7 days

- G2252 for brief communication by a physician or qualified health professional with a patient or caregiver to determine whether an office visit is needed

These asynchronous telehealth services don’t require the normal originating site fee.

Telehealth Consultation Codes

- 99241-99245 for telehealth consultation services

- 99446-99447 for interprofessional telephone/internet/EHR consultations

- 99448-99449 for interprofessional telephone/internet/EHR consultations for patients with Medicare

Consult codes are used when a provider is seeking input on a case from a specialist via telehealth.

Remote Therapeutic Monitoring

- 98975-98976 for remote therapeutic monitoring services for 20+ minutes a month

- 98977-98980 for additional remote therapeutic monitoring beyond the first 20 minutes

These codes are used for RPM programs managing a patient’s health condition.

Other Telehealth Services

- 90836-90838 for psychotherapy sessions

- 90839-90840 for crisis psychotherapy

- 90845-90847 for psychoanalysis sessions

- 90863 for pharmacologic management

- 96151-96154 for health behavior assessment and intervention

- 99354-99355 for prolonged service office or outpatient codes

- 99358-99359 for prolonged service inpatient codes

Telehealth Billing Modifiers

In addition to CPT codes, telehealth claims require modifiers to identify the visit was performed virtually.

The main telehealth modifiers include:

- 95 – Synchronous telehealth service rendered via real-time interactive audio and video telecommunications system

- GQ – Asynchronous telehealth service for store and forward

- G0 – Asynchronous telehealth service for remote patient monitoring

Sometimes GT or U1 modifiers may also be required depending on payer. Modifiers go after the CPT code on the claim (e.g. 99213-95).

Telehealth Place of Service Codes

For telehealth services, the place of service (POS) on claims should be the originating site where the patient is located.

Common POS codes for telehealth include:

- 02 – Telehealth Provided Other than in Patient’s Home

- 10 – Telehealth Provided in Patient’s Home

- 11 – Office

The main POS code for synchronous telehealth is 02, while for RPM it is usually 10 or 11. Providers shouldn’t use the POS code for their distant site office where they are located.

Documentation Requirements

Proper documentation is key for getting telehealth claims paid.

Documentation should include:

- Informed consent – Patient agrees to telehealth service

- Privacy practices – Steps taken to ensure privacy of encounter

- Medical necessity – Why service could not be delivered in person

- Technology used – Type of telehealth platform and functions utilized

- Physical location of patient and provider – Document both sites

- Clinical notes – Same as for in-person visit

Thorough EMR notes are essential to showing medical necessity for the telehealth service if audited.

Originating Site Fee

For real-time synchronous visits, Medicare and some payers provide an originating site facility fee to the location where the patient received virtual services. This fee reimburses for staff, equipment, and supplies at the originating site.

As of 2023, the originating site facility fee is around $28 for a telehealth visit. To get this fee, claims must include the Q3014 code and POS code for where the patient was located.

However, Medicare no longer pays this fee for virtual visits at a patient’s home. And the fee only applies to live video visits, not other telehealth modalities.

Private Payer Telehealth Policies

While Medicare has specific telehealth rules, private payer policies vary widely.

Common telehealth billing issues with commercial payers include:

- Not covering telehealth at all or only for certain specialties

- Restricting telehealth to rural areas

- Only reimbursing live video visits, not phone or RPM

- Not paying the originating site fee

- Requiring prior authorization for telehealth services

- Limiting telehealth coverage to in-network providers only

It is critical providers verify the latest telehealth policies for all their contracted payers before billing. This includes checking if telehealth reimbursement was temporarily expanded due to COVID-19.

State Telehealth Policies

In addition to federal regulations and private payer rules, state laws also govern telehealth billing requirements.

Key issues determined at the state level include:

- Telehealth modality – Some states only allow live video visits

- Telehealth parity laws – Require private insurers to cover telehealth like in-person care

- Consent standards – Rules on informed consent for telehealth

- Licensure for out-of-state providers – Multistate practice standards for telehealth

- Prescribing – Restrictions on telehealth prescribing for controlled substances

Providers should be familiar with the telehealth regulations in each state where they provide virtual services.

Telehealth Revenue Cycle Management

To maximize telehealth revenue, practices must take steps to ensure proper coding, billing, and collection:

- Update fee schedules – Establish appropriate fees for telehealth services

- Educate providers on coding – Train clinicians on selecting proper telehealth CPT codes and modifiers

- Verify insurance benefits – Check patient coverage for telehealth before visit

- Obtain prior authorizations – Get pre-approvals when required by payers

- Enhance charge capture – Update EMR to automatically capture telehealth charges

- Refine claim scrubbing – Tweak claim edits to allow telehealth CPT codes and modifiers

- Improve first-pass rate – Minimize telehealth claim rejections and denials

- Audit telehealth documentation – Ensure proper supporting documentation in medical records

- Send patient statements promptly – Bill patients for any cost-sharing after claim adjudication

Ongoing monitoring, auditing, and training will be necessary as telehealth billing rules rapidly evolve.

Telehealth Coding and Billing Tips

Here are some top telehealth billing tips for practices:

- Always include a telehealth modifier like 95 or GQ when appropriate.

- Use the correct place of service code based on where the patient is located.

- Don’t use regular office visit codes for virtual check-ins or e-visits.

- Make sure documentation supports the level of E/M telehealth code billed.

- Don’t bill for both telehealth and in-person visits on the same day.

- Check eligibility and benefits to confirm coverage for services.

- Use HIPAA-compliant video platforms to ensure security and privacy.

- Obtain patient consent before initiating a telehealth service. This ensures the patient agrees to receive virtual care.

- Consent can be verbal or written. Document consent in the medical record.

- Explain the telehealth technology, provider credentials, billing practices, and privacy guidelines to patients.

- Inform patients of the benefits and potential risks of telehealth compared to in-person care.

- Allow patients to opt-out of telehealth in favor of an office visit if they prefer.

- Have patients sign a telehealth consent form that covers program details, privacy policies, and billing practices.

- Consent forms should give the patient the option to discontinue telehealth at any time.

- Confirm that patients can access and use the telehealth technology before scheduling visits.

- Follow up with patients after visits to address any concerns about their telehealth experience.

- Update consent forms regularly as telehealth offerings evolve to keep patients informed.

- Comply with state informed consent laws and health board telehealth regulations.

- Review any temporary COVID-19 telehealth policies that may sunset.

- Don’t use telehealth codes for faxing records or scheduling appointments.

- Append CR modifier for catastrophe/disaster related telehealth.

- Get an NPI to bill for telehealth if using a personal device.

- Report E/M telehealth code based on medical decision making.

- Don’t substitute video visits for in-person care when clinically necessary.

- Set up Q3014 as a billable charge in your billing system.

- Consider separate telehealth tax identification numbers (TINs).

- Conduct internal audits to validate telehealth documentation.

- Develop telehealth supervision guidelines for trainees or mid-levels.

- Establish data reporting workflows to track telehealth utilization.

- Check state Medicaid plans for covered telehealth services.

- Review managed care contracts for excluded telehealth services.

- Join telehealth associations to stay on top of latest billing updates.

The Future of Telehealth Billing

Telehealth adoption is expected to continue rising, with utilization for services like chronic care management and remote patient monitoring expanding. This will lead to ongoing changes in telehealth regulations and payer policies.

Telehealth adoption is expected to continue rising, with utilization for services like chronic care management and remote patient monitoring expanding. This will lead to ongoing changes in telehealth regulations and payer policies.

Regularly checking for telehealth coding updates and clarifications will be essential. Key sources include Medicare physician fee schedules, CPT manual changes, and payor billing manuals.

Investing in telehealth-enabled EMR and revenue cycle management solutions can also help practices scale virtual care while optimizing billing and collections. Training staff on telehealth workflows will further support efficient operations.

As telehealth becomes a standard way patients access healthcare, mastering the nuances of virtual care billing will be key for providers’ financial success. Payers are also eager to see the positive impact telehealth can have on costs and outcomes. Staying up-to-date on telehealth regulations and proactively managing telehealth revenue cycles gives practices the opportunity to get reimbursed correctly and make their telehealth programs thrive.