The Evolving Landscape of Genetic Testing Reimbursement

Genetic testing continues to be one of healthcare’s most dynamic and challenging areas for reimbursement. With new test methodologies emerging, payer policies shifting, and coding structures being refined, staying current is essential for financial sustainability.

Figuring out how to properly code and bill for genetic testing services can dramatically improve your laboratory or practice’s bottom line while ensuring patients receive the advanced care they deserve. The following content will walk you through the latest updates to genetic testing CPT codes, provide strategic approaches to maximize reimbursement, and offer practical implementation advice that can make a measurable difference to your revenue cycle.

Figuring out how to properly code and bill for genetic testing services can dramatically improve your laboratory or practice’s bottom line while ensuring patients receive the advanced care they deserve. The following content will walk you through the latest updates to genetic testing CPT codes, provide strategic approaches to maximize reimbursement, and offer practical implementation advice that can make a measurable difference to your revenue cycle.

What’s New for 2025: Key Genetic Testing CPT Code Changes

The field of genetic testing has seen significant coding updates this year, reflecting both technological advancements and efforts to better capture the complexity of modern genomic medicine:

Expanded Genomic Sequencing Procedure (GSP) Codes

The most substantial changes have occurred within the GSP code family, with refinements that better reflect the varying complexities of different sequencing technologies:

- 81425-81427 (Whole exome sequencing): Now include more specific guidelines distinguishing between proband-only testing, trio analysis, and reanalysis services

- 81450-81455 (Targeted genomic sequence analysis panels): Updated to include expanded coverage for specific genes associated with emerging clinical applications

- New Code 81456: Specifically developed for targeted genomic sequence analysis panels for monitoring minimal residual disease (MRD) with improved specificity compared to previous coding options

Pharmacogenetic Testing Updates

The pharmacogenomic testing codes have been restructured to better reflect clinical utility and testing complexity:

- 81225-81231 (Pharmacogenomic gene analysis): Revised descriptors that more clearly differentiate between single gene and multi-gene panel approaches

- New Code 81232: Created specifically for pharmacogenomic analysis related to psychiatric medication management, reflecting the growing importance of precision psychiatry

- Expanded 81355: Now includes additional variants for NUDT15, improving coverage for thiopurine metabolism testing

Revised Molecular Diagnostic Procedures

Traditional molecular diagnostic procedures have also seen meaningful updates:

- 81400-81408 (Molecular pathology procedures): Significant revisions to the tier structure to better align with current laboratory workflows and costs

- New Tier 2 Molecular Pathology Codes: Several additions to capture emerging biomarkers with demonstrated clinical utility

- Clarified 81479 (Unlisted molecular pathology procedure): Updated guidelines on when this code is appropriate versus using more specific codes

MoPath Multianalyte Assays with Algorithmic Analyses (MAAA)

The MAAA code set continues to expand as more proprietary tests gain recognition:

- 81500-81599: Multiple new codes added for proprietary tests that have demonstrated clinical validity and utility

- Algorithmic Specificity: Enhanced requirements for documenting the specific algorithms used in test interpretation

Strategic Coding for Maximum Reimbursement

Understanding the code updates is just the first step. Implementing strategic approaches to coding and billing can significantly impact your reimbursement success.

Let’s explore key strategies:

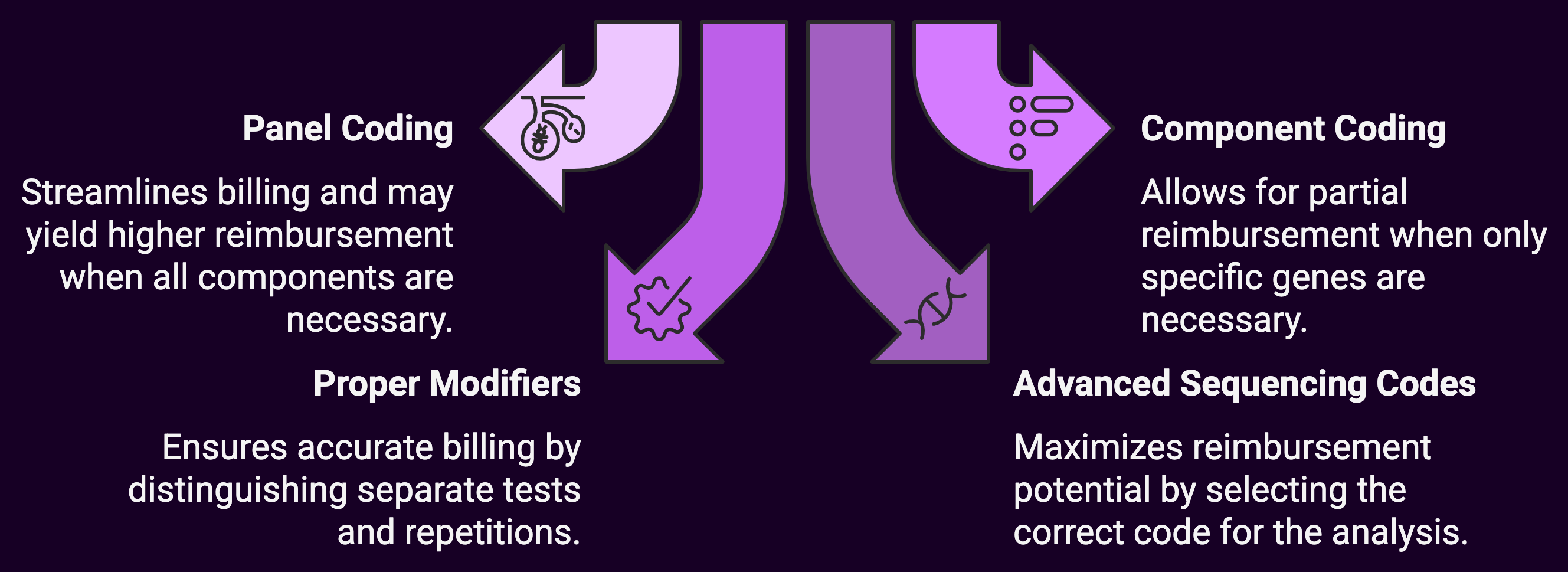

1. Master the Art of Panel versus Component Coding

One of the most complex areas of genetic testing reimbursement involves deciding when to bill as a panel versus individual components:

Panel Coding Approach:

- Use comprehensive panel codes (e.g., 81432 for hereditary breast cancer panel) when all components within the panel are medically necessary

- Benefits include streamlined billing and potentially higher reimbursement when the panel value exceeds the sum of individual components

Component Coding Approach:

- Bill individual gene analysis codes when only specific genes within a panel are medically necessary

- May result in better reimbursement when payers have restrictive panel policies but more liberal individual gene coverage

Practical Tip: Perform regular reimbursement analyses comparing panel versus component coding for your most common tests across major payers. Document your findings in a decision matrix to guide billing staff.

Financial Impact Example: For a hereditary cancer panel analyzing 14 genes, panel coding (81432) might yield $825 from a commercial payer, while component coding for the same genes might total $1,250 if all components are covered. Conversely, if only certain genes meet medical necessity, the component approach allows for partial reimbursement rather than a full panel denial.

2. Leverage Proper Modifiers

Modifiers can significantly impact genetic testing reimbursement but are frequently misunderstood or misapplied:

- 59 Modifier: Essential for distinguishing separate and distinct genetic tests performed on the same day

- 76 Modifier: Appropriate when repeating the same test on the same day for clinical reasons

- 91 Modifier: Used when multiple tests of the same type are repeated to monitor the condition, treatment, or drug level

- 52 Modifier: Can be used when a reduced service is performed, such as when fewer genes in a defined panel are analyzed due to medical necessity limitations

Practical Tip: Create a modifier decision tree specific to genetic testing scenarios commonly encountered in your practice. Include examples of proper documentation language that supports each modifier’s use.

Patient underwent BRCA1/2 mutation analysis (81211) to assess hereditary breast cancer risk. Additionally, due to family history of Lynch syndrome, separate MLH1/MSH2/MSH6/PMS2/EPCAM panel testing (81292, 81295, 81298, 81317, 81319) was performed. These represent distinct clinical indications requiring separate genetic analyses.

3. Optimize Advanced Sequencing Code Selection

The expanded genomic sequencing procedure (GSP) codes offer significant reimbursement potential but require careful selection:

- 81410-81471: Ensure you’re using the appropriate code based on the exact number of genes and exons analyzed

- 81479: Reserve this unlisted code for truly novel methodologies that cannot be reported using existing codes

Practical Tip: Document the specific analysis methodology, number of genes and exons, and bioinformatics approach to support code selection. Create a crosswalk between your testing menu and the appropriate CPT codes.

Test analyzed 37 genes associated with hereditary cardiovascular disorders using next-generation sequencing. Analysis included all coding exons (589 total exons) plus 10bp of adjacent intronic sequence. Bioinformatics analysis included read alignment, variant calling, and filtering against population frequency databases. Code 81448 selected as this meets the definition of a panel of 5-50 genes for inherited cardiomyopathy.

4. Understand the Z-Code Intersection

For many genetic tests, proper CPT coding must be paired with appropriate Z-codes (unique test identifiers) for certain payers:

- Z-codes help payers identify specific tests and methodologies

- Mismatches between CPT codes and Z-codes frequently trigger denials

Practical Tip: Maintain a current matrix of test offerings that includes both appropriate CPT codes and corresponding Z-codes. Regularly verify that your Z-code registrations accurately reflect your current methodologies.

Financial Impact: A single mismatch between Z-code and CPT code assignments can delay payment by 45-90 days or result in outright denial, significantly impacting cash flow for high-dollar genetic tests.

Documentation Best Practices for Genetic Testing Claims

Even perfect coding won’t help if documentation doesn’t adequately support medical necessity.

Here are key documentation strategies specifically for genetic testing services:

1. Establish Clear Medical Necessity

For genetic tests, medical necessity documentation is particularly scrutinized:

Best Practice: Ensure documentation includes:

- Specific diagnosis codes that support testing

- Detailed family history when relevant to testing decisions

- Prior testing results that inform the current testing strategy

- How results will impact clinical management (treatment selection, monitoring approach, etc.)

34-year-old female with newly diagnosed triple-negative breast cancer. Patient reports paternal grandmother with ovarian cancer at age 49 and paternal aunt with breast cancer at age 42. BRCA1/2 testing is medically necessary to inform surgical approach (consideration of bilateral mastectomy vs. lumpectomy) and to assess eligibility for PARP inhibitor therapy in the metastatic setting if disease progresses. Results will also inform cancer surveillance recommendations and testing recommendations for family members.

2. Document Pre-Test Genetic Counseling

Many payers now require documentation of genetic counseling before testing:

Best Practice: Document:

- Pre-test counseling including discussion of test limitations and possible results

- Patient’s understanding and consent

- Name and credentials of the provider performing counseling

Pre-test genetic counseling provided by Jane Smith, MS, CGC (certified genetic counselor). Patient counseled on possible results (positive, negative, or variant of uncertain significance) and limitations of testing. Implications for patient and family members discussed. Patient demonstrated understanding and provided informed consent for hereditary cancer panel testing.

3. Support Test Selection Rationale

With multiple testing options available, documenting why a specific test was selected is crucial:

Best Practice: Clearly articulate:

- Why the specific methodology was chosen over alternatives

- How the gene content of a panel aligns with the patient’s clinical presentation

- Reason for comprehensive versus targeted approach

Comprehensive hereditary cancer panel selected over BRCA1/2 testing alone due to patient’s complex family history across multiple cancer types (breast, ovarian, and pancreatic). Panel includes 83 genes associated with hereditary cancer syndromes that could explain the pattern observed in this family. Results will guide risk-reduction strategies and surveillance for multiple cancer types.

Advanced Billing Strategies for Complex Genetic Tests

The most sophisticated genetic testing operations employ these advanced strategies:

1. Implement Test-Specific Coverage Verification

Generic coverage verification isn’t sufficient for genetic testing:

- Create test-specific checklists that capture all payer-specific requirements

- Develop payer-specific prior authorization templates for common genetic tests

- Implement a system to track payer policy updates affecting genetic test coverage

Practical Tip: Build a knowledge base of payer-specific coverage criteria for your most common tests. Update this quarterly and ensure all staff have access to current information.

2. Deploy Strategic Appeal Processes

Given the complexity of genetic testing claims, denials are common but can often be overturned:

- Create templated appeal letters for common denial reasons

- Compile supportive literature for clinical utility of specific tests

- Develop relationships with payer medical directors to discuss complex cases

Practical Tip: Track appeal success rates by test type and denial reason. Use this data to identify patterns and refine your documentation and coding approaches accordingly.

Financial Impact: A strategic appeals process can recover 20-30% of initially denied genetic testing claims, representing hundreds of thousands of dollars annually for a medium-sized laboratory.

3. Utilize Advance Beneficiary Notices (ABNs) Effectively

For Medicare patients, proper ABN use is essential:

- Genetic tests frequently fall into “sometimes covered” categories

- Test-specific ABNs should clearly state why the test might not be covered

- Consider implementing electronic ABNs to streamline the process

Medicare may not pay for hereditary cancer panel testing because:

1. Patient does not meet Medicare’s criteria for having a personal history of cancer

2. Medicare may cover only specific genes rather than the full panel

3. Medicare may determine testing is for screening purposes rather than diagnostic purposes

Leveraging Technology for Genetic Testing Reimbursement

Technology solutions can dramatically improve genetic testing reimbursement outcomes:

1. Automated Medical Necessity Screening

Several platforms now offer automated medical necessity screening specifically for genetic tests:

- Real-time verification of ICD-10 codes against payer-specific genetic testing policies

- Integration of family history information into medical necessity algorithms

- Documentation prompts to ensure all required elements are captured

Practical Tip: When evaluating these systems, prioritize those that regularly update their rules engines to reflect the rapidly changing genetic testing coverage landscape.

2. Genetic Testing Prior Authorization Platforms

Specialized prior authorization platforms for genetic testing can significantly improve approval rates:

- Payer-specific questionnaires that capture exactly what each insurer requires

- Clinical decision support to identify the most appropriate test based on clinical indicators

- Real-time status tracking to reduce administrative burden

Financial Impact: Implementation of specialized genetic testing prior authorization platforms typically increases approval rates by 15-25% and reduces time to authorization by 30-50%.

3. Predictive Analytics for Reimbursement

Advanced analytics can help predict which tests are likely to be reimbursed:

- Machine learning algorithms that identify patterns in successful claims

- Predictive models for expected reimbursement by test type and payer

- Test mix optimization recommendations based on historical reimbursement data

Practical Tip: Begin by analyzing your own historical data before investing in predictive analytics solutions. Look for patterns in denials and successful appeals to identify immediate improvement opportunities.

Payer-Specific Strategies

Different payers have dramatically different approaches to genetic testing coverage:

1. Medicare Nuances

Medicare coverage for genetic testing continues to evolve:

- Local Coverage Determinations (LCDs) remain the primary guidance for genetic test coverage

- MolDX program jurisdictions have distinct requirements from other Medicare regions

- Required documentation elements vary significantly between Medicare Administrative Contractors (MACs)

Practical Tip: Create MAC-specific documentation templates that incorporate all required elements for your jurisdiction. Pay particular attention to “reasonable and necessary” language specific to each genetic test type.

2. Commercial Payer Variations

Commercial payers have widely varying policies:

- Some require specific laboratories or testing platforms

- Prior authorization requirements differ significantly between payers

- Medical policy updates occur at different frequencies and often with minimal notice

Practical Tip: Create a commercial payer matrix specific to genetic testing that includes:

- Required turnaround time for prior authorizations

- Documentation requirements by test type

- Preferred laboratory networks

- Specific coding requirements (e.g., whether to use stacked codes or panel codes)

3. Self-Pay and Patient Responsibility Optimization

With high-deductible plans becoming more common, managing patient financial responsibility is critical:

- Develop transparent patient cost estimation processes

- Implement patient-friendly payment plans specifically for high-cost genetic tests

- Create financial counseling protocols specific to genetic testing

Practical Tip: Track insurance verification results and proactively identify patients who will have significant out-of-pocket costs. Provide cost information and payment options before testing to avoid surprise bills and potential non-payment.

Implementing Your Genetic Testing Reimbursement Optimization Plan

Knowledge without action yields no benefit. Here’s a structured approach to implementation:

1. Conduct a Comprehensive Coding Audit

Begin with a thorough assessment of your current practices:

- Review 30-50 claims across different test types and payers

- Compare coding against current guidelines and payer policies

- Identify patterns of undercoding, denials, and successful appeals

Practical Tip: Create a spreadsheet tracking audit findings by test type, with columns for coding accuracy, documentation completeness, denial rate, and potential revenue impact.

2. Develop Provider Education Programs

Clinician understanding of genetic testing requirements is essential:

- Create reference guides for common genetic testing scenarios

- Develop documentation templates that capture all required elements

- Implement quarterly updates on changing payer requirements

Practical Tip: Use case studies from your practice to illustrate both successful and problematic documentation patterns.

3. Establish Continuous Monitoring

The genetic testing landscape changes rapidly, requiring ongoing vigilance:

- Monitor payer policy updates weekly

- Track denials by reason code and test type

- Analyze reimbursement trends quarterly

Month 1: Complete comprehensive coding audit

Month 2: Develop and implement documentation templates

Month 3: Train staff on updated policies and procedures

Month 4: Implement technology solutions for prior authorization

Month 5: Establish monitoring dashboards

Month 6: Conduct follow-up audit to measure improvement

Summary: Building a Sustainable Genetic Testing Program Through Strategic Reimbursement

The field of genetic testing represents both tremendous clinical opportunity and significant financial challenges. Testing methodologies continue to advance and clinical applications expand, which means the reimbursement landscape will undoubtedly continue to evolve.

Laboratories and providers can significantly improve their reimbursement outcomes while ensuring patients have access to these valuable diagnostic tools. Optimization is an ongoing process requiring continuous monitoring and adaptation.

The most successful genetic testing programs combine clinical excellence with reimbursement expertise, creating a sustainable model that can weather the ongoing changes in both science and payment systems. Investing time in understanding the nuances of genetic testing CPT codes and implementing best practices for documentation and billing positions your organization for both clinical and financial success in the rapidly changing genomic medicine landscape.

Disclaimer: This article is provided for informational purposes only and does not constitute legal, billing, or financial advice. CPT codes and reimbursement rates are subject to change, and providers should verify current information with their specific payers before implementing any coding strategies. CPT® is a registered trademark of the American Medical Association.